About The Author

CONNECT WITH THIS AUTHOR

April 09, 2025

March 27, 2025

October 26, 2024

August 20, 2024

July 09, 2024

February 26, 2024

January 22, 2024

November 29, 2023

November 14, 2023

Market Insights

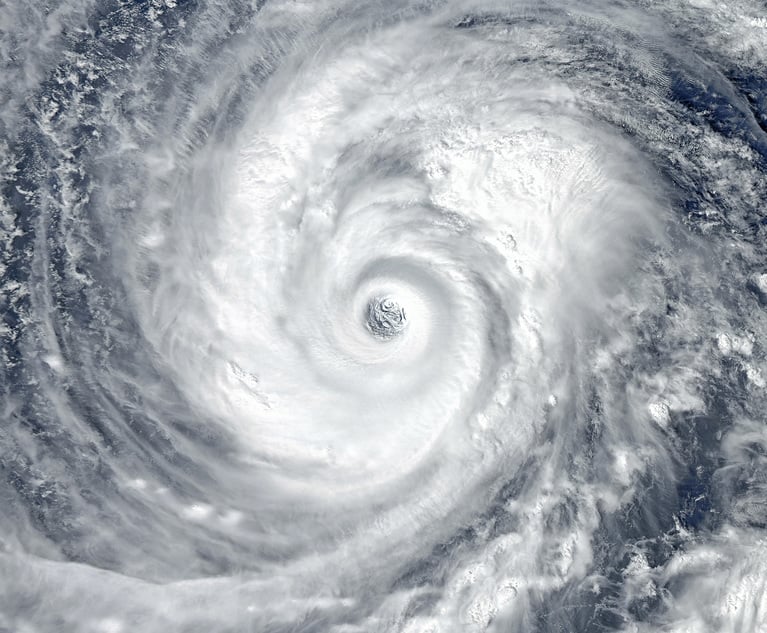

Catastrophe bond market headed for major surge in issuance

October 30, 2023

Trending Stories

- 1An Inside Look at Contact Center Modernization in Insurance

- 2Georgia jury awards elderly woman $4.2M for dog attack

- 3Enhance Your Negotiation Tactics for Auto Liability

- 4Boost Underwriting Efficiency & Improve Risk Assessment for Commercial Property Insurance

- 5Court overturns $26.3M Farmers Insurance class action judgment