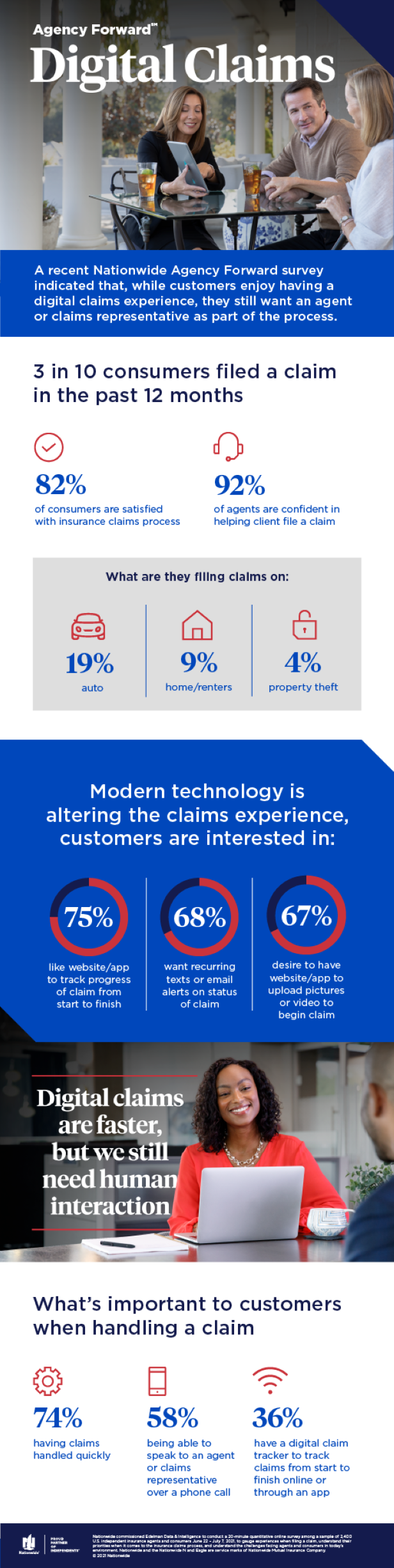

According to a recent Nationwide Agency Forward survey, while customers are becoming more comfortable with digital claims tools, most still rate being able to communicate with an actual agent high on their list of priorities.

"When we are putting the customer and service representative together in a digital world, it is still crucial that the customer feels supported by being able to reach a person if they need it," Martha Frye, Nationwide's senior vice president of personal lines claims, said in a press release about the survey. "Claims are usually filed after something bad has happened, so we're trying to strike the balance of helping with personal expertise, along with digital solutions to keep them informed and speed it along—both are really important."

Recommended For You

Want to continue reading?

Become a Free PropertyCasualty360 Digital Reader

Your access to unlimited PropertyCasualty360 content isn’t changing.

Once you are an ALM digital member, you’ll receive:

- Breaking insurance news and analysis, on-site and via our newsletters and custom alerts

- Weekly Insurance Speak podcast featuring exclusive interviews with industry leaders

- Educational webcasts, white papers, and ebooks from industry thought leaders

- Critical converage of the employee benefits and financial advisory markets on our other ALM sites, BenefitsPRO and ThinkAdvisor

Already have an account? Sign In Now

© Touchpoint Markets, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more inforrmation visit Asset & Logo Licensing.