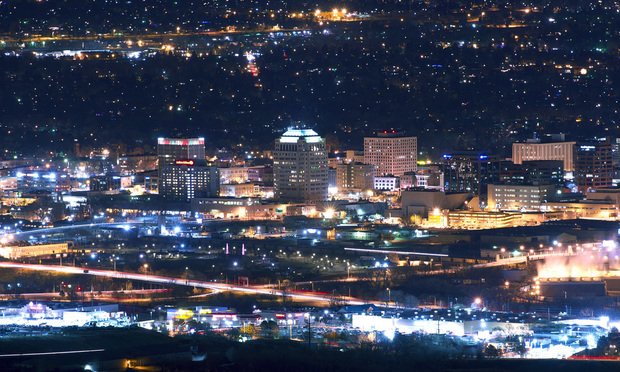

Michael DeLong, CFA's insurance advocate, said in a release: "The bill creates a process to ensure that insurance markets are more equitable. With its enactment, Colorado has an opportunity to be a leader in the national effort to reduce systemic bias in insurance and other financial services." (Credit: welcomia/ Shutterstock)

Michael DeLong, CFA's insurance advocate, said in a release: "The bill creates a process to ensure that insurance markets are more equitable. With its enactment, Colorado has an opportunity to be a leader in the national effort to reduce systemic bias in insurance and other financial services." (Credit: welcomia/ Shutterstock)

New legislation in Colorado, which the governor and state insurance commissioner have signed, will require insurance companies to demonstrate that their use of external data and complicated algorithms do not discriminate on the basis of certain classes and will help guarantee that citizens do not overpay for coverage or become unfairly targeted by insurance companies because of who they intrinsically are.

Recommended For You

Want to continue reading?

Become a Free PropertyCasualty360 Digital Reader

Your access to unlimited PropertyCasualty360 content isn’t changing.

Once you are an ALM digital member, you’ll receive:

- Breaking insurance news and analysis, on-site and via our newsletters and custom alerts

- Weekly Insurance Speak podcast featuring exclusive interviews with industry leaders

- Educational webcasts, white papers, and ebooks from industry thought leaders

- Critical converage of the employee benefits and financial advisory markets on our other ALM sites, BenefitsPRO and ThinkAdvisor

Already have an account? Sign In Now

© Touchpoint Markets, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more inforrmation visit Asset & Logo Licensing.