Illustration by Shaw Nielsen is from the April 2021 issue of NU Property & Casualty magazine.

Illustration by Shaw Nielsen is from the April 2021 issue of NU Property & Casualty magazine.

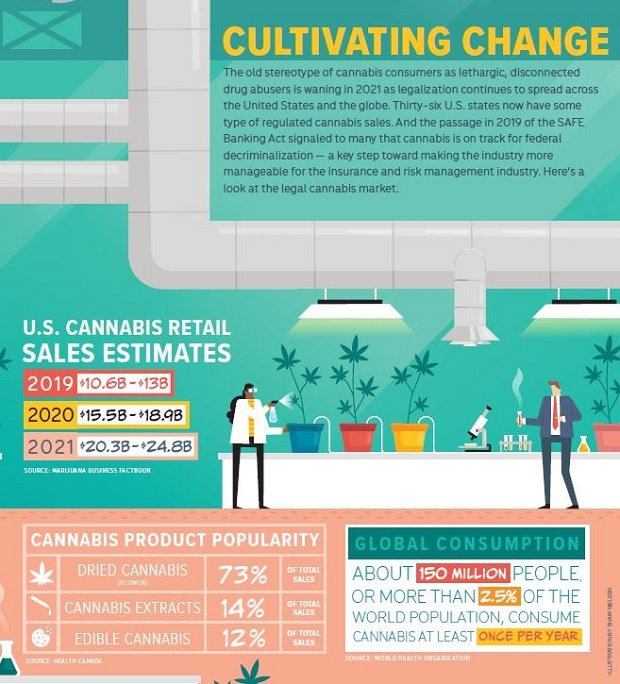

Insurance in the cannabis industry is big business, and business owners need to know what policies are available and what those policies cover. Why? Because in insurance policies, like all other business contracts, the risk of a business venture is divided between the contracting parties. Your insurance policies are contracts where you pay your insurer to take some of the risk of your business venture away from you — for a fee, of course. Companies that insure cannabis ventures charge an above-average premium to take on above-average risk, though they may be covering less of your business risk than you think is covered.

Recommended For You

Want to continue reading?

Become a Free PropertyCasualty360 Digital Reader

Your access to unlimited PropertyCasualty360 content isn’t changing.

Once you are an ALM digital member, you’ll receive:

- Breaking insurance news and analysis, on-site and via our newsletters and custom alerts

- Weekly Insurance Speak podcast featuring exclusive interviews with industry leaders

- Educational webcasts, white papers, and ebooks from industry thought leaders

- Critical converage of the employee benefits and financial advisory markets on our other ALM sites, BenefitsPRO and ThinkAdvisor

Already have an account? Sign In Now

© 2025 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.