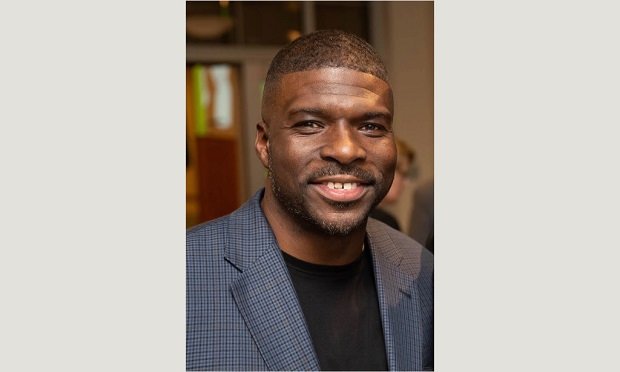

Deon Hornsby is assistant vice president, regional underwriting manager for the Chicago and Midwest Region of AIG's Private Client Group. (Courtesy photo)

Deon Hornsby is assistant vice president, regional underwriting manager for the Chicago and Midwest Region of AIG's Private Client Group. (Courtesy photo)

Like so many people, in the weeks that followed the May 25, 2020, death of George Floyd, Deon Hornsby felt a mixture of anger, fear and frustration. He also knew he wanted to do something about it.

Recommended For You

Want to continue reading?

Become a Free PropertyCasualty360 Digital Reader

Your access to unlimited PropertyCasualty360 content isn’t changing.

Once you are an ALM digital member, you’ll receive:

- Breaking insurance news and analysis, on-site and via our newsletters and custom alerts

- Weekly Insurance Speak podcast featuring exclusive interviews with industry leaders

- Educational webcasts, white papers, and ebooks from industry thought leaders

- Critical converage of the employee benefits and financial advisory markets on our other ALM sites, BenefitsPRO and ThinkAdvisor

Already have an account? Sign In Now