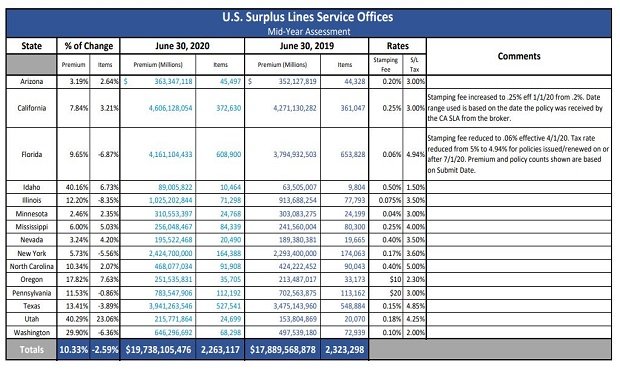

Each of the 15 stamping offices reported premium increases for mid-year 2020 with eight states reporting double-digit percentage increases. While transaction counts were down overall, nine states reported increases. (Wholesale & Specialty Insurance Association)

Each of the 15 stamping offices reported premium increases for mid-year 2020 with eight states reporting double-digit percentage increases. While transaction counts were down overall, nine states reported increases. (Wholesale & Specialty Insurance Association)

Midyear surplus lines premium assessments reported by the 15 stamping and service offices in the United States illustrated the strong momentum the excess and surplus lines market had as 2020 began as well as the creeping impact of the COVID-19 pandemic as the year unfolded.

Recommended For You

Want to continue reading?

Become a Free PropertyCasualty360 Digital Reader

Your access to unlimited PropertyCasualty360 content isn’t changing.

Once you are an ALM digital member, you’ll receive:

- Breaking insurance news and analysis, on-site and via our newsletters and custom alerts

- Weekly Insurance Speak podcast featuring exclusive interviews with industry leaders

- Educational webcasts, white papers, and ebooks from industry thought leaders

- Critical converage of the employee benefits and financial advisory markets on our other ALM sites, BenefitsPRO and ThinkAdvisor

Already have an account? Sign In Now