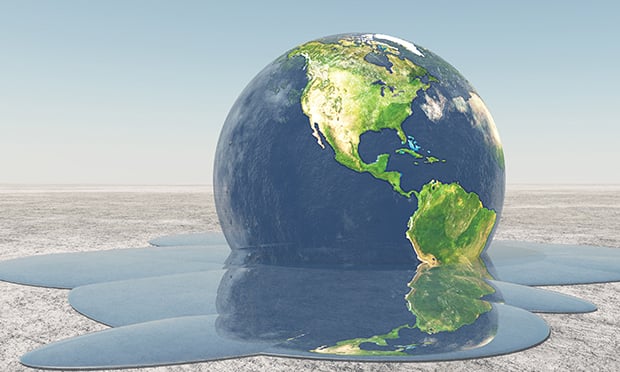

Coverage analysis will be crucial for the remainder of the 21st century and underwriting will undoubtedly "stiffen" as damages become more severe. (Photo: Shutterstock)

Coverage analysis will be crucial for the remainder of the 21st century and underwriting will undoubtedly "stiffen" as damages become more severe. (Photo: Shutterstock)

There are scores of disasters created by increased global warming; most, but not all, are insurable in some manner, and adjusters will remain busy with the investigation, evaluation and resolution of coverage, liability and damages.

|Covered risks

The Intergovernmental Panel on Climate Change (IPCC) warns that the disasters scientists previously predicted are already occurring, and "taken as a whole, the range of published evidence indicates that the net damage costs of climate change are likely to be significant and increase over time." Further, such change "is projected to continue over this century and beyond…"

Recommended For You

Want to continue reading?

Become a Free PropertyCasualty360 Digital Reader

Your access to unlimited PropertyCasualty360 content isn’t changing.

Once you are an ALM digital member, you’ll receive:

- Breaking insurance news and analysis, on-site and via our newsletters and custom alerts

- Weekly Insurance Speak podcast featuring exclusive interviews with industry leaders

- Educational webcasts, white papers, and ebooks from industry thought leaders

- Critical converage of the employee benefits and financial advisory markets on our other ALM sites, BenefitsPRO and ThinkAdvisor

Already have an account? Sign In Now

© Touchpoint Markets, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more inforrmation visit Asset & Logo Licensing.