Using big data to predict non-weather water claims risk

While non-weather water damage is a single peril, many pathways lead to a non-weather water claim.

Non-weather water claims are among the most common type of property insurance claims —both in personal and commercial lines. One in 15 people in the United States with a standard five-year home insurance policy will experience a non-weather water claim at some point during their coverage.

Often caused by plumbing and appliance leaks and failures, non-weather water claims cost insurers $8.2 billion annually in personal lines alone, or 20% of all property insurance losses in the U.S. The average non-weather water claims costs $6,695 in personal lines but can vary from $1,560 to more than $75,000 depending on the expensiveness — and expansiveness — of the damage.

Losses are similar on the commercial side, adding up to over $16 billion annually in the U.S., but claim severity is especially high for commercial properties.

While the problem is pervasive, it has been difficult for insurers to pinpoint which policies are at greatest risk for these types of claims. Until now.

The top states for non-weather water claim risks

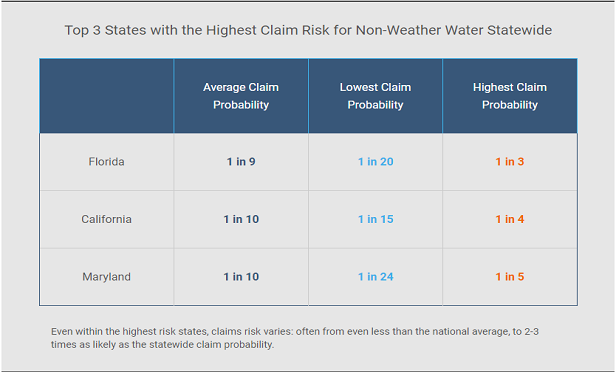

Recent research has revealed that the top three states for non-weather water claims risk are Florida, California and Maryland.

Nationally, non-weather water claim probability ranges dramatically — from a low of 1 in 167 over the average five-year policy life, to a high of 1 in 3. Both claim frequency and severity vary widely by location. And while some states have the highest claims rates and losses, variation in non-weather water claims is higher block to block than from state to state.

Why does claim frequency and severity vary so much?

So what causes these drastic fluctuations? In short, non-weather water claim frequency and severity vary so widely because so too do its causes. From appliance and water heater leaks and failures to ruptured connecting hoses and frozen pipes — many pathways can lead to a non-weather water claim. Even soil and geological interactions can lead to plumbing failures, which, like a domino effect, can result in significant damage and a non-weather water claim.

When trying to predict potential causes of non-weather water claims, underwriters need to look at a variety of factors, including climate, hydrology, and physiography, as well as property build qualities, conditions, and repair costs. Each of these considerations interacts in unique combinations that are predictive of water claim probability and severity.

A more accurate non-weather risk assessment

The diversity of causes of non-weather water damage makes it challenging to collect data and quantify risk, leaving a gap in overall property risk assessment. Having insight into these causes within a particular location during underwriting allows insurers to write coverage more profitably, avoid the highest risk locations, and identify areas with the lowest risk. Block-level scores can also provide a straight-forward territory overlay for tiering.

Recent data from Location, Inc. found that on just 59,000 new quotes, a client could have saved $1.2 million over the lifetime of their policies ($234,000 in the first year) by avoiding the worst 2% of risks and referring the second tier 8% worst risk to underwriting. The estimated payback on their investment was 4.1 months. By examining quantifiers that have historically been unaccounted for, insurers can unlock valuable insights that enable them to underwrite and price policies more accurately, minimizing financial loss and strengthening their return on investment.

Related:

- Facing off against flooding in 2020

- Managing claims in a changing climate

- Nonadversarial claims advocacy — a way to stabilize the insurance market

Dr. Andrew (andrew.schiller@locationinc.com) is the CEO and founder of Location Inc. The views expressed here are the author’s own.