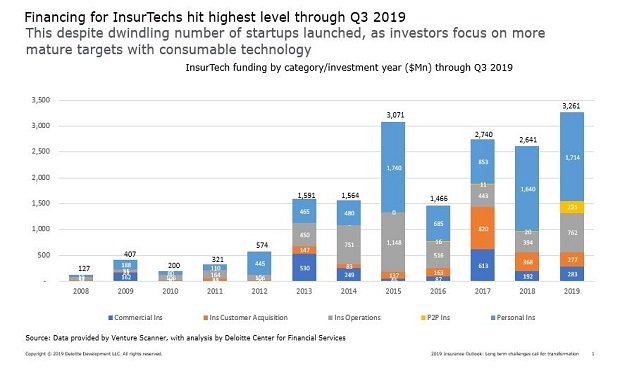

Until recently, InsurTech investment was often motivated by a "fear factor" — concern among insurers and general financiers about missing out on future unicorns. Now, investors and carriers appear to be getting more savvy and demanding about where they place their bets. (Image provided by Deloitte)

Until recently, InsurTech investment was often motivated by a "fear factor" — concern among insurers and general financiers about missing out on future unicorns. Now, investors and carriers appear to be getting more savvy and demanding about where they place their bets. (Image provided by Deloitte)

The InsurTech startup boom may finally be fading after a pioneering decade in which nearly 1,200 new entities were launched, backed by over $18 billion in venture capital. Yet few expect an InsurTech investment bust anytime soon, with valuations for the survivors likely to keep rising thanks to the law of supply and demand and the increasingly symbiotic relationship developing among InsurTechs and incumbent carriers.

Recommended For You

Want to continue reading?

Become a Free PropertyCasualty360 Digital Reader

Your access to unlimited PropertyCasualty360 content isn’t changing.

Once you are an ALM digital member, you’ll receive:

- Breaking insurance news and analysis, on-site and via our newsletters and custom alerts

- Weekly Insurance Speak podcast featuring exclusive interviews with industry leaders

- Educational webcasts, white papers, and ebooks from industry thought leaders

- Critical converage of the employee benefits and financial advisory markets on our other ALM sites, BenefitsPRO and ThinkAdvisor

Already have an account? Sign In Now

© Touchpoint Markets, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more inforrmation visit Asset & Logo Licensing.