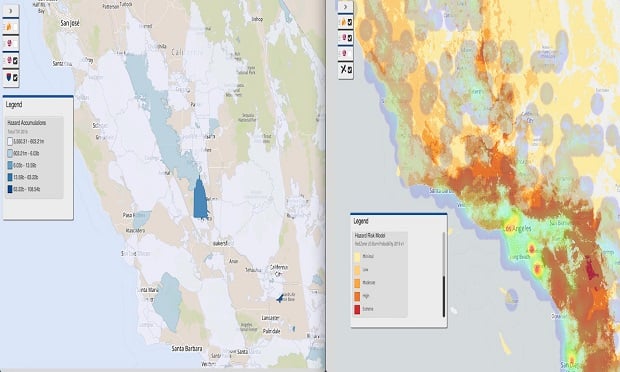

The above screenshots show RedZone's new models for use in portfolio-level analysis. On the left is RedZone's burn probability layer. When combined with the image on the right, which is RedZone's hazard control zones, you can develop a firmer understanding of portfolio composition when it comes to accumulations and likeliness to burn. (Image provided by SpatialKey)

The above screenshots show RedZone's new models for use in portfolio-level analysis. On the left is RedZone's burn probability layer. When combined with the image on the right, which is RedZone's hazard control zones, you can develop a firmer understanding of portfolio composition when it comes to accumulations and likeliness to burn. (Image provided by SpatialKey)

Florida State University Risk Management Professor Lynn McChristian says, "California is the lab for managing exposure to wildfire risk."

Recommended For You

Want to continue reading?

Become a Free PropertyCasualty360 Digital Reader

Your access to unlimited PropertyCasualty360 content isn’t changing.

Once you are an ALM digital member, you’ll receive:

- Breaking insurance news and analysis, on-site and via our newsletters and custom alerts

- Weekly Insurance Speak podcast featuring exclusive interviews with industry leaders

- Educational webcasts, white papers, and ebooks from industry thought leaders

- Critical converage of the employee benefits and financial advisory markets on our other ALM sites, BenefitsPRO and ThinkAdvisor

Already have an account? Sign In Now