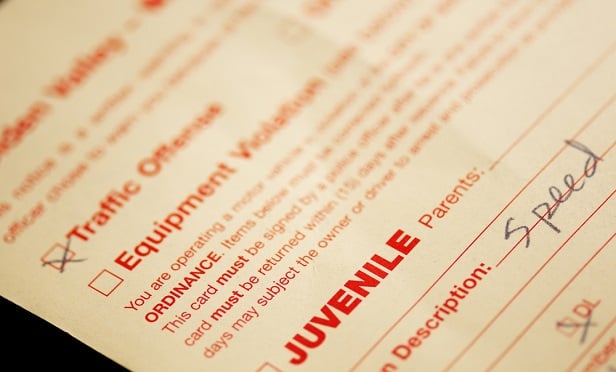

Risky driving behavior is can be an indicator of a higher frequency of filing home insurance claims. (Photo: Shutterstock)

Risky driving behavior is can be an indicator of a higher frequency of filing home insurance claims. (Photo: Shutterstock)

An individual's driving record is often one of the most important variables in insurers' rating and underwriting plans. Risky driving behavior is also correlated to a higher frequency of filing a home insurance claim and signals increased mortality rates in life insurance. State Motor Vehicle Reports (MVRs) have traditionally been viewed as the 'gold standard' by insurers to verify an individual's driving record; however, MVRs can be expensive. MVRs may also lack conviction activity, which could be "costly" to insurers in terms of missed premium and unidentified risk.

Recommended For You

Want to continue reading?

Become a Free PropertyCasualty360 Digital Reader

Your access to unlimited PropertyCasualty360 content isn’t changing.

Once you are an ALM digital member, you’ll receive:

- Breaking insurance news and analysis, on-site and via our newsletters and custom alerts

- Weekly Insurance Speak podcast featuring exclusive interviews with industry leaders

- Educational webcasts, white papers, and ebooks from industry thought leaders

- Critical converage of the employee benefits and financial advisory markets on our other ALM sites, BenefitsPRO and ThinkAdvisor

Already have an account? Sign In Now

© 2025 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.