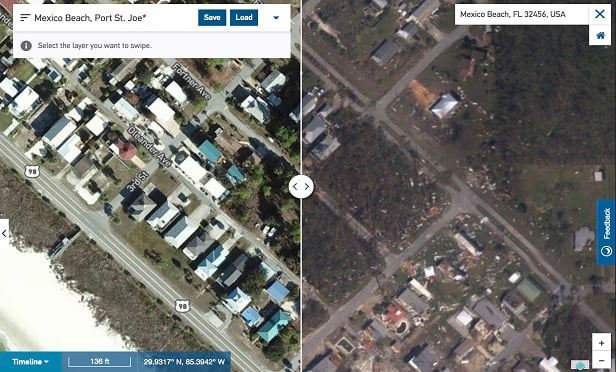

An aerial view of Mexico Beach in Panama City, Florida, provides insight on what the beach looked like before and after it was hit by Hurricane Michael last month. (Photo: Airbus Aerial)

An aerial view of Mexico Beach in Panama City, Florida, provides insight on what the beach looked like before and after it was hit by Hurricane Michael last month. (Photo: Airbus Aerial)

As we enter the last month of the 2018 hurricane season, it's safe to say the U.S. has seen its fair share of natural disasters. Hurricane Florence's damage costs are estimated to exceed $50 billion, and, most recently, Hurricane Michael was recorded as the third most intense continental U.S. landfall on record as a Category 4 hurricane.

As the extent of catastrophe damage continues to grow exponentially, insurers are turning to technology to help them better evaluate, understand and respond to natural disasters. One such technology solution at the heart of today's disaster response efforts is aerial data.

|Look to the sky

Imagery from drones, manned aircraft and satellites is becoming increasingly valuable to claims adjusters as they face hazardous and often unknown conditions during the claims process. In fact, Novarica estimated that nearly 20% of P&C carriers are pursuing aerial imaging solutions.

Recommended For You

Want to continue reading?

Become a Free PropertyCasualty360 Digital Reader

Your access to unlimited PropertyCasualty360 content isn’t changing.

Once you are an ALM digital member, you’ll receive:

- Breaking insurance news and analysis, on-site and via our newsletters and custom alerts

- Weekly Insurance Speak podcast featuring exclusive interviews with industry leaders

- Educational webcasts, white papers, and ebooks from industry thought leaders

- Critical converage of the employee benefits and financial advisory markets on our other ALM sites, BenefitsPRO and ThinkAdvisor

Already have an account? Sign In Now

© Touchpoint Markets, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more inforrmation visit Asset & Logo Licensing.