On Dec. 5, the Federal Emergency Management Agency (FEMA) announced that it is submitting a claim to recover the full $1.042 billion in reinsurance coverage under its 2017 Reinsurance Program.

This claim is based upon the National Flood Insurance Program (NFIP)'s losses associated with Hurricane Harvey. Those paid losses exceeded the minimum threshold for the NFIP's reinsurance coverage.

The NFIP transferred $1.042 billion of the NFIP's financial risk to the private reinsurance markets earlier in 2017, marking what FEMA described as "a key step toward a stronger and more resilient program" in the statement announcing the claim.

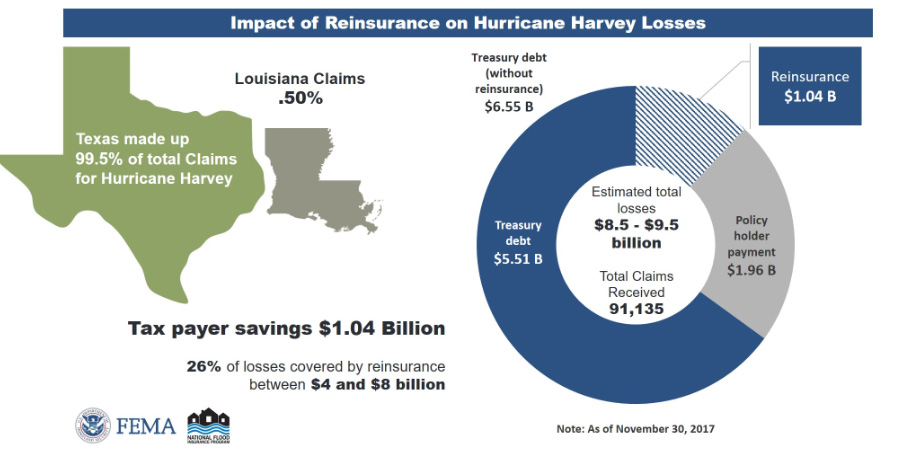

In January 2017, FEMA executed the 2017 Reinsurance Agreement with 25 reinsurance markets representing some of the largest insurance and reinsurance groups worldwide. FEMA expects the 2017 placement of reinsurance to cover a portion of NFIP losses above the $4 billion arising from Hurricane Harvey, which FEMA says should save taxpayers close to $1 billion.

The reinsurers that are part of the agreement will indemnify FEMA for flood claims on an occurrence basis. The agreement is structured to cover 26% of losses between $4 billion and $8 billion, up to a maximum of $1.042 billion. The coverage cost FEMA — that is, U.S. taxpayers — a total premium of $150 million for the coverage.

|$4 billion in claims — so far

FEMA surpassed $4 billion in paid claims to insured flood survivors of Hurricane Harvey n Nov. 6, 2017, triggering the NFIP reinsurance placement. The full extent of losses to the 2017 NFIP are still unknown, but loss estimates range between $8.5 billion and $9.5 billion, which means that FEMA should recover the entire $1.042 billion in reinsurance. FEMA sent initial bills to reinsurers today, according to the statement.

So far, FEMA said, the "trifecta of Hurricanes Harvey, Irma and Maria" generated more than 120,000 NFIP claims, marking the second largest claims year in NFIP history. NFIP has paid more than $6.687 billion in claims so far, with processing ongoing. FEMA assured the public that reinsurance will not impact claims payments to insured flood survivors.

FEMA described the 2017 reinsurance placement as a cornerstone for a multi-year strategy that promotes private sector participation in flood-risk management. FEMA is in the process of securing a new reinsurance placement for 2018.

How did FEMA get to the reinsurance agreement? The agency received the authority to secure reinsurance through the Biggert-Waters Flood Insurance Reform Act of 2012, and the Homeowner Flood Insurance Affordability Act of 2014. According to FEMA.

Hurricane Sandy claims ($8.3 billion) in October 2012 and Hurricane Katrina claims ($16.3 billion) in August 2005 resulted in program debt when the cois st of flood policy claims far exceeded the NFIP's premium revenues; reinsurance places the NFIP in a better position to manage losses incurred from similar major events.

Want to continue reading?

Become a Free PropertyCasualty360 Digital Reader

Your access to unlimited PropertyCasualty360 content isn’t changing.

Once you are an ALM digital member, you’ll receive:

- Breaking insurance news and analysis, on-site and via our newsletters and custom alerts

- Weekly Insurance Speak podcast featuring exclusive interviews with industry leaders

- Educational webcasts, white papers, and ebooks from industry thought leaders

- Critical converage of the employee benefits and financial advisory markets on our other ALM sites, BenefitsPRO and ThinkAdvisor

Already have an account? Sign In Now

© 2024 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.