(Bloomberg View) – The first game of this year's World Series earned a dubious distinction for the highest temperature ever recorded at the Fall Classic.

At 103 degrees, the temperature at 5 p.m. Tuesday in Los Angeles was far above the previous record of 94 degrees set in Phoenix in 2001.

Up the California coast, San Luis Obispo matched the highest temperature ever recorded in the U.S. so late in the calendar year. This exceptional heat is only one of the ways in which cities are experiencing climate change.

Too few are prepared for what's in store.

Urban vulnerability

Sea-level rise is another problem. Cape Coral, Florida, the fastest-growing city in the U.S., for example, is also “a precarious civilization engineered out of a watery wilderness” that one big storm could wipe off the map. Urban vulnerability in the face of rising seas and ever-more-intense storms isn't unique to Florida, either.

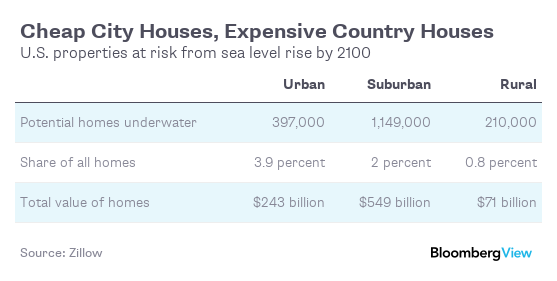

This has led economists at the real estate listing company Zillow to calculate the scope and scale of U.S. properties most at risk from rising seas. By 2100, sea-level rise will threaten more than 1.5 million homes, worth nearly $900 billion. The most vulnerable of these (as a percentage of housing stock in urban, suburban and rural areas) are the lowest-priced homes in cities, and the most expensive ones in rural areas.

|Adapting to threats

Adapting to these threats to America's coasts will require financial support. Through its flood insurance programs, special congressional allocations and the Federal Emergency Management Agency, the federal government is the ultimate backstop for communities rebuilding after natural disasters.

As my colleague Christopher Flavelle notes, proposed budget cuts to federal programs and agencies could prove harmful even before disaster strikes — by limiting coastal communities' ability to access credit markets.

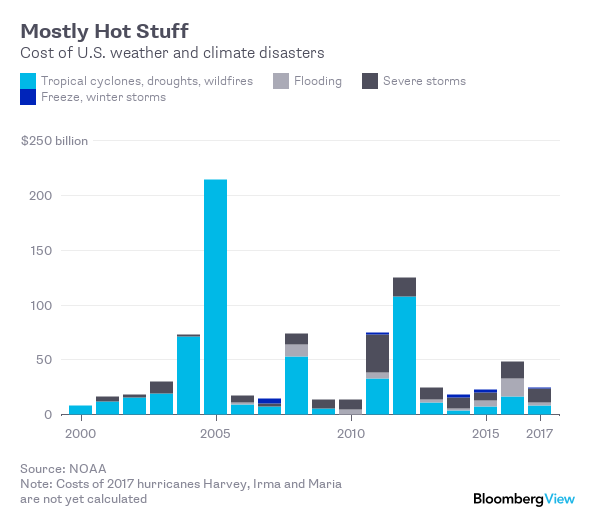

Regardless of proposed budget cuts or policy changes, the government's own data points very clearly to the magnitude of the effects of weather and climate disasters in the U.S. The National Oceanic and Atmospheric Administration keeps a dataset of every billion-dollar weather and climate disaster since 1980.

This year is on pace to record the highest number so far — even before counting the total costs of hurricanes Harvey, Irma and Maria, and California's wildfires. And while weather events come in all types, the vast majority of the damages sustained have been caused by “warm” disasters.

In light of NOAA's data, a recommendation this week from the Government Accountability Office on the potential economic effects of climate change seems modest. The president, the GAO says, “should use information on the potential economic effects of climate change to help identify significant climate risks facing the federal government.” Look at that chart above, and I think we can agree the economic repercussions are already clear.

While government remains unprepared, corporations increasingly consider climate change to be a threat to business as usual. Some 1,400 multinational companies now factor a carbon price into their business plans or will soon, up from 150 companies in 2014, according to the environmental disclosure platform CDP.

The private sector is going long on preparation, but the public sector is still falling short.

This column does not necessarily reflect the opinion of the editorial board or Bloomberg LP and its owners.

Related:

Copyright 2018 Bloomberg. All rights reserved. This material may not be published, broadcast, rewritten, or redistributed.

Want to continue reading?

Become a Free PropertyCasualty360 Digital Reader

Your access to unlimited PropertyCasualty360 content isn’t changing.

Once you are an ALM digital member, you’ll receive:

- Breaking insurance news and analysis, on-site and via our newsletters and custom alerts

- Weekly Insurance Speak podcast featuring exclusive interviews with industry leaders

- Educational webcasts, white papers, and ebooks from industry thought leaders

- Critical converage of the employee benefits and financial advisory markets on our other ALM sites, BenefitsPRO and ThinkAdvisor

Already have an account? Sign In Now

© 2024 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.