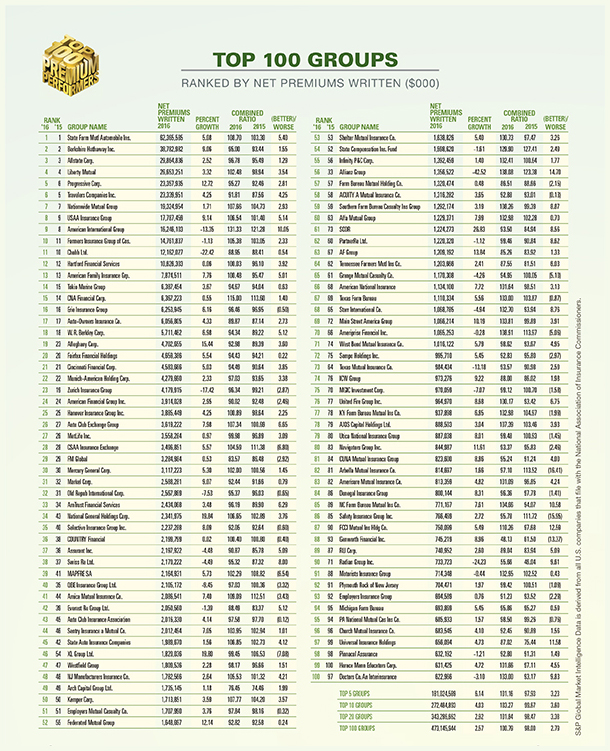

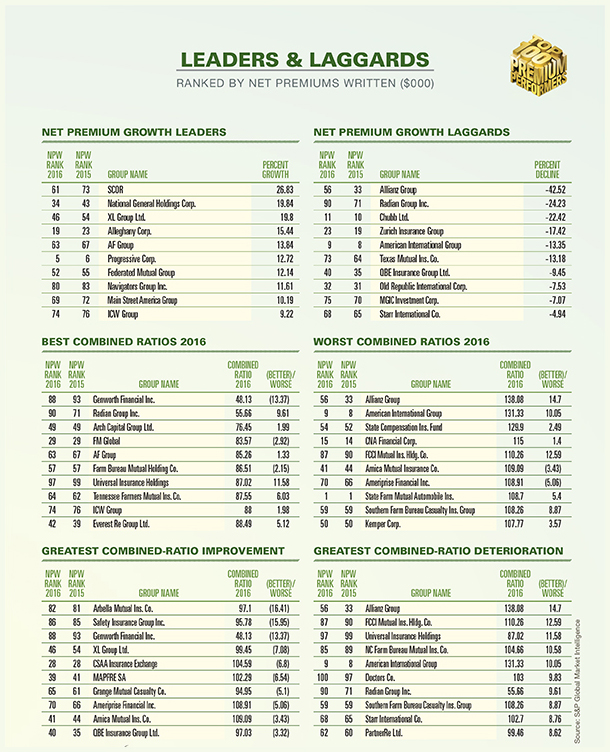

National Underwriter's Top 100 and Heads of the Lines lists — the data for which is provided by S&P Global Market Intelligence — offer a look at who's on top, who's taken a hit, and who's making progress in a crowded and highly competitive P&C market.

It also serves as a reminder that when it comes to premium earners in the top 100 groups and companies, there is the Top 10 — and then there's Everyone Else. The top 10 groups (ranked here by net premiums written, in $000s) represent some $182 billion (nearly 40%) of the approximate $473 billion total NPW among the top 100.

With a few exceptions, the top 10 groups and companies remain unchanged from years past, but that doesn't mean there aren't stories to tell once you delve into the data. Consider some of the biggest gainers in terms of percent growth: Among them, National General Holdings Corp., which posted nearly 20% growth in NPW; Alleghany Corp., which increased its NPW by 15.44%; and Navigators Group Inc., which showed 11.61% improvement in NPW while also reducing its combined ratio by 2.46 points to 93.37.

While AIG remains ensconced in the top 10 Groups, its combined ratio in 2016 was one of the highest in the industry, at 131.33. The carrier says that combined ratio figure "reflects prior year development, widely reported at this point, which we have addressed through our adverse development cover with Berkshire for accident year 2015 and prior, and by setting more conservative loss picks for AY 2016 and 2017, to further protect against future prior year development," according to a spokesman. "It is important to note that improvements in business mix and the increased use of underwriting tools and analytics led to a 4.1 improvement in our adjusted AY loss ratio in financial year 2016 to 66.7 from 70.8 in financial year 2015, after adjusting the prior year for the increase in loss picks."

AIG's decline in NPW, meanwhile, "reflects our strategy to improve Commercial's underwriting results," the company said. "About half of the decline is related to the increased use of reinsurance and exits from highly unprofitable lines, mostly in U.S. casualty, where portfolio remediation efforts are most intensely focused." The remaining half, a spokesman added, "is related to improved risk selection and increased use of tools and analytics, which helped bring about the 4.1 point year-over-year improvement in our adjusted accident year loss ratio to 66.7 in financial year 2016, as mentioned. Our focus at AIG is on key growth areas that offer compelling value."

Allianz Group's percent decline in NPW is at least in part attributable to the fact that not all of its subsidiaries report their figures to the NAIC; its reported combined ratio, however, doesn't help, at 138.08. On the company side, readers may note a huge increase in NPW growth (94.24%) for Allianz Global Risks U.S. Ins. Co. The spike, according to S&P Global Market Intelligence, is caused by an intercompany pooling arrangement which included Fireman's Fund Insurance Co. in 2016; previously, Fireman's Fund was not part of the pooling arrangement.

Meanwhile, in individual product lines, what is striking is the amount of net premiums being garnered by two key players in writing stand-alone Cybersecurity: AIG and XL Group. It's also worth noting that in last year's rankings, AIG hadn't cracked the top five; this time, it leads the pack.

The S&P Global Market Intelligence data throughout this feature is derived from all U.S. companies that file with the National Association of Insurance Commissioners (NAIC). The rankings in individual lines (Commercial Auto, Inland Marine, Fire, etc.) reflect net premiums written (in $000s), with the exception of Directors and Officers and stand-alone Cybersecurity — which are ranked by direct premiums written due to the fact that NAIC statements do not disclose net premiums written for those lines.

(Click images to enlarge.)

Want to continue reading?

Become a Free PropertyCasualty360 Digital Reader

Your access to unlimited PropertyCasualty360 content isn’t changing.

Once you are an ALM digital member, you’ll receive:

- Breaking insurance news and analysis, on-site and via our newsletters and custom alerts

- Weekly Insurance Speak podcast featuring exclusive interviews with industry leaders

- Educational webcasts, white papers, and ebooks from industry thought leaders

- Critical converage of the employee benefits and financial advisory markets on our other ALM sites, BenefitsPRO and ThinkAdvisor

Already have an account? Sign In Now

© 2025 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.