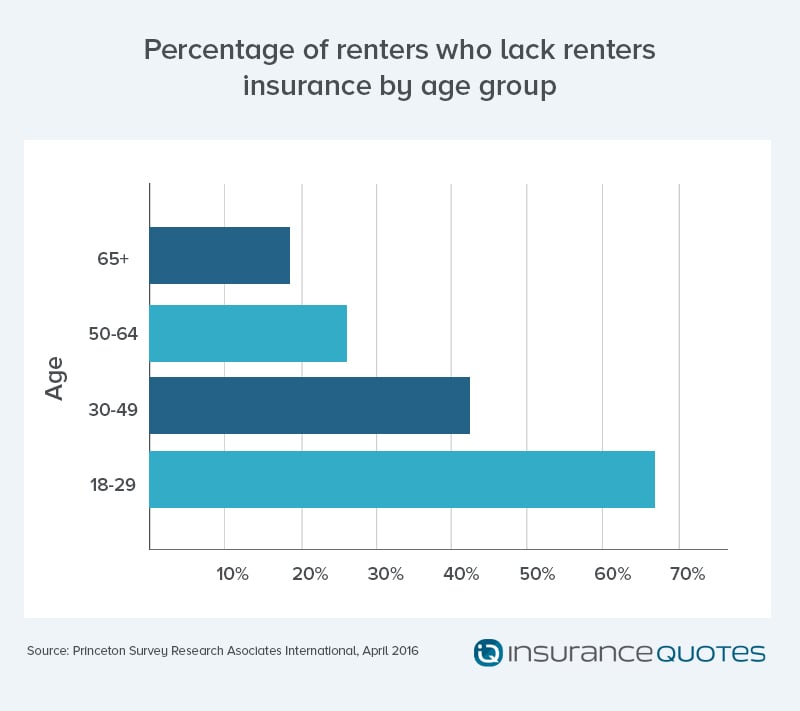

Here's a paradox: Millennials are most likely to rent their homes, but are least likely to purchase renters insurance coverage.

According to a new survey from Princeton Survey Research Associates International for InsuranceQuotes.com, 66% of 18- to 29-year-olds rent their homes, compared to 37% of consumers overall. However, nearly 70% of those millennials don't have Renters' insurance.

So what's keeping them from getting the coverage? Surprisingly, 59% of consumers in this age group most likely would say cost isn't the reason they lack Renters' insurance. Interestingly, 61% of millennials say they live in a secure enough property to choose skipping the coverage. Forty-three percent also claim they don't have enough property to insure, and 41% say they don't understand how the product actually works.

Compare that to 33% of all renters who say they don't have renters insurance because they don't understand the product.

(Click chart to enlarge.)

As many young millennials graduate high school and college and move on to the next chapters of their lives — which more often than not includes renting a home — here are some important facts to share with millennial clients on the importance of Renters' insurance:

Educate clients on the components of Renters' insurance

Renters' insurance has three main components:

- Personal property coverage: Renters' insurance covers the contents of a home including clothes, bicycles, furniture, dishes, TVs and other electronics. As a rough guide to the dollar amount of coverage for a client to buy, add up the cost to replace all the major items in a home: appliances they own, computers, other electronics and furniture, and then double that amount.

- Liability coverage: The liability component might be the biggest reason to get Renters' insurance because it can protect clients from huge financial losses. Renters' insurance can cover clients in a lawsuit by someone injured in their home and if their dog bites someone outside the home.

- Additional living expenses coverage: Another feature included in most renters insurance policies is called additional living expenses coverage. If a client can't stay in their apartment after a fire, burst pipe or other disaster, this coverage will pay for temporary lodging.

Encourage millennial consumers to take their time

Let clients know they can take their time and do their research when shopping for Renters' insurance. Explain all their options to them and gather quotes from several insurers for them to choose from.

Let millennial clients know they can boost liability limits

Most policies come with $100,000 of liability coverage, and most renters don't think to increase that. Let clients know that they can get $500,000 in coverage for about an extra $20 per year — chump change in comparison to what they could lose.

Remind millennials about Flood insurance

While it does cover personal property damaged in a natural disaster, not all Renters' insurance policies cover floods caused by natural disasters.

They may cover water damage from a plumbing problem, but many renters may need to purchase additional Flood insurance. Recommend the coverage to millennial clients living in a flood-prone area.

Related: 5 reasons why renters need insurance

Want to continue reading?

Become a Free PropertyCasualty360 Digital Reader

Your access to unlimited PropertyCasualty360 content isn’t changing.

Once you are an ALM digital member, you’ll receive:

- Breaking insurance news and analysis, on-site and via our newsletters and custom alerts

- Weekly Insurance Speak podcast featuring exclusive interviews with industry leaders

- Educational webcasts, white papers, and ebooks from industry thought leaders

- Critical converage of the employee benefits and financial advisory markets on our other ALM sites, BenefitsPRO and ThinkAdvisor

Already have an account? Sign In Now

© 2024 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.