It hasn’t been an easy year for the world’s wealthiest individuals.

Volatile stock markets, tanking oil prices and a stronger dollar led to a dramatic reshuffling of wealth around the globe and a drop in billionaire fortunes for the first time since 2009, according to Forbes.

In its 30th annual guide to the world’s richest people, Forbes found 1,810 billionaires, down from a record 1,826 a year ago. Sixteen individuals with ties to the insurance industry — down from 20 last year — made Forbes' 2016 list of world billionaires.

This year’s billionaires with connections to the insurance industry include the son of a Chicago meat-packer, a former appliance door-to-door salesman, a World War II flight navigator and a passionate environmentalist.

Overall, the United States has 540 billionaires, more than any other country in the world. It’s followed by mainland China with 251 and Germany with 120.

Here are the world’s 16 billionaires with wealth linked to insurance, according to Forbes’ 2016 list:

(Photo: YouTube)

No. 1,694: Ion Tiriac, 76

Bucharest, Romania

Net worth: $1.14 billion.

Source of wealth: banking, insurance, self-made.

Financial and real estate investor Ion Tiriac hold shares in insurance and auto leasing concerns and still runs his high-end car museum dedicated to his cars and motorcycles from Jaguar, Bentley, Mercedes-Benz, Rolls Royce and their ilk.

Tiriac competed in the 1960 Olympics as an ice hockey player and later switched to tennis, eventually coaching several tennis greats, including Boris Becker, Steffi Graf and Goran Ivanisevic. Most recently, he advised Romanian tennis ace Simona Halep to sign sponsorship contracts with companies such as Adidas and Vodafone.

(Photo: www.wrberkley.com)

No. 1,577 (4-way tie): William Berkley, 69

Greenwich, Conn.

Net worth: $1.14 billion.

Source of wealth: insurance, self-made.

William R. Berkley got the entrepreneurial bug as a young man. He founded insurance company W.R. Berkley Corp. in 1967 with just $2,500 while he was an MBA student at Harvard. The company, which had $5.3 billion in revenue in 2013, does business through 27 subsidiaries that insure everything from mobile surgery units to jewels to fine art. One of its fastest-growing units insures sports and entertainment companies.

Berkley took the company public in 1974. Revenue surpassed the $1 billion mark in 1995 after nearly two decades of acquisitions. He has a nearly 20% stake, though roughly half of his shares are pledged as collateral for loans. For this reason, Forbes applied a 50% discount to the pledged shares. Berkley is chairman and CEO. His son, W. Robert Berkley, is president and chief operating officer.

(Photo: YouTube)

No. 1,577 (4-way tie): Henry Engelhardt, 58

Cardiff, United Kingdom

Net worth: $1.22 billion.

Source of wealth: insurance, self-made.

The son of a Chicago meat packer, Henry Engelhardt aspired to be a journalist before turning to entrepreneurship. He started insurance company Admiral Group in 1993. The Welsh company offers car and home insurance in the United Kingdom and was behind the country's first online insurance price comparison website.

Based in Cardiff, Admiral also has operations in Spain, France, Italy and the United States. Its American brands include Elephant Auto Insurance and Comparenow.com. Admiral is known for its lighthearted, employee-friendly culture. Its "Ministry of Fun" organizes events for all staff members, such as dress-up days, rock band contests and surfing trips.

Engelhardt announced that he'll step down as CEO in mid-2016, but he will still be involved in the company in some capacity. He and his wife, Diane, started the Moondance Foundation, and have donated 6.5 million Admiral shares in the past four years.

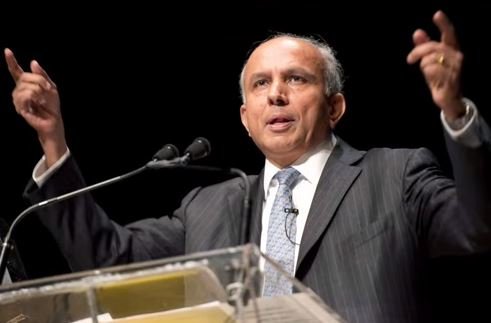

(Photo: YouTube)

No. 1,577 (4-way tie): V. Prem Watsa, 65

Toronto

Net worth: $1.04 billion.

Source of wealth: insurance, investments, self-made.

Prem Watsa founded Toronto-based financial services company Fairfax Financial Holdings in 1985 and remains its chairman and CEO. Born in Hyderabad, India, he later joined his brother in Canada, and then enrolled in the University of Western Ontario's MBA program. He paid his way through school by selling appliances door to door. After a stint as an investment analyst, Watsa struck out on his own in 1984.

Watsa began snatching up insurance companies, modeling his business after the success of his idol: Warren Buffett. Fairfax now maintains property and casualty insurance and reinsurance interests across four continents, and holds stakes in numerous companies, including IBM and phone maker BlackBerry. He also owns a stake in Fairfax India, a publicly traded subsidiary investing in Indian businesses.

Surin Upatkoon, a Thai national, currently lives in Kuala Lumpur, Malaysia. (Photo: iStock)

No. 1,577 (4-way tie): Surin Upatkoon, 66

Kuala Lumpur, Malaysia

Net worth: $1.15 billion.

Source of wealth: insurance, telecoms, lotteries.

The Thai national started his career as a manager at his father's textile company, MWE Weaving Mills, in 1971. He got his biggest break when he participated in the acquisition of a major stake in Multi-Purpose Holdings Bhd., which he later split into MPHB Capital, an insurance and real estate outfit.

More than 60% of Surin Upatkoon's wealth comes from the 10% stake in Thai telecom InTouch he sold in 2013. He also has interests in gambling company Magnum.

This May 7, 2012 photo shows Charles Munger, vice-chairman of Berkshire Hathaway, during an interview in Omaha, Neb. (Photo: Nati Harnik/AP Photo)

No. 1,476 (tie): Charles Munger, 92

Los Angeles

Net worth: $1.29 billion.

Source of wealth: Berkshire Hathaway, self-made.

As vice chairman of Berkshire Hathaway, Charlie Munger is Warren Buffett's right-hand man and investment partner. Berkshire has several subsidiary insurance companies. Munger is also chairman of the Daily Journal Corp., a California-based publisher, and he sits on the board of wholesale retailer Costco.

An Omaha native, Munger attended the University of Michigan, but dropped out to serve as a meteorologist in the U.S. Army Air Corps during World War II. He later graduated from Harvard Law and, in 1959, met Buffett at a dinner party.

Like Buffett, he's a pragmatic investor and a major philanthropist. In 2013, Munger pledged more than $100 million for new graduate residences at the University of Michigan, and in 2014, he gave $65 million to the University of California, Santa Barbara's Kavli Institute for Theoretical Physics for a new visitor's residence.

Toronto is where Hal Jackman made his billions. (Photo: iStock)

No. 1,476 (tie): Hal Jackman, 83

Toronto

Net worth: $1.24 billion.

Source of wealth: insurance, investments, self-made.

Hal Jackman and his family are the largest shareholders of E-L Financial Corp., a Toronto investment and insurance holding company, which provides insurance and financial services through its subsidiaries, the Dominion of Canada General Insurance Co. and Empire Life Insurance Co.

Born to a former member of parliament, Harry Jackman, Hal Jackman served as the 25th lieutenant governor of Ontario from 1991 to 1997. The University of Toronto alumnus has donated over $40 million to his alma mater and was its chancellor from 1997 to 2003. He chairs the Hal Jackman Foundation, which supports arts and cultural institutions in Toronto.

Jackman has handed over his business to the next generation. His son, Duncan, is the chief executive officer and president of E-L Financial, although Jackman remains the honorary chairman.

The only retail insurance company in the Soviet Union, Rosgosstrakh is still Russia's largest insurance company, and owned by billionaire Danil Khachaturov. (Photo: iStock)

No. 1,275: Danil Khachaturov, 44

Moscow

Net worth: $1.5 billion.

Source of wealth: insurance, banking, real estate, self-made.

Khachaturov studied construction and finance at Moscow schools and went to work at privately held BIN Bank and then at Slavneft, an oil company led at the time by billionaire Mikhail Gutseriev.

Between 2001 and 2003, he and his partners spent $60 million buying 75% of then-insolvent Rosgosstrakh from the government. In 2010, they bought the remaining 25%. What was once the only retail insurance company in the Soviet Union, Rosgosstrakh is still Russia's largest insurance company, with $2.4 billion in revenue. In May 2015, the Bank of Russia suspended the insurer's license for 13 days after receiving 2,300 complaints from clients.

In this Oct. 9, 2012 photo, George Joseph, the chairman of Mercury General Corp., poses for photos in his office in Los Angeles. (Photo: Jae C. Hong/AP Photo)

No. 1,198: George Joseph, 94

Los Angeles

Net worth: $1.54 billion.

Source of wealth: insurance, self-made.

Back in 1961, door-to-door insurance salesman George Joseph realized that Auto insurance companies weren't screening their customers correctly. That led him to start Mercury General, which offered cut-rate deals to safer-than-average drivers.

Joseph, a former World War II flight navigator, is still on the job today, serving as chairman of his $3 billion (in sales) publicly traded insurer. In 2012, the nonagenarian backed Proposition 33, a California ballot measure that would have given drivers "persistency discounts" for maintaining Auto insurance. Critics said it would drive up prices for people who hadn't been able to afford insurance. It did not pass.

In 2005, Rolf Gerling, a current resident of Zurich, Switzerland, sold his 94% stake in Gerling Konzern to Talanx Group, Germany's third-largest insurance company, for an estimated $1 billion. (Photo: iStock)

No. 1,067: Rolf Gerling, 61

Zurich, Switzerland

Net worth: $1.65 billion.

Source of wealth: insurance.

In 1904, Rolf Gerling's grandfather launched a small insurance business, Gerling Konzern, which his father Hans expanded into a global insurance group. In 1992, following the death of his father, Gerling, an economist by training, sold a 30% stake to Deutsche Bank. He chaired the supervisory board but showed little interest in managing the business. Eventually, mismanagement coupled with losses from the Sept. 11, 2001, terrorist attacks and costly asbestos claims plunged his legacy into turmoil.

Forced to sell assets to raise capital, Gerling Konzern became a shadow of its former self. Deutsche Bank, after having raised its stake to 34.5% through capital injections, bailed out in 2003, basically receiving in exchange for its interest a share of the credit insurer Gerling NCM, which had been broken apart in a deal involving another Gerling Konzern shareholder, Swiss Re. Finally, in 2005, Gerling sold his 94% stake in Gerling Konzern to Talanx Group, Germany's third-largest insurance company, for an estimated $1 billion.

A passionate environmentalist who lives in Switzerland, Gerling, while overseeing Gerling Konzern, raised awareness of environmental-related risk factors within the insurance industry. In the 1990s, he was instrumental in getting 50 insurance companies to sign a United Nations pledge to consider the issues of climate change and other environmental problems in their business practices. Today, he sits on the foundation board of the Research Institute of Organic Agriculture and supports ecology-minded projects through the Gerling Foundation.

(Photo: YouTube)

No. 959 (tie): Othman Benjelloun, 83

Casablanca, Morocco

Net worth: $1.9 billion.

Source of wealth: banking, insurance.

Othman Benjelloun sits at the helm of BMCE Bank, one of Morocco's largest banks. Through his holding company FinanceCom, he is also the majority shareholder of insurance company RMA Watanya, and has a minority stake in Meditelecom, Morocco's second largest mobile phone operator.

To house BMCE's new headquarters, Benjelloun is building a 30-story rocket-shaped tower that will loom over Casablanca.

The Kyobo Life Insurance Building in downtown Seoul, South Korea. (Photo: Ian Mutto/Wikimedia)

No. 959 (tie): Shin Chang-Jae, 62

Seoul, South Korea

Net worth: $1.9 billion.

Source of wealth: insurance.

Shin Chang-Jae was a practicing obstetrician and a professor at Seoul National University when he joined Kyobo Life Insurance in 1996, as his father, Shin Yong-Ho, was undergoing cancer treatment. The elder Shin had founded the company (formerly known as Daehan Kyoyuk Insurance Co.) in 1958.

When Shin Chang-Jae became chairman and CEO in 2000, it was reeling from investment portfolio losses in the aftermath of the Asian Financial Crisis. He turned the company around by focusing on customer satisfaction, risk control and strengthening what has become one of the most admired corporate cultures in Korea. Through an extensive distribution network of agents and financial planners, the company offers insurance and asset-management products to more than five million customers.

Shin, who maintains a busy schedule of public speeches and lectures, is known for his management acumen and commitment to helping others. In 2010, he received the 19th Montblanc de la Culture Arts Patronage Award for his support of Korean literature through the Daesan Foundation, established under the auspices of Kyobo Life Insurance by his father.

To encourage young readers, Shin Yong-Ho also established, in 1980, what has become perhaps the most famous bookstore in Korea — the Kyobo Book Center at the insurer's headquarters building in Gwanghwamun, in downtown Seoul.

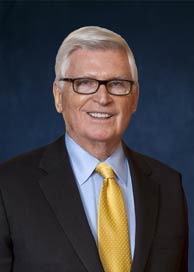

(Photo: www.ryansg.com)

No. 771: Patrick Ryan, 78

Winnetka, Ill.

Net worth: $2.3 billion.

Source of wealth: insurance, self-made.

Two years after stepping down from reinsurance giant Aon, Patrick Ryan came out of retirement in 2010 to create insurance company Ryan Specialty Group. His new business keeps its financials close to the vest, but by all accounts it has been a wild success. Ryan Specialty now operates three subsidiaries out of its Chicago headquarters.

Ryan founded his first business, Pat Ryan & Associates, in 1964, five years after graduating from Northwestern's business school. He merged his first company with Combined International in 1982, renamed it Aon, and grew the business into the world's largest reinsurance broker.

A minority owner of the Chicago Bears, Ryan led the Windy City's failed bid for the 2016 Olympic Games. He is also a Northwestern trustee, and has paid for renovations to its athletic facilities and scholarships for low-income students.

(Photo: YouTube)

No. 421: Vanich Chaiyawan, 84

Bangkok

Net worth: $3.7 billion.

Source of wealth: insurance, beverages, self-made.

Thai insurance tycoon Vanich Chaiyawan's son Chai, who runs Thai Life, the family's biggest asset, is aiming to improve the company's ranking as Thailand's third-largest life insurer. Forecasting a 10% growth in Thailand's insurance market in 2016, he's focused on the country's aging population with new products and speedy settlements. After selling a 15% stake to Japan's Meiji Yasuda 3 years ago, he acquired the 50% stake in Thai Cardif that he didn't own from BNP Paribas.

Vanich also has a small stake in fellow billionaire Charoen Sirivadhanabhakdi's Thai Beverage.

(Photo: PPF Group N.V.)

No. 96: Petr Kellner, 51

Vrane nad Vitavou, Czech Republic

Net worth: $10.6 billion.

Source of wealth: insurance, banking, self-made.

The Czech Republic’s richest man, Petr Kellner got his start in the early 90's selling office supplies, then borrowed $1 million against that business and started an investment fund which he used it to buy a controlling stake in the biggest Czech insurer during its privatization. He received the final payment from Italian insurer Generali, closing the $3.6 billion repurchase of his former joint venture Generali PPF Holding. Kellner is investing his cash hordes in biotech.

Kellner, with his wife, endows scholarships at his Open Gate School and became the leading sponsor of a library-think-tank for Czech ex-president Vaclav Klaus. Kellner is also famous for having the biggest collection of Czech modern photography. His firm is the new general partner of the Prague Spring international music festival to be held in May.

Billionaire investor Warren Buffett speaks at an event Omaha, Neb., Wednesday, Dec. 16, 2015. (AP Photo/Nati Harnik)

No. 3: Warren Buffett, 85

Omaha, Neb.

Net worth: $60.8 billion.

Source of wealth: Berkshire Hathaway, self-made.

In his 2016 letter to shareholders, Warren Buffett, CEO of Berkshire Hathaway, displayed cheery optimism for America's future. The fifth-most valuable corporation in the United States, Berkshire owns companies such as Geico, Dairy Queen and Fruit of the Loom, and has significant investments in Wells Fargo, IBM and Coca-Cola.

Berkshire Hathaway subsidiary insurance companies include:

Known for his relative frugality, Buffett still lives in the Omaha home he purchased for $31,500 in 1958. He says his best investment was buying Benjamin Graham's legendary book, "The Intelligent Investor," in 1949.

In the 30 years Forbes has tracked global wealth, only five people have held the title of richest person on planet — three of those five still rank among the four richest in the world, including Warren Buffett.

Join us on Facebook and give us a Like!

Want to continue reading?

Become a Free PropertyCasualty360 Digital Reader

Your access to unlimited PropertyCasualty360 content isn’t changing.

Once you are an ALM digital member, you’ll receive:

- Breaking insurance news and analysis, on-site and via our newsletters and custom alerts

- Weekly Insurance Speak podcast featuring exclusive interviews with industry leaders

- Educational webcasts, white papers, and ebooks from industry thought leaders

- Critical converage of the employee benefits and financial advisory markets on our other ALM sites, BenefitsPRO and ThinkAdvisor

Already have an account? Sign In Now

© 2024 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.