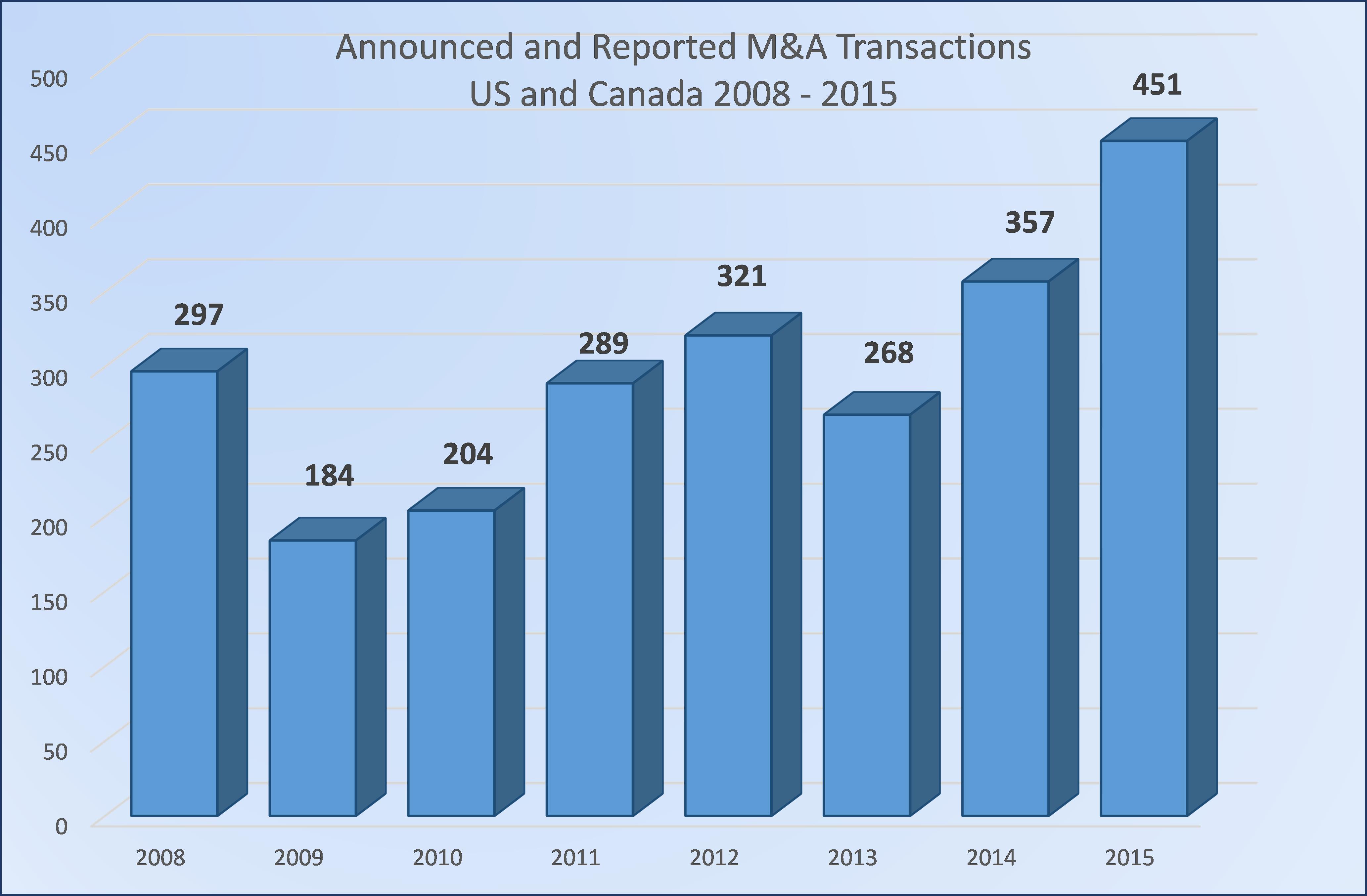

Insurance agency mergers and acquisitions hit a record high of 451 reported transactions for the U.S. and Canada in 2015, surpassing the previous record of 357 in 2014, according to a report from Optis Partners.

“This is strong evidence of a steady, entrenched shift in buyer dynamics,” said Timothy J. Cunningham, managing director of Optis, a Chicago-based investment banking and financial consulting firm specializing in the insurance industry, and National Underwriter Property & Casualty advisory board member. “Private-equity backed buyers were responsible for virtually all of the year-over-year growth, while P&C agencies dominated the seller category.”

Indeed, private-equity-backed agencies were 2015’s biggest buyers, with 242 transactions, which is an increase of more than 50% from the year previous, the “2015 Agent-Broker Mergers & Acquisitions” report states. This is the first time that any buyer group has accounted for the majority of transactions, Cunningham says.

Caledona, Mich.-based brokerage Acrisure (which is backed by Genstar Capital) made the most transactions, with 56 acquisitions. Lake Mary, Fla.-based AssuredPartners, backed by Apax Partners, came in second with 38 transactions, followed by Chicago-based brokerage Hub International, backed by Hellman & Friedman, with 37 transactions.

What’s driving this trend is the “limited options available to investors to generate the returns they seek,” the report states. “Interest rates have been paltry for years; the U.S. stock market has become more volatile after years of growth … Meanwhile, the insurance brokerage business has proven to be an opportunistic vehicle that meets investors’ return demands.” As such, private-equity-backed buyers are “willing to push agency values to levels not seen in many years.”

Privately owned insurance companies purchased 109 agencies in 2015, followed by public brokers (50 transactions), banks (24 transactions) and all others, which includes carriers (26 transactions).

Property and casualty agencies drive sales

Fifty-seven percent of merger and acquistion sales were of P&C-focused agencies, Optis says in its report. Agencies specializing in both P&C and employee benefits represented 17% of the sales, which is the same percentage of transactions for agencies with employee benefits only.

The report covers agencies selling primarily property and casualty insurance, agencies selling both P&C and employee benefits, and employee benefits agencies.

Data for the report comes from reported transactions in the insurance distribution sector for both retail and wholesale producers, including managing general agencies and managing general underwriters.

Data is restricted to those agencies providing P&C, employee benefits, or a combination thereof. The total number of transactions actually is greater than the 451 reported, as many buyers and sellers do not report transactions, Optis said in its report.

(Click image to enlarge)

Trends in annual number of insurance agency mergers and acquisitions, 2008-2015. Source: OPTIS Partners.

Have you Liked us on Facebook?

Want to continue reading?

Become a Free PropertyCasualty360 Digital Reader

Your access to unlimited PropertyCasualty360 content isn’t changing.

Once you are an ALM digital member, you’ll receive:

- Breaking insurance news and analysis, on-site and via our newsletters and custom alerts

- Weekly Insurance Speak podcast featuring exclusive interviews with industry leaders

- Educational webcasts, white papers, and ebooks from industry thought leaders

- Critical converage of the employee benefits and financial advisory markets on our other ALM sites, BenefitsPRO and ThinkAdvisor

Already have an account? Sign In Now

© 2024 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.