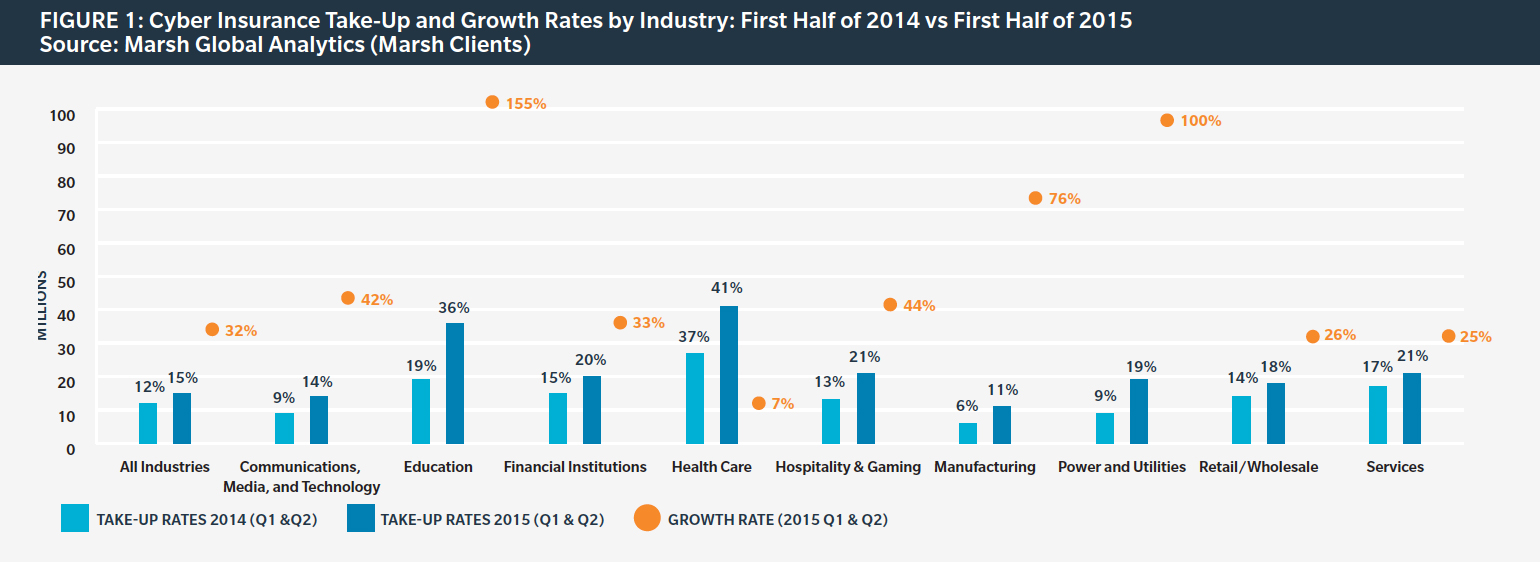

As more and more high-profile cyber attacks are identified, businesses are increasing their investment in cyber insurance to help mitigate their risk exposure in the event their data is hacked. According to U.S.-based insurance broker Marsh in its latest report, Benchmarking Trends: Cyber Attacks Drive Insurance Purchases for New and Existing Buyers, client spending on standalone cyber insurance increased 32% for the first half of 2015. Pricing for cyber insurance also increased – especially for industries that have experienced significant cyber losses.

Across specific business lines, spending grew significantly. (See Figure 1) Power and utility companies increased their growth rate 100%, nearly doubling their take-up rates for the same period in 2014. Universities and other education-based institutions saw a growth rate of 155% – a 90% change in their cyber insurance take-up rates over the previous year. Marsh notes that "school settings are ripe for cyber attacks due to the hefty amount of student and staff personnel information that is stored in a variety of places."

Following the Anthem hack earlier this year, spending by healthcare organizations increased to 41% in 2015, up from 37% in 2014. Based on the type of information health care providers hold, they are prime targets for cyber criminals who understand the opportunities shared data exposures present. There are also threats that exist because of individuals filing false healthcare claims with stolen data.

The hospitality and gaming industries, as well as the financial sectors experienced a 5-8% increase in cyber purchases for the first half of 2015 too. While financial institutions are already targets of cyber attacks, a new warning from Standard & Poor's stated that banks could run the risk of having credit ratings downgraded if an organization is unprepared for a cyber incident.

(Photo: WaveBreak Media/ThinkStock)

In the communications, media and technology (CMT) sector, companies with revenues over $1 billion purchased 50% more cyber coverage for the first six month of 2015 ($55.8 million) than during the same period in 2014 ($38 million). More sophisticated attacks have prompted companies in the CMT sector to escalate cyber spending, with most purchasing an average of $18.1 million in cyber limits.

The retail sector, which has already seen a number of high-profile cyber attacks at Home Depot, Target, Michaels, and Lord & Taylor, experienced a 32% rise in the cost of cyber insurance. The average price increase was 19% for other business sectors. Healthcare firms experienced rate increases similar to the retail sector because of changes in the program structure, especially in the area of managed care.

The high-profile cyber breaches have gotten the attention of businesses, which are now being far more proactive in their risk management strategies. Corporate leaders recognize that it is no longer just an IT problem and that the most effective programs are implemented enterprise-wide. While overall capacity in the market is abundant at $500 million per risk on average, large companies purchased only $30.4 million in coverage limits during the first half of 2015.

According to Marsh, it is vital for organizations to assess their vulnerabilities, determine how they would respond in an actual cyber breach, and be proactive in preparing for this eventuality. Network security firm, FireEye, says attackers are quick to adapt as businesses change their cyber strategies. Companies are learning sooner if there has been a breach, but FireEye says hackers continue to utilize new techniques for each phase of an attack.

See related story: The 10 most expensive data breaches to date

How can you transform your risk management preparedness and response strategy into a competitive advantage? Introducing ALM's cyberSecure — A two-day event designed to provide the insights and connections necessary to implement a preparedness and response strategy that changes the conversation from financial risk to competitive advantage. Learn more about how this inaugural event can help you reduce risk and add business value.Want to continue reading?

Become a Free PropertyCasualty360 Digital Reader

Your access to unlimited PropertyCasualty360 content isn’t changing.

Once you are an ALM digital member, you’ll receive:

- Breaking insurance news and analysis, on-site and via our newsletters and custom alerts

- Weekly Insurance Speak podcast featuring exclusive interviews with industry leaders

- Educational webcasts, white papers, and ebooks from industry thought leaders

- Critical converage of the employee benefits and financial advisory markets on our other ALM sites, BenefitsPRO and ThinkAdvisor

Already have an account? Sign In Now

© 2024 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.