For much of the country, summer is synonymous with good times and having fun. But on the Gulf Coast and along the Eastern Seaboard—and particularly at property and casualty insurance companies—it's also a time for trepidation. As we approach September, and hurricane season is fully underway, people from Maine to Florida, Alabama to Texas, brace for the potentially devastating effects of hurricanes developing in the Gulf and the Atlantic.

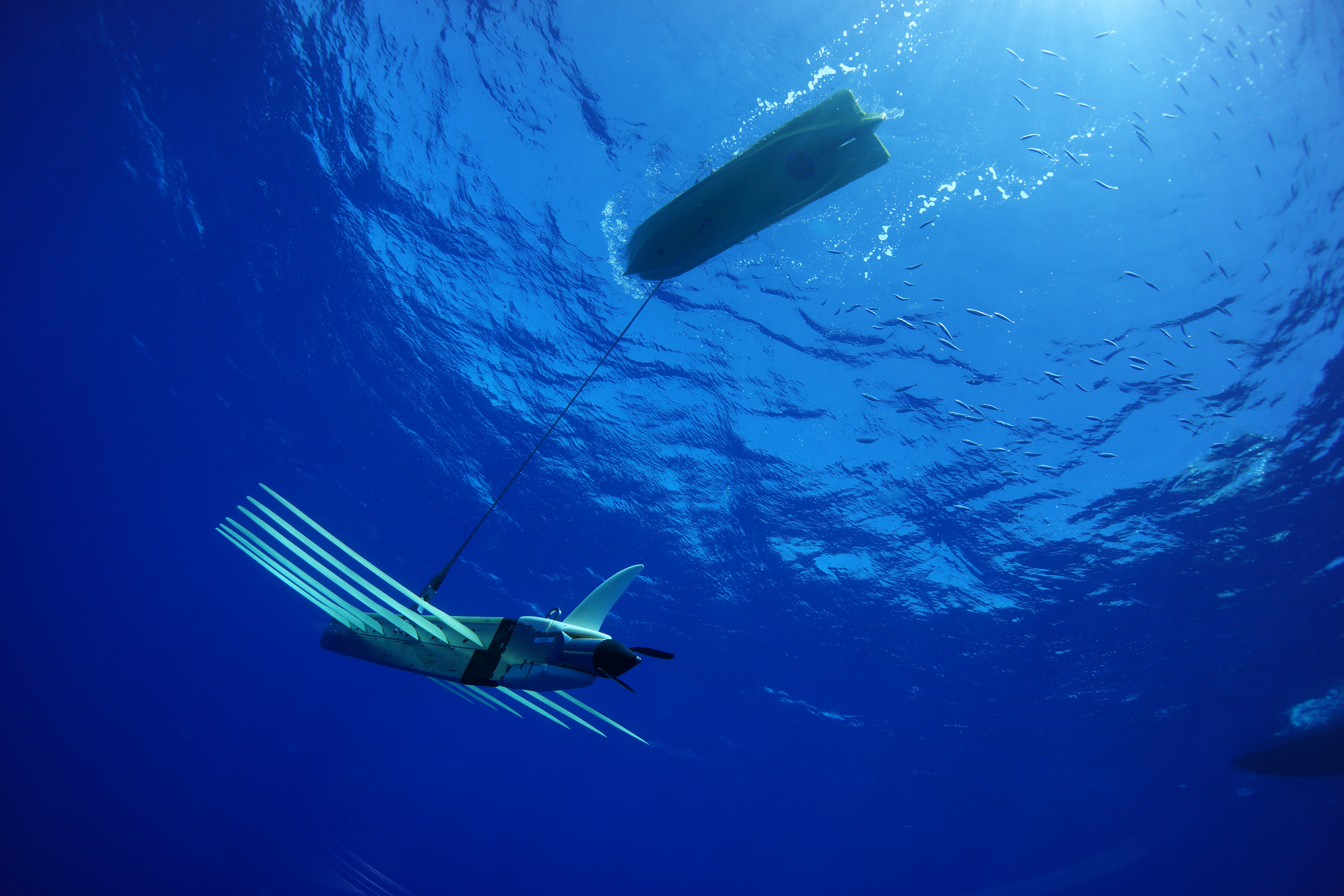

Hurricanes are massive, complicated weather systems, due to their complexity and the difficulty of gathering data in some of the most extreme conditions on Earth. But advanced technology like Liquid Robotics' (LRI) Wave Glider®, an unmanned ocean robot capable of operating through even the most severe Category 5 storms, can continuously collect and transmit hurricane intensity data in real time. This is game changing.

Wave Gliders connect the undersea world to air, space and shore through unprecedented monitoring, assessment and protection of the world's oceans. They have survived 17 hurricanes, cyclones and typhoons, and most recently tweeted their way through the 2014 hurricane season. They collect real-time data to aid meteorologists in better modeling and predicting hurricane intensity; a key to improving evacuation preparedness, reducing false alarms and saving lives.

Certainly weather services and emergency preparedness professionals stand to gain a great deal from these advanced systems. Catastrophe (CAT) modeling in the insurance industry also is realizing the benefits of having superior and more accurate data.

It's all about the data

Crucially important to the work of insurance providers, CAT models provide a reasonable estimation of the potential damage, strength, and trajectory of an incoming storm system. Historically, CAT models were used only by reinsurers and typically applied only to aggregate portfolios. Over the past 10 years, however, CAT models have been increasingly applied through risk-based assessment and analysis. But despite this rise in popularity, CAT models still suffer from a lack of accurate data.

A model is only a representation of reality. Depending on the questions being asked a model could be highly complex or extremely simple, and it is in understanding the limits of a model that its value can be properly achieved. If you don't have real data to insert into the CAT model—for example, the true intensity of the storm—then the model will be flawed.

This was particularly true in 2005, when Hurricane Katrina made land fall in Louisiana. CAT models failed to predict Katrina's historic intensity and direction, leading to an underprepared emergency response and catastrophic destruction.

On average, it costs $1 million to evacuate and prepare one mile of coastline for an incoming hurricane. Though it is a hefty price tag, this cost is but a fraction of the potential life and monetary cost incurred by lack of preparedness for a serious storm. When Hurricane Katrina hit an underprepared Louisiana, more than 1,500 people were killed and total property damage was estimated to be in excess of $100 billion.

During Hurricane Andrew, which occurred in August 1992, more than $10 billion in insured residential damage and $16 billion in total insured damages were reported.

CAT modeling failed to predict these storms and the intense damage they would cause—a reflection of the poor quality of data upon which they are built. Many models are inaccurate simply because they're constrained by a lack of data and scientific knowledge. This is certainly the case with the catastrophe models used extensively by the insurance industry. No matter how many Ph.D.s work on a catastrophe model, the fundamental uncertainties around the frequencies and intensities of large magnitude events can't be removed.

Sources of data gathering

Sources of data gathering

Historically, data on hurricanes has been gathered by three methods: P-3 "hurricane hunters," planes flown directly above massive storms to collect data from 10,000 feet above the ocean's surface; moored weather buoys that often become inoperable during the violent storms; or satellites collecting data 250 miles above the surface of the ocean where collection of the intensity data occurs.

These sources of data play a significant part in understanding the development and trajectory of a hurricane, and data collected from such a significant distance paints an inadequate picture of the storm's intensity and movement potential. CAT models used for Katrina and Andrew found this to be true, and the resulting under-preparation was devastating. But the Wave Glider will improve the accuracy of the CAT modeling because it is providing real-time data from the surface of the ocean during the entire storm.

As insurers continue to demand higher quality data, the technology industry will rise to meet the challenge. Currently, LRI's Wave Glider is the only unmanned ocean robot proven to collect and transmit real-time data from the sea's surface during active hurricanes. Far more accurate than a plane 10,000 feet above the surface, Wave Gliders provide a critical stream of storm data to enable insurers and forecasters to more accurately predict the intensity of an incoming storm. With the potential to save thousands of lives and billions of dollars, utilization of technology like the Wave Glider is an easy way to drastically increase the efficacy of existing CAT modeling.

I firmly believe that improved and accurate data from LRI's Wave Glider technology could encourage insurers who have left the voluntary market in coastal states—where homeowners must obtain coverage from government-mandated plans—to return, ultimately bringing down the cost of coverage with more competition and a shared risk pool.

What's more, a fleet of Wave Gliders pre-positioned off the coast of the Atlantic and in the Gulf has the potential to save thousands of lives and billions of dollars by providing early warning data on storm intensity. As CEO of LRI, I know that the Wave Glider is a true game-changer for the actuarial models used by property and casualty insurers. Our technology should be part of every major Property & Casualty insurer's portfolio of tools to assist in making the underwriting process for catastrophes more reliable with real-time, accurate data. LRI is poised not only to help save lives and minimize property damage, we have the ability to also revolutionize and transform the economics of the insurance and reinsurance marketplace.

Want to continue reading?

Become a Free PropertyCasualty360 Digital Reader

Your access to unlimited PropertyCasualty360 content isn’t changing.

Once you are an ALM digital member, you’ll receive:

- Breaking insurance news and analysis, on-site and via our newsletters and custom alerts

- Weekly Insurance Speak podcast featuring exclusive interviews with industry leaders

- Educational webcasts, white papers, and ebooks from industry thought leaders

- Critical converage of the employee benefits and financial advisory markets on our other ALM sites, BenefitsPRO and ThinkAdvisor

Already have an account? Sign In Now

© 2024 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.