Purchasing auto insurance is never a "fun" experience for customers. But part of the reason it's so difficult is because each state is different in what each requires in terms of coverage.

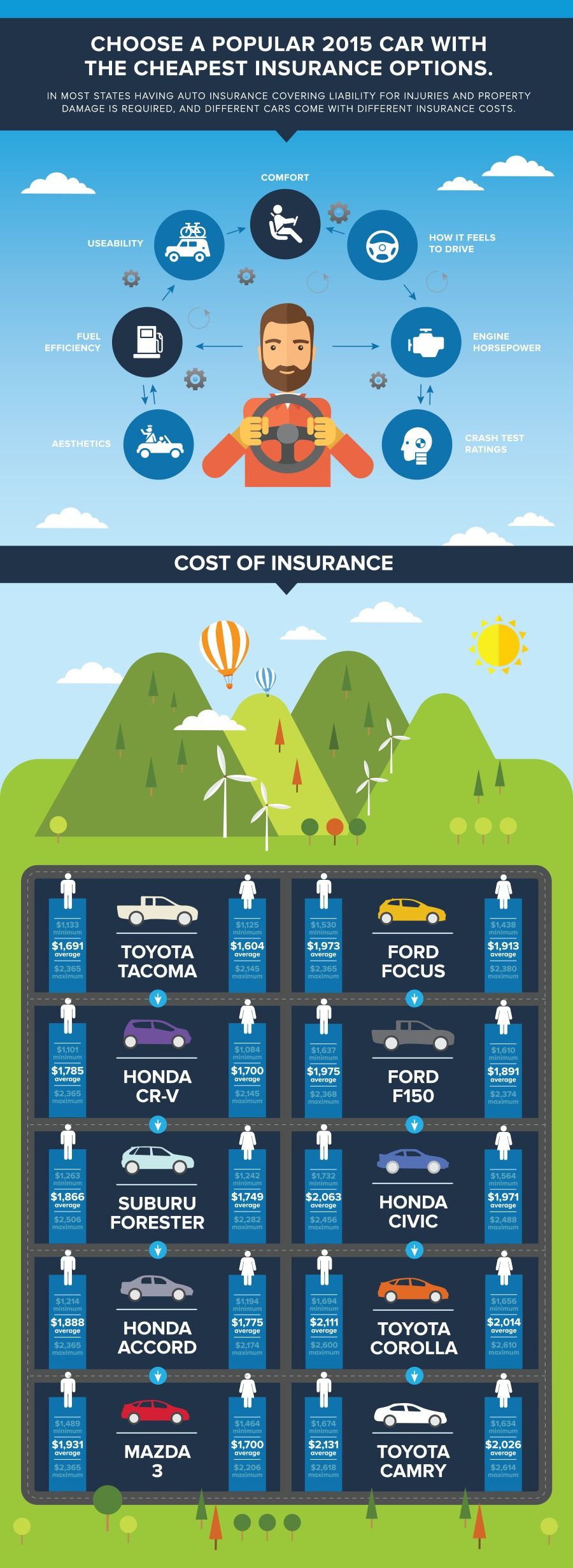

Deciphering what additional coverage you need is even more confusing. If you drive one of the 10 vehicles mentioned in the Compare.com infographic below and you are paying quite a bit more than the upper and lower limits, you have a solid case as to why you should change policies.

[Related: The 10 least expensive 2015 model year cars to insure]

If you don't drive one of the 10 vehicles listed below and are curious about how much you are paying versus what other auto insurers are willing to charge, Compare.com offers a tool to compare auto insurance now!

(Source: Compare.com)

[Related: Here are the 10 states where people pay the most for insurance coverage]

Want to continue reading?

Become a Free PropertyCasualty360 Digital Reader

Your access to unlimited PropertyCasualty360 content isn’t changing.

Once you are an ALM digital member, you’ll receive:

- Breaking insurance news and analysis, on-site and via our newsletters and custom alerts

- Weekly Insurance Speak podcast featuring exclusive interviews with industry leaders

- Educational webcasts, white papers, and ebooks from industry thought leaders

- Critical converage of the employee benefits and financial advisory markets on our other ALM sites, BenefitsPRO and ThinkAdvisor

Already have an account? Sign In Now

© 2025 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.