Employee theft is a real risk and it can happen to you.

A new report on employee theft from Hiscox finds that the majority of employee thefts occur in small businesses that have 500 employees or less. Hiscox looked at all federal actions involving employee theft over the calendar year 2014 and found that nearly 72% involved organizations with fewer than 500 employees. Within that set, four of every five victim organizations had fewer than 100 employees, and more than half had fewer than 25.

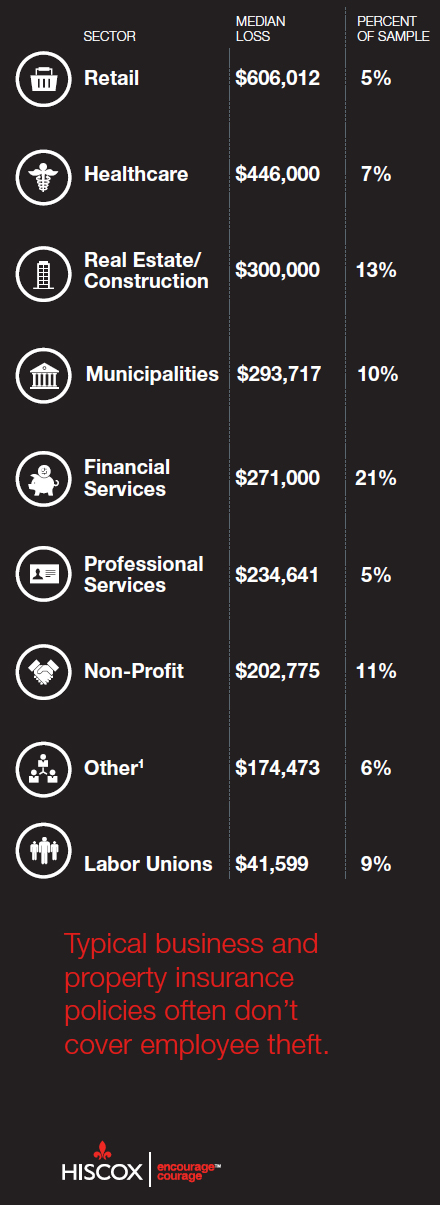

The study also found that financial services organizations (such as insurance companies, banks and credit unions) are most at risk, accounting for over 21% victim organizations. Other organizations with a high concentration of employee thefts are non-profits (11%), municipalities (10%) and labor unions (9%).

The study also found that financial services organizations (such as insurance companies, banks and credit unions) are most at risk, accounting for over 21% victim organizations. Other organizations with a high concentration of employee thefts are non-profits (11%), municipalities (10%) and labor unions (9%).

Although they don't have the most incidences of employee theft, retail entities and the healthcare industry have the largest median losses, losing an average of $606,012 and $446,000 respectively in the year studied.

See the infographic on the right for a full list of median lost income. Click on the image for full-size.

According to Hiscox, most instances of employee theft are perpetrated by employees with long tenures who have developed trust within the organization. Fifty-three percent of employee theft schemes were carried out by employees in senior roles, with those stakeholders engaging in schemes with a median loss of $313,939.

More than 40% of thefts surveyed were perpetrated by a professional in a finance or accounting role, Hiscox found. Non-management employees were responsible for 43% of thefts, with a median loss of $234,641.

Additionally, Hiscox found that the median age of employee theives was 50, and that 60% of perpetrators were women.

Hiscox breaks down the profiles of employee schemers in the infographic on the next page.

Fifty-eight percent of employee theft cases surveyed by the Association of Certified Fraud Examiners (ACFE) showed absolutely no recovery of losses, making it extremely important for businesses to mitigate the risk.

Hiscox has eight tips organizations can follow to minimize the likelihood and impact of losses related to employee thefts. Risk mitigation tactics are especially important for small to medium-sized businesses, which can be devastated by an instance of employee theft.Click “next” to see 8 tips to mitigate employee theft risks.

(docstockmedia/Shutterstock.com)

1. Establish best practices in the accounting department.

Hiscox encourages businesses to mandate dual signatures or dual review on disbursements (checks and wires). It is also important to create separation in key business processes. For example, separate the money from record-keeping so that no single employee can control a process from beginning to end, and don't let the accounts payable person reconcile back accounts.

(Pressmaster/Shutterstock.com)

2. Bring fraud deterrence into the light.

Provide a short training session for all employees to illustrate the damaging impact of fraud and abuse, and provide practical advice on how to spot fraud. According to Hiscox, even just creating a “perception of detection” within a work environment and cut down on instances of employee theft.

(kurhan/Shutterstock.com)

3. Set “Tone at the Top.”

Have everyone from management, audit and the leadership team talk about fraud prevention. Be sure employees are aware of internal controls and ask employees if they know of any weaknesses in the controls and how to improve them. A private hotline is a good way to promote reporting misconduct. According to ACFE, more than 40% of all cases are detected by a tip, nearly half of which came from employees.

(kurhan/Shutterstock.com)

4. Conduct comprehensive audits that specifically look for fraud.

Surprise audits are particularly effective because fraudsters will not have time to alter, destroy or misplace records and other evidence.

(BlueSkyImage/Shutterstock.com)

5. Thoroughly screen prospective employees.

Background checks are a good place to start, but they do not reveal arrests without convictions, let alone plea deals and settlements. A comprehensive screening should also include credit checks, reference checks and interviews. And don't be afraid to ask about an employment gap; Hiscox reports there have been many times where a fraudster who submitted a resume with an employment gap and was never asked about turned out to have been serving time in prison for embezzlement from their prior employer!

(Digital Media Pro/Shutterstock.com)

6. Mind your vendors.

Do not retain vendors that are owned by friends or family of existing employees. Conduct background checks on all vendors and always separate the vendor approval process and authorization of payments to vendors.

(Andrey Burmakin/Shutterstock.com)

7. Respond to suspected theft swiftly.

When fraud is suspected, leadership should immediately retain legal counsel to conduct an internal investigation. This is critical to discourage copycat actions and potential employment claims down the road. Appropriately determining the nature and extent of the loss and who is responsible will facilitate civil actions to recover stolen funds and enhace the entity's ability to recover a restitution if a referral to law enforecement is made. Law firms with experience in white collar crime will also have recommendations for forensic accounts and can hire those firms to work hand-in-hand with legal counsel under the protection of the attorney-client privilege.

(Olga Danylenko/Shutterstock.com)

8. Maintain appropriate insurance coverage.

Understand the limits and exclusions of existing and prospective policies. Typical business owners' and property insurance policies often exclude coverage for employee thefts. The best protection is a strong crime policy, which typically includes:

- A broad definition of “employee” including coverage for employees known to have prior incidents of theft or dishonesty

- No conviction requirement for coverage to apply

- Coverage for theft from the organization and any of its clients

- Coverage for theft perpetrated by employees of vendors

Good crime policies also include coverage for losses caused by outsiders through cyber deception, social engineering, vendor theft, funds transfer fraud, computer fraud, telephone toll fraud and other instances of misconduct. Crime policies can even be written to cover expenses such as hiring an investigator to respond to a possible loss.

Want to continue reading?

Become a Free PropertyCasualty360 Digital Reader

Your access to unlimited PropertyCasualty360 content isn’t changing.

Once you are an ALM digital member, you’ll receive:

- Breaking insurance news and analysis, on-site and via our newsletters and custom alerts

- Weekly Insurance Speak podcast featuring exclusive interviews with industry leaders

- Educational webcasts, white papers, and ebooks from industry thought leaders

- Critical converage of the employee benefits and financial advisory markets on our other ALM sites, BenefitsPRO and ThinkAdvisor

Already have an account? Sign In Now

© 2024 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.