If increased car insurance premiums have you shopping for a new insurance provider, you're not alone. According to the J.D. Power 2015 U.S. Insurance Shopping Study, many auto insurance customers are shopping for a new insurer, but surprisingly few are actually switching providers.

Auto insurers increased rates by an average of 2.1% nationwide in 2014, following an increase of 2.5% in 2013. Those rate hikes are contributing to customers shopping for a better deal. However, while more customers are shopping for a new insurer—39% in 2014 compared with 32% in 2013—only 29% actually switched in 2014, compared with 37% in 2013.

Consumers looking for premium savings, positive experience

Customers who switched insurers indicate an average premium savings of $388 in 2015, compared with $340 in 2014 and $351 in 2013. While price is the most obvious aspect of a policy for consumers to focus on during the shopping process, there are clearly other factors that are crucial to a positive experience.

"Many customers are obtaining quotes and gathering information on insurer websites, but the day-to-day interactions they have with their insurer, especially if they have to file a claim, will be the ultimate moment of truth for the customer," says Valerie Monet, director of the insurance practice at J.D. Power.

Key findings for insurance agents and brokers

- With increasing shopping and decreasing switching among shoppers, insurer close rates—the ability to convert a prospective shopper from quoting to closing—decreased to 13% in 2015 from 18% in 2014.

- Optimizing marketing and advertising efforts to ensure strong brand awareness among prospective customers is critical for insurance providers. Despite the industry increasing its advertising budget by 6% in 2015, compared with 2014, brand awareness of insurance providers among their prospective customers declined to 60% in 2015 from 62% in 2014.

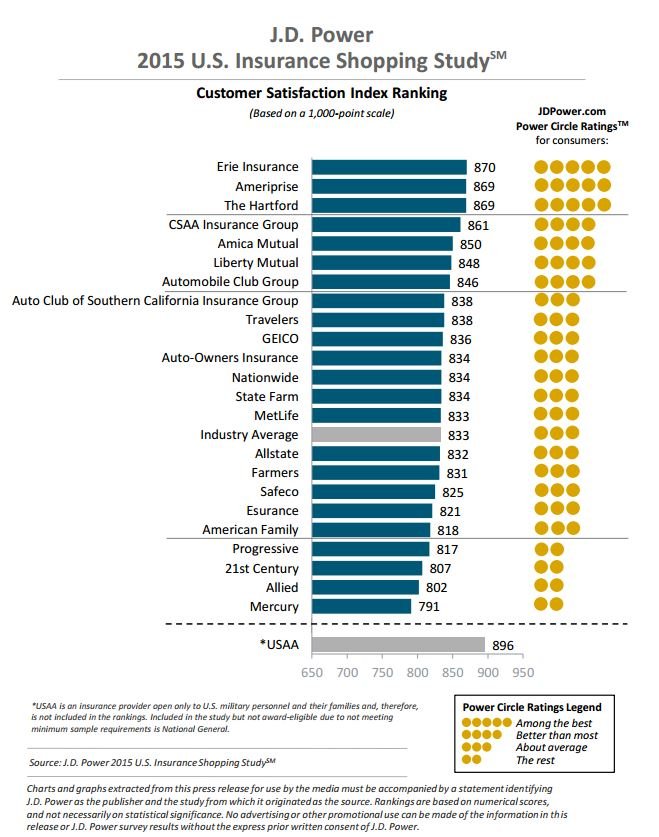

2015 customer satisfaction rankings of auto insurers

For a third consecutive year, Erie Insurance ranks highest among auto insurers in providing a satisfying purchase experience. Rounding out the top three are Ameriprise and The Hartford (tie). See the Customer Satisfaction Index Ranking chart below for a look at the top 25 auto insurers in customer satisfaction

The 2015 U.S. Insurance Shopping Study is based on responses from more than 15,600 shoppers who requested an auto insurance price quote from at least one competitive insurer in the past 9 months and includes more than 50,000 unique customer evaluations of insurers.

Want to continue reading?

Become a Free PropertyCasualty360 Digital Reader

Your access to unlimited PropertyCasualty360 content isn’t changing.

Once you are an ALM digital member, you’ll receive:

- Breaking insurance news and analysis, on-site and via our newsletters and custom alerts

- Weekly Insurance Speak podcast featuring exclusive interviews with industry leaders

- Educational webcasts, white papers, and ebooks from industry thought leaders

- Critical converage of the employee benefits and financial advisory markets on our other ALM sites, BenefitsPRO and ThinkAdvisor

Already have an account? Sign In Now

© 2024 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.