According to the National Hurricane Center in Miami, the Atlantic hurricane season runs from June 1st through November 30th every year. Some years are worse in terms of damage than others -- 2005 remains the busiest season for the Atlantic region on record with 28 named storms -- but every summer brings the potential for significant weather events between the Caribbean and eastern Canada.

(For what it is worth, many weather experts are predicting an unusually quiet year for hurricanes in 2015. Colorado State University has predicted no more than seven named storms this year, three of which will be hurricane-strength, but only one that's a category 3 or higher.)

We aren't in the thick of hurricane season yet, but it is never too early for homeowners and business owners in the potential path of these storms to prepare for the worst, and that includes a thorough annual review of their insurance coverage.

The Insurance Information Institute (I.I.I.) has assembled the following checklist for property owners in hurricane regions. Is there anything else you would recommend for your clients in at-risk areas? Let us know in the comments or @PC_360.

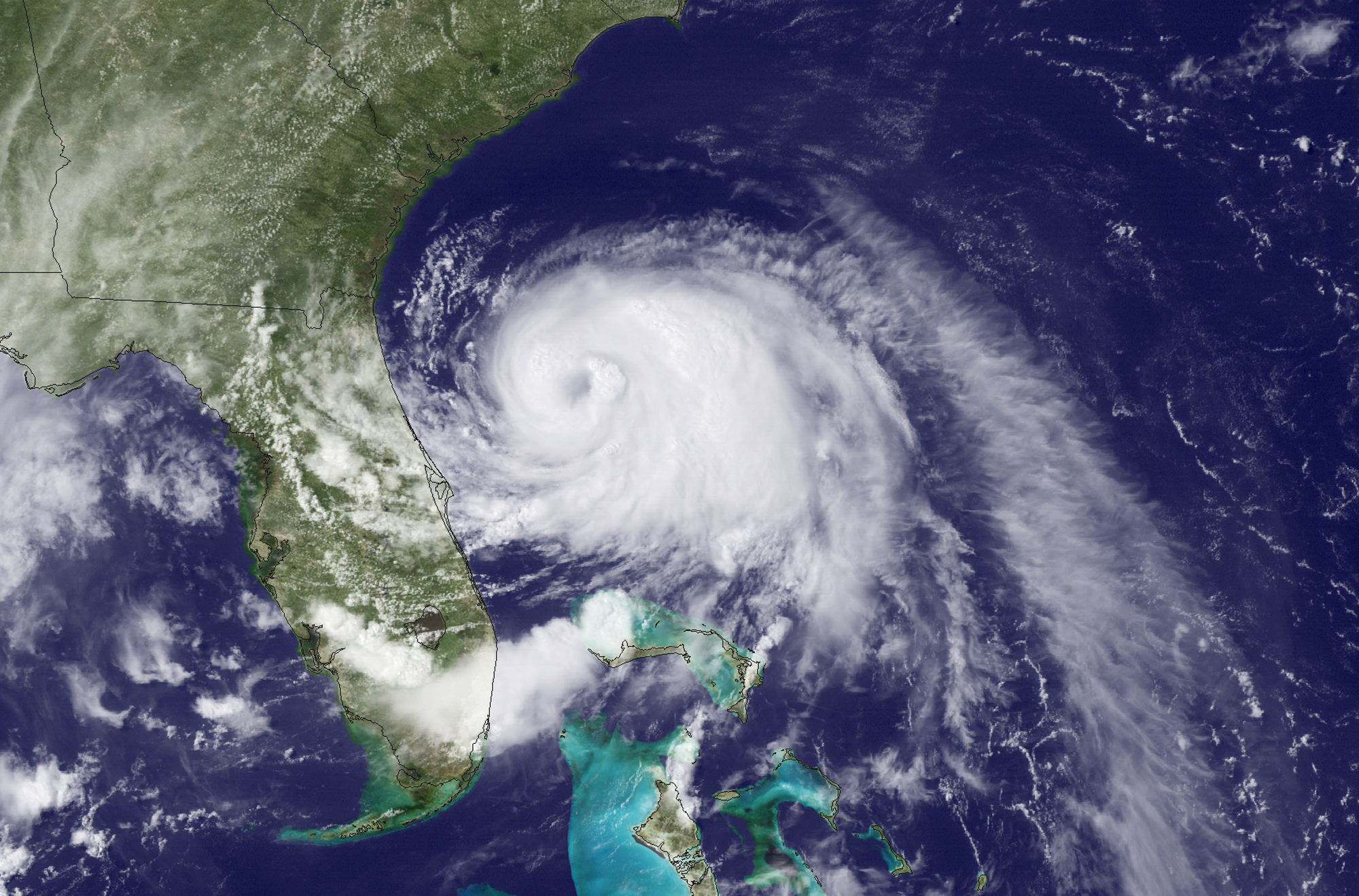

(Photo / Shutterstock)

Is your policy limit enough to rebuild your home in the event of a loss?

The I.I.I. recommends the following homeowners coverages as add-ons to help protect customers against the costs of rebuilding a total loss:

- Extended Replacement Cost Policy – pays an additional 20% or more above the policy limits.

- Guaranteed Replacement Cost Policy – pays the full amount to rebuild your home whatever the ultimate cost.

- Inflation Guard – automatically adjusts the coverage limits to reflect changes in construction costs.

- Ordinance or Law Coverage – pays a specified amount for rebuilding to new building codes, should your community adopt stricter codes.

(AP Photo)

Do you know the value of everything you own?

I.I.I. writes: "Most insurers provide coverage for personal possessions—approximately 50 to 70 percent of the amount of insurance you have on the structure of your home. Is this enough? The best way to determine what you actually need is to conduct a home inventory—a detailed list of your belongings and their estimated value."

The group also suggests that customers check what type of insurance they have in place for their belongings, whether it is replacement cost coverage or actual cash value coverage.

(AP Photo)

Does your policy provide enough Additional Living Expenses coverage?

This coverage will provide for basic living expenses in the event that an insured's home is rendered uninhabitable by an insured disaster, including hotel costs, food costs and other expenses.

According to I.I.I.:

- "ALE coverage is generally equal to 20 percent of the amount of insurance coverage that you have on the structure of your house; however, most insurers offer the option of higher coverage limits.

- Many policies provide ALE reimbursements only for a specific amount of time; make sure you’re comfortable with the time limits in your policy."

(Photo / Shutterstock)

What is the percentage of the hurricane/windstorm deductible stated in your policy?

"Insurers in every coastal state from Maine to Texas include separate deductibles for hurricanes and/or windstorms in their homeowners policies," the I.I.I. writes. "Unlike the standard 'dollar deductible' on an auto or home policy, a hurricane or windstorm deductible is usually expressed as a percentage. It is clearly stated on the Declarations (front) page of your homeowners policy."

These deductibles range from 1% to 5% percent of a home's insured value, and only apply in the event of a specific type of natural disaster (a hurricane for a hurricane deductible and high winds for a windstorm deductible).

(Photo / Shutterstock)

What disasters does your insurance policy cover?

According to the I.I.I., "standard homeowners insurance policies provide coverage for hurricanes, wind, theft, fire, explosion, lightning strikes and a host of other disasters." However, watch for exclusions like flood or earthquake, which are not covered.

I.I.I. suggests the following additional coverages for customers in hurricane-prone areas:

- Sewer Back-Up Coverage

- Flood Insurance

Speaking of flood insurance, do you have it?

According to I.I.I., 90% of all natural disasters include flooding, and hurricanes are most certainly on this list. As a result, a separate flood insurance policy is important for anyone who lives either in hurricane country or otherwise on a flood plain.

Want to continue reading?

Become a Free PropertyCasualty360 Digital Reader

Your access to unlimited PropertyCasualty360 content isn’t changing.

Once you are an ALM digital member, you’ll receive:

- Breaking insurance news and analysis, on-site and via our newsletters and custom alerts

- Weekly Insurance Speak podcast featuring exclusive interviews with industry leaders

- Educational webcasts, white papers, and ebooks from industry thought leaders

- Critical converage of the employee benefits and financial advisory markets on our other ALM sites, BenefitsPRO and ThinkAdvisor

Already have an account? Sign In Now

© 2024 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.