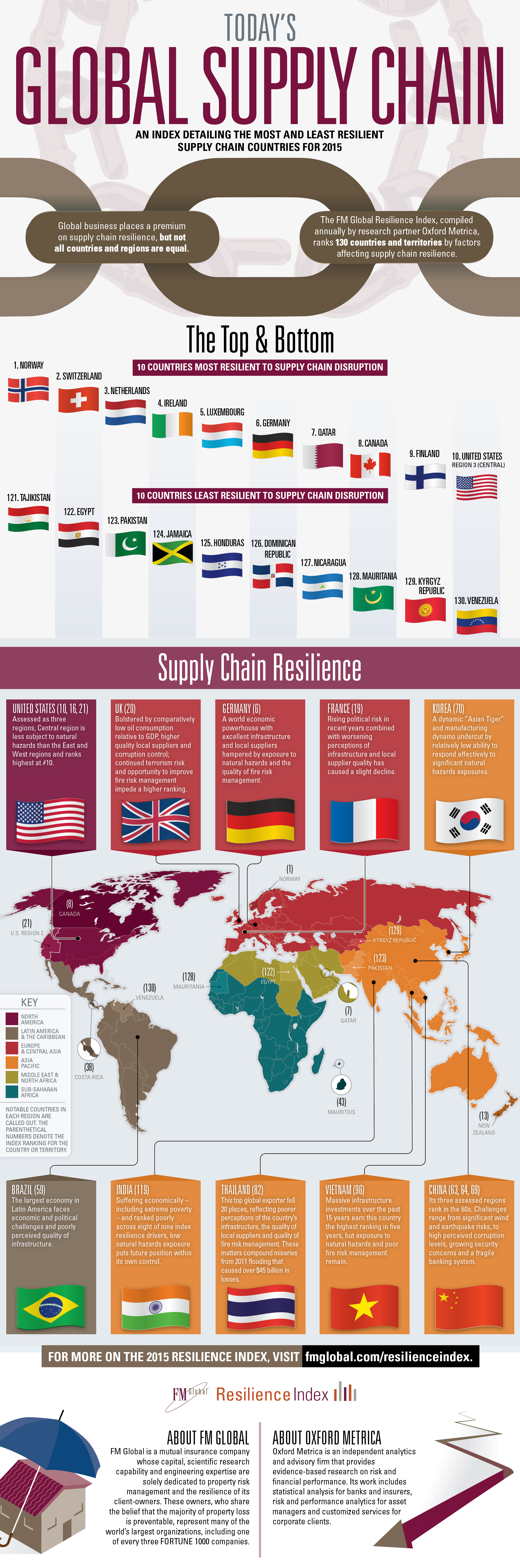

What do Norway, Qatar and Finland have in common? They’re ranked among the top 10 countries that are most resilient to business supply chain disruption, according to the 2015 FM Global Resilience Index, issued today by business property insurer FM Global, headquartered in Johnston, R.I. Tajikistan, Mauritania and Venezuela rank in the bottom 10 of countries least resilient to business supply chain disruption.

According to FM Global, the index is the first data-driven tool to rank the supply chain resilience of 130 countries and territories around the world to help executives prioritize where they should focus their risk management and investment efforts. The index aggregates nine drivers of resilience into three factors: economic, risk quality and the supply chain itself.

- Economic factor drivers are gross domestic product (GDP) per capita, political risk and oil intensity, which is a measure of a country’s vulnerability to changes in oil prices and supply.

- The risk quality factor consists of a country’s exposure to natural hazards, the quality of its natural hazard risk management and the quality of its fire risk management.

- The supply chain factor looks at how well a country controls corruption, the quality of its infrastructure and the quality of local suppliers.

Business decision-makers use the Resilience Index to develop insights into the risks and opportunities in their supply chain, better guiding their operating strategies in four major areas:

- Selecting suppliers based on the supply chain risk/resilience of the countries in which they’re located

- Deciding where to locate facilities

- Evaluating the resilience of the countries in which existing facilities are located

- Assessing the supply chain resilience of countries in which customers’ facilities are based

For governments evaluating their country’s attractiveness for foreign investment, the index can help them determine where to invest in strengthening infrastructure or to adopt new standards to strengthen natural hazard and fire risk management, for example.

(Photo: Kidsana Maimeetook/Shutterstock)

Understanding ‘resilience’

Louis A. Gritzo, Ph.D., vice president, research, FM Global, explains that the term resilience captures all the factors that can go into the bad things happening that relate to business. The factors include all the hazards that are presented as well as the ability for those hazards to be managed within those countries.

The more resilient a country is the less likely that bad things will happen to an organization as a result of hazards, whether natural or manmade. When businesses understand how resilient a country is they do a better job of managing and mitigating risk, and they’re better prepared when bad things do happen.

Companies often find surprises when they start looking at their supply chains. The concern for most companies is not with their first- or even second-tier suppliers, but deeper with the third and fourth tiers. “These are the things that challenge companies working in today’s brittle environment,” says Gritzo. “When one link breaks, then the whole chain breaks.”

Companies need to communicate the importance of understanding the vulnerability of every level within the supply chain throughout the chain. The value of the index, Gritzo believes, is that “It opens the topic up for discussion in a very straightforward fashion.” It also combines many complicated factors and issues into one index that everyone in the supply chain can refer to when planning for business disruptions.

(Photo: karen roach/Shutterstock)

Pros and cons of all locations

From studying the trends in natural catastrophe losses, Gritzo explains, a driving factor in the increased cost of losses is the increase in the number of businesses exposed to natural catastrophes, not that the hazards themselves are changing. Businesses have more values in locations once thought of as remote than ever before.

Trends are important to savvy risk managers, Gritzo notes. They ask themselves “How can I spot things going bad before they become a problem for my business?” Risk managers can use the index as a resource to focus on the right things for their business.

“The index helps the risk manager know which country to look at and which factors are driving resilience in a particular ecosystem,” Gritzo says. For example, managers can see whether a particular country has an infrastructure issue or a political risk issue. By examining GDP per capita, companies can see signs of overall economic health. Risk managers can say “These are the issues that are dominating in this country.” Organizations then are better equipped to weigh the pros and cons of outsourcing or doing business in a particular location, including the U.S., which ranks number 10 on the index.

“The current environment in the U.S. is conducive to the manufacturing renaissance that’s taking place,” Gritzo notes, due to several factors including the availability of domestically produced affordable energy, capital to invest in facilities and a talented labor pool looking for jobs. Whether companies choose to return to the U.S. may depend on what they’re outsourcing and where their suppliers are now. Their decisions also may depend on what their global supply chain looks like for future as well as current business opportunities.

M&A, expansion considerations

In addition, the index can be a valuable due-diligence tool for companies involved in mergers and acquisitions (M&A), Gritzo says. Management can consider the way the resilience of one company will fit with the resilience of the other. The index can help management evaluate the options of which suppliers to keep as part of the supply chain.

Many companies have suppliers in different locations with different risk factors and ratings on the Resilience Index, which is one way to limit risk and protect the supply chain. “If all your suppliers have the same risk driver,” Gritzo explains, “they may not be as independent as you think they are.”

One “modestly large company” is using the index in its risk management dashboard to track hundreds of suppliers, Gritzo says. “The reality today is that it doesn’t take a huge business to have many suppliers or to need the index.” Small to medium-size businesses may have a good view of their current supply chain because it’s not very long. But as they consider expansion, the index gives them an initial view of the world that helps guide their decisions on where and how to grow.

By the numbers

Although this is the second year that the results of FM Global’s research have been presented in the index, it includes five years of data. To do the research, 1,800 engineers visit 60,000 to 70,000 locations and perform more than 100,000 risk assessments per year. The engineers visit a variety of physical plants from office buildings to the most sophisticated manufacturing facilities around the world.

The world is getting more complex, Gritzo says. The business environment is more brittle than ever, and managers are looking to make data-driven decisions. The data in the index gives managers the knowledge to know where to look within their suppliers and their suppliers’ suppliers. “It’s a vital asset in improving the way business is done,” he concludes.

Want to continue reading?

Become a Free PropertyCasualty360 Digital Reader

Your access to unlimited PropertyCasualty360 content isn’t changing.

Once you are an ALM digital member, you’ll receive:

- Breaking insurance news and analysis, on-site and via our newsletters and custom alerts

- Weekly Insurance Speak podcast featuring exclusive interviews with industry leaders

- Educational webcasts, white papers, and ebooks from industry thought leaders

- Critical converage of the employee benefits and financial advisory markets on our other ALM sites, BenefitsPRO and ThinkAdvisor

Already have an account? Sign In Now

© 2024 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.