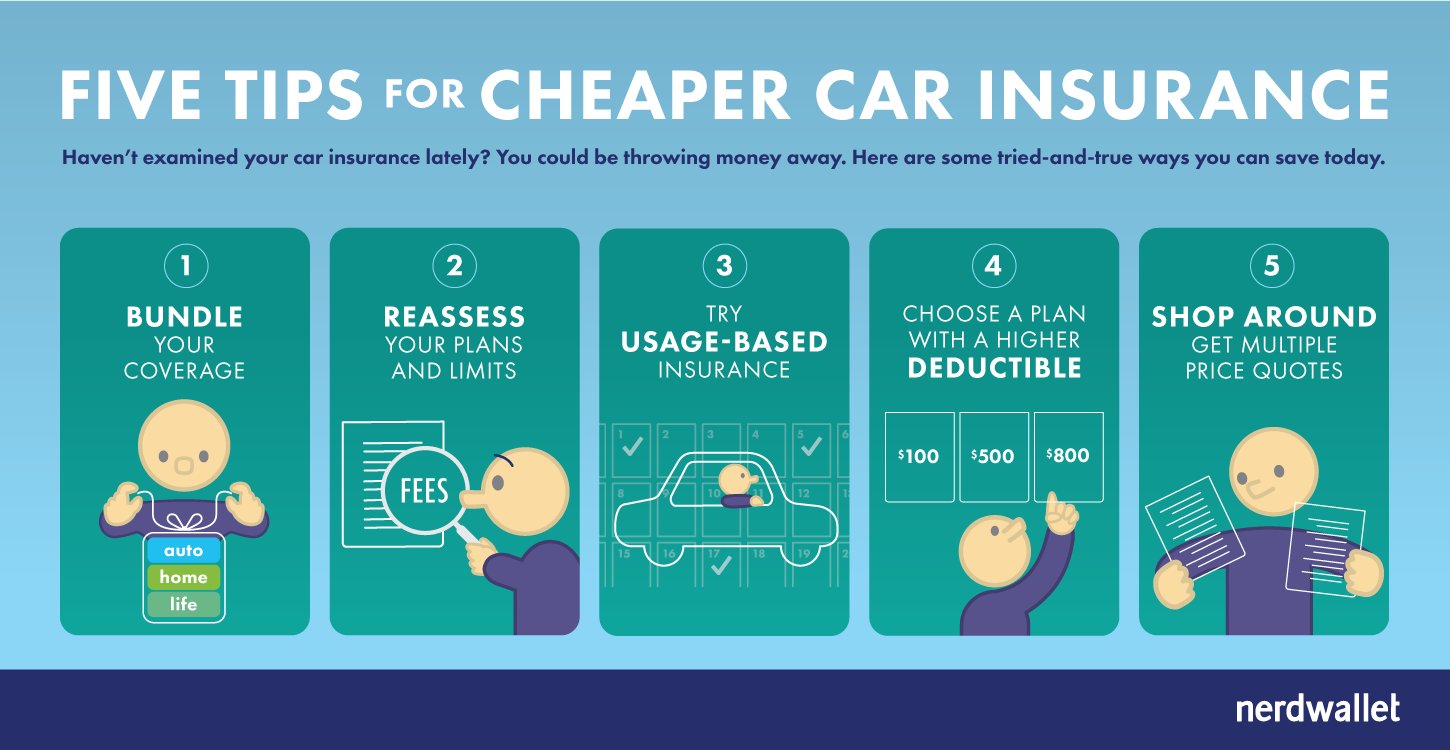

Everyone who drives needs car insurance, but seeing the monthly premium disappear from your bank account can still hurt. Even though insurance is a necessity for most people, there are some tried-and-true ways to find cheap car insurance.

1. Bundle your coverage

Customers can typically get discounts by buying multiple insurance policies through the same company. If you only need auto insurance, this won't be much help, but if you buy homeowners or renters coverage, or if you insure multiple cars, you should expect lower rates.

2. Reassess your plans and limits

It's never wise to have less coverage than you need, even if it gets you cheaper car insurance. Opting for lower liability limits might save you money, but it could come back to haunt you if you're at fault in an accident. You should always have enough liability coverage to protect your assets – including an umbrella policy, if your auto policy's limits aren't high enough.

However, you may be able to trim your coverage in other ways. Have an old car? Drop comprehensive and collision coverage, and consider using what you'd pay in premiums toward your new car fund. And check to make sure you don't have duplicate coverage. For example, you don't need towing and labor coverage if you're a member of AAA.

3. Try usage-based insurance

If you're willing to give your insurance company access to more information about your driving habits, you could save money on premiums. Progressive and State Farm, along with other insurers, now offer usage-based insurance programs.

With usage-based insurance, you place a device in your vehicle that records certain information, including how much you drive and how abruptly you brake. If the device shows that you drive less often than average or that you practice safe driving behavior, you'll receive a discount.

Keep in mind that while insurers say the majority of customers receive discounts, signing up for usage-based insurance might not save you money. And privacy advocates have raised concerns about such insurance, especially the fact that it allows insurers to tell — with a high degree of accuracy — where you're driving. If you're concerned about Big Brother, look for savings elsewhere.

4. Choose a higher deductible

Your deductible is the amount you pay for covered repairs before your car insurance kicks in and pays the rest. It stands to reason that increasing the amount of your deductible would lead to a lower premium, though drivers in some areas will see better results than others. And remember that you might need to pay your deductible someday, so don't commit to an amount that's more than you can afford. Keep the amount in an emergency fund in case you need it.

5. Shop around for cheap insurance

Loyalty is a great quality, and some insurers reward longtime customers with discounts. In other cases, your insurer will take your continued business as a hint that they can jack up your rates. And some insurers are simply friendlier than others to families with teenage drivers or drivers with spotty records. It's always smart to gather a few quotes around renewal time, even if your or your family's insurance needs haven't changed, to ensure that you're getting the best deal.

Related: The 7 hidden costs of 'cheap' car insurance

Top graphic by Enrico M. Limcaco. Hand-car illustration via iStock.

This article originally appeared on NerdWallet.

Want to continue reading?

Become a Free PropertyCasualty360 Digital Reader

Your access to unlimited PropertyCasualty360 content isn’t changing.

Once you are an ALM digital member, you’ll receive:

- Breaking insurance news and analysis, on-site and via our newsletters and custom alerts

- Weekly Insurance Speak podcast featuring exclusive interviews with industry leaders

- Educational webcasts, white papers, and ebooks from industry thought leaders

- Critical converage of the employee benefits and financial advisory markets on our other ALM sites, BenefitsPRO and ThinkAdvisor

Already have an account? Sign In Now

© 2025 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.