While there has been progress toward the pace of tech adoption, the speed from 2013 seems to have hit the brakes in 2014, with investments returning to what the industry saw in 2012, according to a report from Strategy Meets Action (SMA). And as technology advances, different insurance products and services will be necessary.

"In today's environment of fast-paced change, an insurer's commitment to innovation must never cease, must never pause, and must always keep a sense of urgency," says Denise Garth, SMA Partner and report author, along with Deb Smallwood, SMA Founder. "Each and every day, insurers must recommit to their innovation journeys … to avoid falling into operational traps."

The pressure from outside influencers and competitors has forced insurers to reprioritize their innovation goals, with enabling growth (42%) and profitability (30%) as the top drivers. To meet those goals, 38% of insurers are focusing on IT upgrades, as detailed in "Innovation in Insurance: Expanding Focus and Growing Momentum," a report based on the survey responses of 79 insurers from North America. Focusing on IT is a reflection of the work involved to modernize core systems, the movement to the cloud and experimenting with next-gen technologies.

Following IT upgrades, business/underwriting (36%), marketing (23%) and then claims, customer engagement/experience and product management and development (all 14%) ranked as top areas for innovation. The explosion of new data and tapping into unstructured data expands insurers' focus to individualized underwriting. Telematics, the Internet of Things and wearables (such as Google Glass) accelerate this focus.

Looking toward the future, respondents see the most opportunity for innovation in reinsurance (48%), supply chain management, asset/investment management and channel management/distribution (46%). As businesses and individuals leverage technologies like the Internet of Things, new types of insurance products and services must be developed. "Just consider what the shift to autonomous vehicles will cause: a move from personal insurance to product liability insurance, or the potential for automotive companies to include insurance in the list price of a new connected vehicle," the report authors state.

Outside influencers and innovation in other industries are accelerating change, affecting all points of the insurance value chain and in the process, redefining the business of insurance. Because these changes are so disruptive, both business and IT insurance leaders must develop a comprehensive view of its impact: assess influence priorities, define business scenarios, prepare plans, experiment to leverage and respond to these influencers.

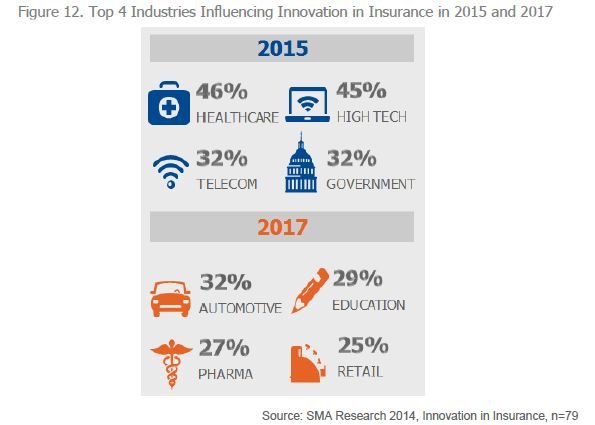

Based on the survey, insurers believe that other industries will influence innovation in insurance next year, and these influencers will change in 2017 (see Figure 12).

Manufacturing, entertainment and retail have all recognized the trend of customer empowerment, and have made changes to transform their businesses to customer-driven operations, leveraging technologies like mobile, social and big data.

Because of customers' experiences with these industries, they are resetting their expectations for insurers.

"This fast adoption of emerging technologies by outside industries and businesses is pushing insurers much farther along in their transformation and innovation journeys," the report says. This is why insurers must pay attention to the outside industries and partner with them to track, assess and leverage the changes and best practices.

Call to Action

SMA says that insurers must do three things in order to achieve their innovation goals:

1. Cultivate: Rethink and reimagine the business of insurance. Energize fresh thinking, adapt quickly to rapid change, embrace outside views, encourage experimentation and accept risk and failure.

2. Activate: Aggressively begin the implementation of new initiatives, including a path of core systems modernization.

3. Accelerate: As insurers begin their innovation journeys, they gain momentum and distance from their competitors.

Want to continue reading?

Become a Free PropertyCasualty360 Digital Reader

Your access to unlimited PropertyCasualty360 content isn’t changing.

Once you are an ALM digital member, you’ll receive:

- Breaking insurance news and analysis, on-site and via our newsletters and custom alerts

- Weekly Insurance Speak podcast featuring exclusive interviews with industry leaders

- Educational webcasts, white papers, and ebooks from industry thought leaders

- Critical converage of the employee benefits and financial advisory markets on our other ALM sites, BenefitsPRO and ThinkAdvisor

Already have an account? Sign In Now

© 2024 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.