Claims organizations are under increasing pressure to manage the legal expenses associated with claims litigation. The legal spend for the P&C insurance market remained flat at $21.3 billion from 2008 to 2012, while premiums shrank, according to SNL Financial and PwC analysis. A general increase in claim complexity and severity, a 3-4% rise in law firm rates, and greater litigation frequency and billable hours over the last five years, as well as a higher focus on short-term productivity for adjusters, have driven higher-than-expected legal service utilization. As a result, there was a 5-15% increase in overall legal expenses for many U.S. P&C insurance carriers from 2008 to 2012.

For these reasons, P&C insurers need new ways to manage claims legal performance. Leading carriers are integrating claims and legal data and developing multi-variable predictive models to facilitate decisions on counsel selection and case budgeting, as well as on choosing to litigate or opt for alternative dispute resolution (ADR).

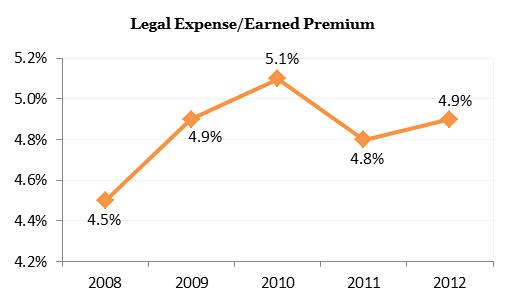

Source: SNL Financial and PwC Analysis

Legal expenses have had a growing impact on the industry's combined ratio. Our industry research, observations and experience show most top tier insurance carriers (gross written premiums above $1bn) are trending above the industry average on their legal expense spend. This graph shows the ratios of legal expense to earned premium in recent years.

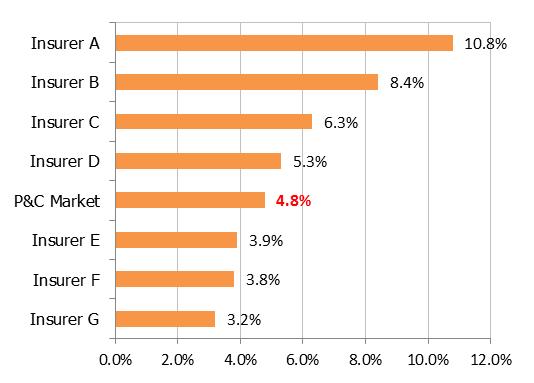

Source: SNL Financial and PwC Analysis

This graph depicts the ratio of legal spend over earned premium at various top tier insurance carriers and compares it to the overall industry standard from 2008 to 2012. The chart shows that some P&C insurance carriers spend considerably more on claims litigation than the industry average.

Insurance Carrier Challenges

Economies of scale achieved through contract negotiations, establishing an upfront litigation strategy, and the adoption of e-billing have led to some advances in both claims and litigation management systems. However, only a handful of insurance companies have taken full advantage of the opportunity to improve their claims legal operations. Many companies still find themselves relying on legacy systems, incomplete data, and cumbersome processes that erode profitability and jeopardize competitiveness.

- Challenge: Legal and claims data quality is low and poorly integrated with core claims systems and legal management systems.

At many companies, much of the data that supports an effective performance-based decision support system exists in multiple operational systems. This lack of a central data source impedes insurers' ability to make decisions, which in turn affects attorney performance ranking, case assignments, and case management. Moreover, even when carriers do establish formal legal performance management practices, they often fail to capture the underlying data that supports meaningful metrics (e.g., outside legal spend by phase by defense plan, negotiation savings, and inside counsel savings).

- Challenge: Current litigation processes lack an analytical basis.

Management faces constant pressure to deliver quick, efficient and effective claims processing. Even in environments that stress effective claims processing, the underlying foundation – business knowledge, strategy and plans – may not have a strong analytic basis. Without a clear understanding of how to improve processes, even the best intentions are likely to fall short.

- Challenge: The parties involved in the process do not have the tools or understanding that facilitates objective performance.

Claims professionals in insurance companies usually do not have enough supporting information and the appropriate tools to effectively manage claims legal expenses. In addition, many law firms are unaware of the performance metrics insurance carriers use to evaluate them. Lack of formal performance metrics and communication with these parties often results in misunderstandings about performance expectations.

However, when they have appropriate techniques to evaluate performance and support day-to-day operational decisions, such as selection of counsels, and adoption of alternate dispute resolution (ADR), claims departments have demonstrated that they can meet (and often exceed) corporate goals. A well-defined case-level litigation strategy driving attorney assignment, quicker dispute resolution, common terms of reference with legal services providers, and improved financial outcome of cases can help companies achieve their claims level performance objective.

The solution: Claims legal performance management

Many carriers focus on managing vendor expense – including legal defence costs – because they recognize there are opportunities to integrate granular claim, suit, rate and usage data by suit type (no fault injury, personal injury and general liability) and jurisdiction to improve quality and consistency of legal vendor service outcomes. Leading carriers are managing legal spend via detailed analysis of case and claim outcome data from modern claims and legal bill management systems.

These carriers also have adopted an approach that utilizes the extensive data that resides in claims and legal systems. This facilitates an updated claims legal performance management strategy, cleansed and integrated data, KPIs (key performance indicators) and advanced predictive tools for attorney selection and assignment, as well as case budget and reserving. (Sample KPIs include settlement rate, settlement cycle time, adjuster assignment scoring, staff vs. external counsel, loss & expense metrics, and claim and case outcome metrics.)

Multi-variable models for decision support

Multi-variable statistical models are helping insurance carriers make more objective decisions. A simple linear model underestimates the risk of severe claims. In fact, claims that simple models treat as non-litigation cases (ones they evaluate against only one variable, such as complexity), actually often end up in litigation. If insurers evaluate the same case against more than one variable, such as complexity and severity, then they are able to more accurately determine their potential litigation exposure. Such cases contribute as much as 60 percent of the totals legal spend, based on PwC's analysis.

Accordingly, carriers should conduct an initial assessment that help them understand the current environment, potential challenges, and a strategic vision of what could be by involving claims, legal and IT stakeholders, and the CFO. Then they should define a legal performance management strategy with clearly identified milestones, deliverables, and a timeline for achieving results. With this information, carriers can more easily identify the return on investment and improve the claims legal spend and performance.

Throughout this process, carriers should make sure they are equipped with the process and analytical tools that will help them eliminate potential pitfalls, and expedite results, as well as enable them to focus on innovating and building business value. Via this approach, many carriers have identified quick "wins" that have totalled between 5-10% of legal spend (approximately $2 to 3 million) and an additional 5-10% reduction as part of a longer term improvement strategy.

Claims organizations must evaluate their legal spend and assess their strategies to manage that spend. A well-defined legal performance management strategy with analytics-based decision support has a track record of providing a significant reduction in legal costs.

Sajid Kadri is a manager in PwC's Insurance Advisory practice with more than 11 years of experience in the P&C insurance sector across areas such as claims management, policy administration, reinsurance, litigation management, focused on transformational initiatives at carriers.

Also contributing to this article were: Richard Pankhurst, director, PwC Advisory Services, who has more than 18 years of experience serving and consulting to the insurance sector in the U.S. and Asia Pacific. Scott Busse, director in PwC's Insurance Advisory practice with more than 12 years of consulting experience helping clients undergo change and realize value through the strategic use of technology. Suman Katragadda, manager in PwC's Advanced Analytics practice, who has over seven years of experience leading numerous analytical engagements within the insurance and healthcare sectors. Doug Bond, director in PwC's Insurance Advisory practice with a focus on delivering data analytics as a means of driving competitive gain and attaining strategic goals.

Want to continue reading?

Become a Free PropertyCasualty360 Digital Reader

Your access to unlimited PropertyCasualty360 content isn’t changing.

Once you are an ALM digital member, you’ll receive:

- Breaking insurance news and analysis, on-site and via our newsletters and custom alerts

- Weekly Insurance Speak podcast featuring exclusive interviews with industry leaders

- Educational webcasts, white papers, and ebooks from industry thought leaders

- Critical converage of the employee benefits and financial advisory markets on our other ALM sites, BenefitsPRO and ThinkAdvisor

Already have an account? Sign In Now

© 2024 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.