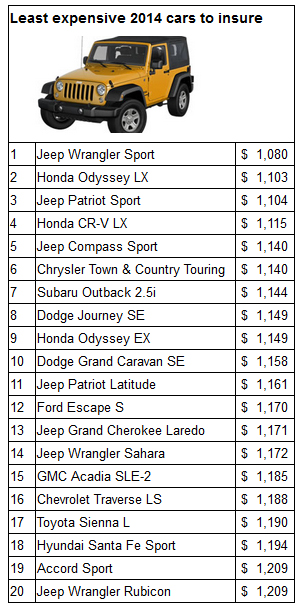

Along with the top 20 most expensive 2014-model cars to insure, Insure.com also released its ranking of the top 20 least expensive 2014-model vehicles to insure. Whereas the “most expensive” list was dominated by expensive sports cars, the “least expensive” list mainly features SUVs and a few minivans.

Insure.com explains that family-friendly SUVs and minivans are made for safely transporting children, therefore drivers of these vehicles are among the least likely to speed, crash, or have an insurance claim.

Seven of the 20 least expensive cars to insure are Jeeps, with the Jeep Wrangler Sport being the least expensive to insure, with an average premium of $1,080. While Jeeps may appear to be rugged, adventurous vehicles, Karl Brauer of Kelley Blue Book tells Insure.com that the owners of Jeeps tend to be single or married women under the age of 45. These vehicles “are used to carefully haul kids around suburbia at sub-50-mile-per-hour speeds most of the time,” Brauer tells Insure.com “This demographic and these driving conditions don't cause a lot of accidents.”

Seven of the 20 least expensive cars to insure are Jeeps, with the Jeep Wrangler Sport being the least expensive to insure, with an average premium of $1,080. While Jeeps may appear to be rugged, adventurous vehicles, Karl Brauer of Kelley Blue Book tells Insure.com that the owners of Jeeps tend to be single or married women under the age of 45. These vehicles “are used to carefully haul kids around suburbia at sub-50-mile-per-hour speeds most of the time,” Brauer tells Insure.com “This demographic and these driving conditions don't cause a lot of accidents.”

Recommended For You

Want to continue reading?

Become a Free PropertyCasualty360 Digital Reader

Your access to unlimited PropertyCasualty360 content isn’t changing.

Once you are an ALM digital member, you’ll receive:

- Breaking insurance news and analysis, on-site and via our newsletters and custom alerts

- Weekly Insurance Speak podcast featuring exclusive interviews with industry leaders

- Educational webcasts, white papers, and ebooks from industry thought leaders

- Critical converage of the employee benefits and financial advisory markets on our other ALM sites, BenefitsPRO and ThinkAdvisor

Already have an account? Sign In Now

© 2025 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.