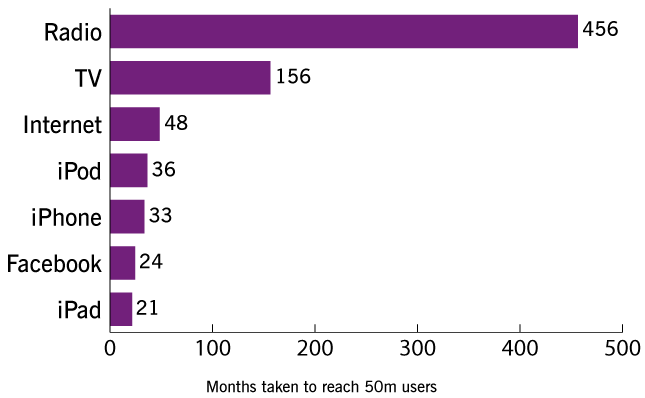

The global pace of technological advances is increasing rapidly with personal computers, the internet and mobile phones being an integral part of our daily lives. As shown in Figure 1 below, TV took 13 years to reach 50 million users, while the internet took just four years and the iPad took under two years to reach the same point. Technology today supports our primary communication; we tweet, shop online, work remotely and access data in two clicks. Given this phenomenal rate of change, the implications for individuals and the corporate world–including the (re)insurance industry–are significant. Technology transforms and supports all we do at home and at work.

It was unimaginable, even five years ago, that technology could give us 3D printing for military parts' production,to create prosthetic joints and design personalized pastaat home. Mobile robotics has enabled computer driven operations, using the MRI scan for guidance, for conditions such as prostate cancer and the self-drive car, which is now a reality. A look at Amazon's acquisitions and investment in robotics show how seriously companies are taking these developments. The Cloud, which reduces the risk of data loss and offers tremendous access and usage flexibility, is another illustration of technological advancement providing major business benefits. All of these examples have a significant impact on how we live our lives but also, how products and services we offer will change with technological advancement.

It was unimaginable, even five years ago, that technology could give us 3D printing for military parts' production,to create prosthetic joints and design personalized pastaat home. Mobile robotics has enabled computer driven operations, using the MRI scan for guidance, for conditions such as prostate cancer and the self-drive car, which is now a reality. A look at Amazon's acquisitions and investment in robotics show how seriously companies are taking these developments. The Cloud, which reduces the risk of data loss and offers tremendous access and usage flexibility, is another illustration of technological advancement providing major business benefits. All of these examples have a significant impact on how we live our lives but also, how products and services we offer will change with technological advancement.

Celent, a research company specializing in insurance technology, surveyed insurance and reinsurance companies to find the current focus for technology investment with 75% of respondents citing underwriting capabilities and expertise as the key differentiator in the business. Digital claims and data capabilities also resonated strongly.

Recommended For You

Want to continue reading?

Become a Free PropertyCasualty360 Digital Reader

Your access to unlimited PropertyCasualty360 content isn’t changing.

Once you are an ALM digital member, you’ll receive:

- Breaking insurance news and analysis, on-site and via our newsletters and custom alerts

- Weekly Insurance Speak podcast featuring exclusive interviews with industry leaders

- Educational webcasts, white papers, and ebooks from industry thought leaders

- Critical converage of the employee benefits and financial advisory markets on our other ALM sites, BenefitsPRO and ThinkAdvisor

Already have an account? Sign In Now

© 2025 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.