Nearmap’s AI-powered models approved in 27 markets

Insurers can leverage the predictive scores to help price risk.

Nearly 30% of senior investment managers at global insurance companies say they are concerned about the ability of their current legacy systems to meet their future regulatory requirements, according to a recent survey by Northern Trust. The study highlights the challenges insurance companies face with complying with the Dodd-Frank Act in the U.S. and the Solvency II directive in Europe.

Northern Trust surveyed more than 250 senior investment managers at global insurance companies with more than $1 billion in assets in the U.S. and Europe. The survey asked how insurance companies are currently managing their investment operations infrastructure, and what they expect will be the best way to meet future needs, particularly in an era of regulatory change and financial pressure.

Northern Trust surveyed more than 250 senior investment managers at global insurance companies with more than $1 billion in assets in the U.S. and Europe. The survey asked how insurance companies are currently managing their investment operations infrastructure, and what they expect will be the best way to meet future needs, particularly in an era of regulatory change and financial pressure.

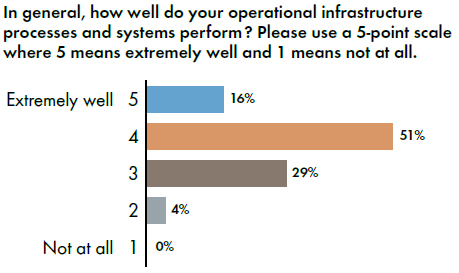

The study found 51% of respondents feel their current operational infrastructure processes perform well, while 16% feel they perform extremely well. However, when asked about the ability of their existing processes and systems to meet future regulatory requirements, 29.9% say they are concerned about their systems being able to comply with Dodd-Frank and Solvency II.

Fifty percent of respondents say their current systems are “customized with obsolete code.” Failing to give up legacy systems is a two-fold problem because the majority of respondents expect up to 25% of their staff will retire within the next five years. Without the staff necessary to maintain those systems—which have been modified by multiple programmers over the years with little documentation—maintenance and adjustments to the new regulations will be a major challenge.

Already have an account? Sign In Now

NOT FOR REPRINT

© 2025 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.

Insurers can leverage the predictive scores to help price risk.

Roger Spears of Schneider Downs discusses how businesses can evaluate their cybersecurity practices and limit their vulnerability to online threats.

More consumers favor insurers with modern platforms and are opting away from older offerings.

White Paper

Sponsored by Vortex Weather Insurance

Parametric Hurricane Insurance: A Strategic Solution for Agents and Brokers

Hurricane-related financial risks can leave businesses vulnerable due to gaps found in traditional insurance policies. Parametric hurricane insurance provides a proactive solution for your clients to recover from hurricane-related financial losses quickly. Learn how this innovative coverage model offers transparent payouts based on measurable storm conditions--helping your clients bridge critical financial gaps when they need it most.

White Paper

Sponsored by Vortex Weather Insurance

Hourly Rain Insurance: A Strategic Solution for Agents and Brokers

Rain-related business disruptions can be costly for your clients. Parametric hourly rain insurance offers a proactive approach to mitigate financial losses from weather conditions. This data-driven solution delivers fast, automated payouts when rainfall thresholds are met, ensuring your clients are protected when they need it most.

Copyright © 2025 ALM Global, LLC. All Rights Reserved.

Copyright © 2025 ALM Global, LLC. All Rights Reserved.