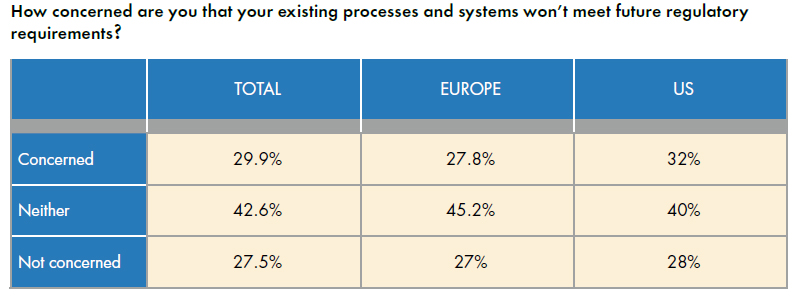

Nearly 30% of senior investment managers at global insurance companies say they are concerned about the ability of their current legacy systems to meet their future regulatory requirements, according to a recent survey by Northern Trust. The study highlights the challenges insurance companies face with complying with the Dodd-Frank Act in the U.S. and the Solvency II directive in Europe.

Northern Trust surveyed more than 250 senior investment managers at global insurance companies with more than $1 billion in assets in the U.S. and Europe. The survey asked how insurance companies are currently managing their investment operations infrastructure, and what they expect will be the best way to meet future needs, particularly in an era of regulatory change and financial pressure.

Northern Trust surveyed more than 250 senior investment managers at global insurance companies with more than $1 billion in assets in the U.S. and Europe. The survey asked how insurance companies are currently managing their investment operations infrastructure, and what they expect will be the best way to meet future needs, particularly in an era of regulatory change and financial pressure.

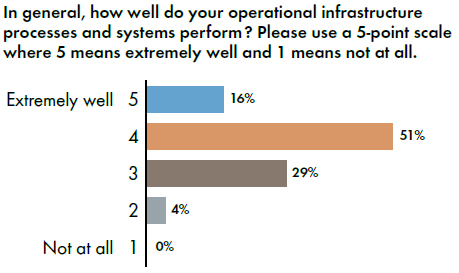

The study found 51% of respondents feel their current operational infrastructure processes perform well, while 16% feel they perform extremely well. However, when asked about the ability of their existing processes and systems to meet future regulatory requirements, 29.9% say they are concerned about their systems being able to comply with Dodd-Frank and Solvency II.

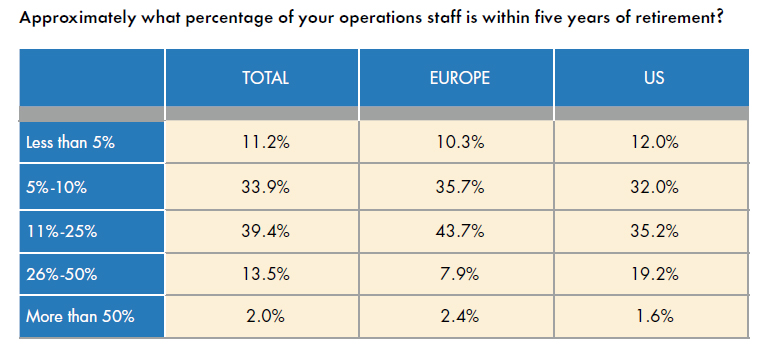

Fifty percent of respondents say their current systems are “customized with obsolete code.” Failing to give up legacy systems is a two-fold problem because the majority of respondents expect up to 25% of their staff will retire within the next five years. Without the staff necessary to maintain those systems—which have been modified by multiple programmers over the years with little documentation—maintenance and adjustments to the new regulations will be a major challenge.

With this in mind, 65% of respondents say they believe they should move away from customized and hard-to-manage software vendors and systems, and instead need to move to standard industry platforms provided by the outsourcing industry.

Download and read more about the survey from Northern Trust HERE.

Want to continue reading?

Become a Free PropertyCasualty360 Digital Reader

Your access to unlimited PropertyCasualty360 content isn’t changing.

Once you are an ALM digital member, you’ll receive:

- Breaking insurance news and analysis, on-site and via our newsletters and custom alerts

- Weekly Insurance Speak podcast featuring exclusive interviews with industry leaders

- Educational webcasts, white papers, and ebooks from industry thought leaders

- Critical converage of the employee benefits and financial advisory markets on our other ALM sites, BenefitsPRO and ThinkAdvisor

Already have an account? Sign In Now

© 2025 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.