Back in 1879, Gilbert and Sullivan created an amusing character named Major-General Stanley in the light opera "The Pirates of Penzance." He enters singing a song satirizing the idea of the "modern" educated British Army officer of the latter 19th century:

"I am the very model of a modern major-general, I've information vegetable, animal, and mineral… I'm very well acquainted, too, with matters mathematical; I understand equations, both the simple and quadratical; about binomial theorem I'm teeming with a lot o' news; with many cheerful facts about the square of the hypotenuse."

Today, near the start of the 21st century (and without tongue planted in cheek), insurers seek the qualities of the model modern major-general to develop predictive modeling expertise. With access to "information vegetable, animal and mineral" and ever-advancing knowledge of "matters mathematical," carriers have available the tools to become business leaders.

Yet some companies have advanced farther than others, which begs several questions:

- Who successfully uses predictive analytics?

- What resources enable their efforts?

- Where do carriers use predictive modeling in pricing, marketing and claims?

- When is it time to deploy or rebuild models?

- Why do carriers use predictive analytics?

- How do carriers build models?

To assess the current state of predictive analytics at insurance companies, Earnix, a provider of integrated pricing and customer analytics solutions for banking and insurance, and ISO, a source of information about property/casualty insurance risk, completed a joint industry survey titled, "2013 Insurance Predictive Modeling Survey."

With the objective of helping insurers learn from the experience of their counterparts, Earnix and ISO conducted the survey to uncover how predictive modeling and analytics are used throughout the industry. Responses were collected online from 269 insurance professionals representing companies that sell personal and commercial coverage in Canada and the United States.

Responses confirm that the industry recognizes the value of predictive analytics but still faces challenges. Data inefficiencies, scarcity of analytic talent and the cost of that talent can hold companies back from completing as many initiatives as they would like. And smaller carriers often have significantly fewer resources to dedicate to modeling. However, carriers can adopt innovative predictive modeling analytics tools to make better business decisions.

The survey responses also serve to answer the six questions raised previously with statistics derived from the experience of carriers in the predictive analytics trenches.

Who successfully uses predictive analytics?

The survey results reveal widespread use of predictive analytics in the insurance industry, with as many as 82% of respondents currently using predictive modeling in one or more lines of business, including personal auto (49%), homeowners (37%), commercial auto (32%), and commercial property (30%). According to survey respondents, predictive analytics enables insurance companies to drive profitability (85%), reduce risk (55%), grow revenue (52%), and improve operational efficiency (39%).

While the use of predictive analytics is pervasive throughout the insurance industry, larger insurance companies are more likely to make use of predictive modeling than smaller ones. In fact, all the respondents from companies that write more than $1 billion in personal insurance use predictive modeling, compared with 69% of the smaller companies that took part in the survey (writing less than $1 billion in personal insurance).

Put in perspective: The high usage rates imply that insurers recognize predictive analytics as a critical tool for improving their top line growth and profitability and managing risk. In short, predictive analytics is important to creating competitive advantage and increasing market share.

The difference in usage rates between smaller and larger carriers is due to at least a couple of reasons. First, many smaller insurers compete on serving specialized markets better than the large carriers, and that strategy may require a minimal reliance on advanced analytics. And more important, there's a definite advantage to scale in developing and implementing predictive analytic solutions. Larger insurers have large stores of historical data that can make predictive analytics more effective, and they can spread the cost of an in-house predictive analytics effort over a larger book of business.

Next page: What resources enable their efforts?

What resources enable their efforts?

All the large companies have resources dedicated to predictive modeling. In companies with more than $1 billion GWP, 63% have a team of more than 10 people, and 22% have a team of 5 to 10 people. Sixty-five percent of the companies with less than $1 billion GWP have one to four people dedicated to predictive modeling, and 9% have no resources dedicated to predictive modeling.

Ninety-one percent of survey respondents use external data to supplement their company's data. Of the companies that use external data, the vast majority (80%) use insurance score or raw credit attributes. Sixty-seven percent use geo-demographical data, and 53% use competitive pricing data. Catastrophe models data and weather data were also mentioned by 46% and 42% of the respondents respectively.

Put in perspective: Again, the responses to this question are reflective of the advantages of scale when developing an in-house analytic capability. A modeling team of more than ten people would represent a multimillion-dollar investment in analytics annually for an insurer. Larger companies can spread the cost over a greater number of policies and also reap the rewards of applying analytics to a greater number of policies, making this a high ROI proposition.

However, even large insurers are not self-sufficient when it comes to predictive data. The survey indicates that nearly all companies using predictive analytics must go outside the company to acquire additional data elements for their predictive analytics programs.

Next page: Where do carriers use predictive modeling in pricing, marketing and claims?

Where do carriers use predictive modeling in pricing, marketing and claims?

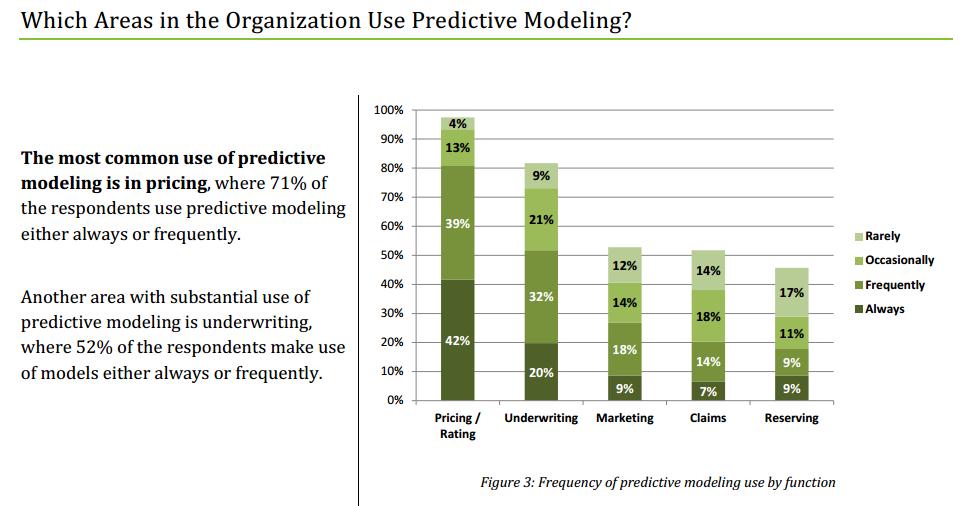

The most common use of predictive modeling is in pricing, where 81% of the respondents use predictive modeling either always or frequently. Another area with substantial use is underwriting, with 52% of respondents using models either always or frequently.

(Source: Earnix Inc. and ISO, 2013)

The two areas that make predominant use of predictive analytics in pricing are loss cost modeling (75% of those that use modeling in pricing) and tiering (70%). Twenty-seven percent of the respondents use predictive analytics for demand modeling.

Risk selection is the primary use of predictive modeling in underwriting, mentioned by over three-quarters (78%) of those that use predictive modeling in underwriting. Fifty-two percent of these respondents use predictive modeling to trigger for additional underwriting information, 33% for company selection, and 16% for product selection.

Close to two-thirds (64%) of the companies that use predictive modeling in marketing use it for target marketing. Other fields of marketing where predictive models are applied include customer retention (44%), cross-sell (32%), agent performance (28%) and lead generation (26%).

Fraud investigation is how half of the companies surveyed use predictive modeling in claims. Forty-four percent of the respondents use predictive modeling in claim loss forecasting and 36 percent in claims triaging.

Put in perspective: Pricing and marketing of personal auto policies is where predictive analytics got its initial foothold in the P&C industry, and the survey indicates that is still where much of the emphasis remains. That makes sense because personal lines auto is where a large share of P&C money is, and it's a very price competitive marketplace, so even minute gains in pricing accuracy can yield big advantages.

But the survey also reflects the trend of applying successful analytic programs to other lines of business and even other functions. While the dollars may be smaller than in personal auto, other lines of business may offer more opportunity to create a competitive advantage.

Next page: When is it time to deploy or rebuild models?

When is it time to deploy or rebuild models?

While some respondents take two to three months (22 percent) or less (10 percent) to deploy new predictive models, as many as 55 percent take more than four months to deploy new models.

Companies that are quicker to deploy new models take advantage of these capabilities with higher frequency of re-estimating and building new models. For example, 53 percent of the companies that take less than one month to deploy new models update their models once a quarter or more frequently, while the majority of companies that take longer only update their models once a year or less frequently.

Put in perspective: The survey responses paint a picture of a surprising level of inefficiency in some carriers' predictive analytics operations, with most requiring more than four months to deploy a model. Decreasing the cycle time of new data to new insights to new competitive advantage is critical to realizing the potential of a predictive analytics program. That could be an opportunity for smaller carriers, which are presumably less bureaucratic and more nimble, to outclass their larger competitors.

Next page: Why do carriers use predictive analytics?

Why do carriers use predictive analytics?

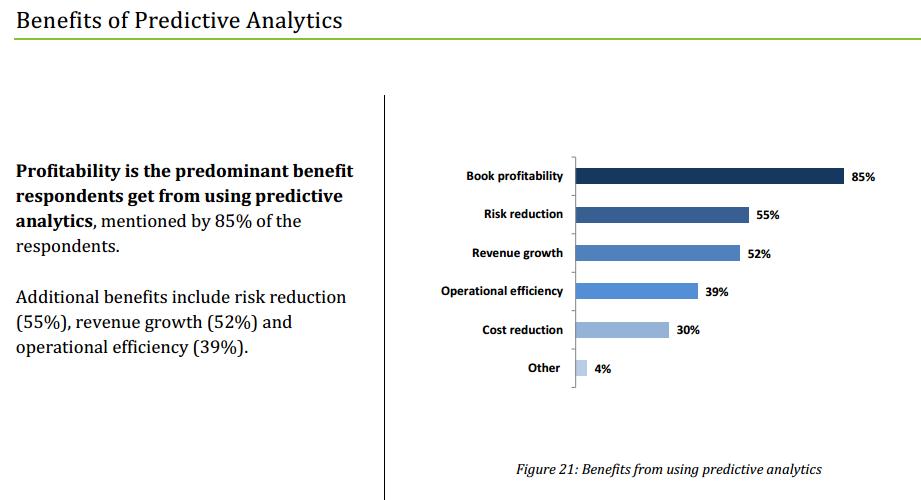

Profitability is the predominant benefit respondents get from using predictive analytics, mentioned by 85% of the respondents. Additional benefits include risk reduction (55%), revenue growth (52%) and operational efficiency (39%)

(Source: Earnix Inc. and ISO, 2013)

When asked to rate the top three changes in their working environment in the past three to five years, respondents pointed out to the following changes (in order of frequency): Do more with fewer resources; more pressure for speed to market; new modeling techniques. Obviously such changes drive the need for predictive analytics expertise.

Put in perspective: Speed, efficiency, effectiveness, profitability, growth–those desirable qualities often contradict each other and create a management challenge for insurers trying to institute an effective predictive modeling program. Again, there would appear to be an opportunity for smaller insurers to maximize their advantages (for example, agility) while leveraging industry models to make up for some of their disadvantages due to lack of scale.

Next page: How do carriers build models?

How do carriers build models?

Close to half of the respondents use either SAS (47%) or Excel (44%) to build models. Other statistical software used to build models include: R (25%), domain-specific modeling software (12%) and SPSS (6%).

Close to three quarters of the respondents (74%) use GLM/GAM in their model building process. Other algorithms used in the model building process include: regression/classification trees (47%), clustering (34%), principal component analysis / Factor analysis (25%) and text mining (16%).

Thirty-six percent of the respondents find using additional data attributes as the most promising avenue to increase the power and quality of the models they built today. Better modeling algorithms/approaches (19%), additional skilled modelers (18%), more efficient modeling software tools (13%) and more efficient extraction tools (10%) are also seen as ways to increase the power and quality of models.

On the flip side, more than half (53%) of the respondents mentioned lack of sufficient data as their organization's top modeling challenge. Other challenges include not enough skilled modelers (47%), need for additional computing resources (31%), and need for better modeling tools (23%).

Lack of know-how/technical expertise and cost are the biggest obstacles mentioned by 42% of the survey respondents. Culture and managing change were mentioned by 16% and 15% of the respondents, respectively.

Put in perspective: Although this survey is a snapshot in time, it supports trends shown in other studies that show use of the open-source software R gaining momentum and challenging the dominance of the large commercial software packages. It seems that the segment of domain-specific modeling software, such as pricing software, is also growing.

As for the algorithms used, their popularity is reflective of the types of analysis being done. For example, GLM/GAM are typically used in pricing models, clustering and principal components are common methods used in marketing analysis, and text mining is often used to analyze claims and underwriting notes.

And the respondents are expressing the historic concerns of data modelers everywhere—the need for more and better data and the people to analyze it.

Looking ahead, according to the survey respondents, personal auto and homeowners will be the focus of new predictive modeling initiatives the in next two to three years (49% each). Commercial auto (37%), commercial property (37%) and businessowners (24%) were also mentioned.

The two functional areas at the focus of predictive modeling initiatives in the next two to three years are pricing and underwriting, cited by 79% and 71% of the respondents respectively.

With these results in mind, the overriding lesson learned from the survey—and, for that matter, from the world of opera as well—is perhaps the following: The major-general song from the 19th century operetta is one of the most difficult patter songs to perform, due to the fast pace and tongue-twisting nature of the lyrics. Similarly, successful predictive modeling takes skill and agility due to its fast-paced evolution and often mind-bending scientific approach. Nevertheless, as shown by the survey, carriers that are "model" modelers can become models of excellence.

Want to continue reading?

Become a Free PropertyCasualty360 Digital Reader

Your access to unlimited PropertyCasualty360 content isn’t changing.

Once you are an ALM digital member, you’ll receive:

- Breaking insurance news and analysis, on-site and via our newsletters and custom alerts

- Weekly Insurance Speak podcast featuring exclusive interviews with industry leaders

- Educational webcasts, white papers, and ebooks from industry thought leaders

- Critical converage of the employee benefits and financial advisory markets on our other ALM sites, BenefitsPRO and ThinkAdvisor

Already have an account? Sign In Now

© 2025 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.