Despite growing concern about risks, private companies largely report wide gaps in coverage and lack of understanding about professional and management liability insurance, according to Chubb's 2013 Private Company Risk Survey.

The survey polled 450 decision makers for U.S. private companies to ascertain concern about corporate risks, uncover risk-mitigation strategies and identify the prevalence of insurance ownership.

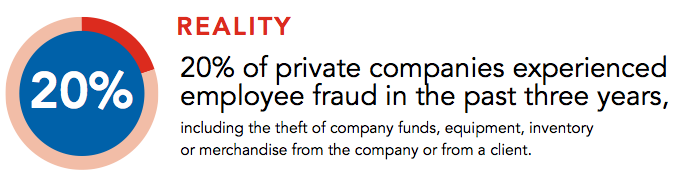

In the past three years since Chubb last conducted its survey, 44% of private companies experienced at least one loss event related to directors and officers (D&O) liability, employment practices liability (EPL), fiduciary liability, employee fraud, workplace violence or cyber liability.

Large companies are especially susceptible to losses, with two-thirds of companies employing more than 250 staff members having experienced a loss since 2010, compared to a third of companies with up to 50 employees. However, smaller companies are less likely to recover from a major loss event, Chubb says.

Click next to see how effectively private companies recognize and manage the biggest risks they face.

(All graphics on the following pages are from Chubb)

Private Company Misconception: GL Covers Everything

| While private companies do express concerns regarding corporate risk, many are not adequately protected by insurance. This may be due to misconceptions surrounding what general-liability insurance covers and what it does not.

While private companies do express concerns regarding corporate risk, many are not adequately protected by insurance. This may be due to misconceptions surrounding what general-liability insurance covers and what it does not.

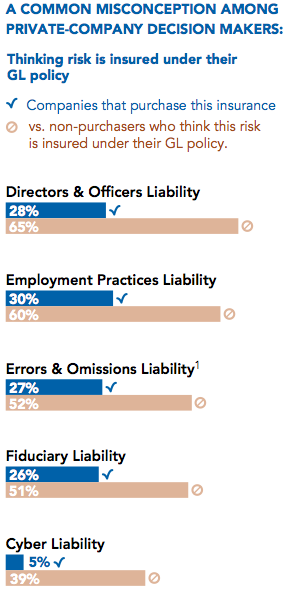

Over 50% of private-company decision makers responding to Chubb's survey do not purchase directors & officers liability coverage, EPLI, errors & omissions liability coverage and fiduciary liability insurance because they believe the associated risks are covered under a GL policy.

Chubb explains that GL covers incidents such as legal liability for claims involving bodily injury, property damage, advertising injury or personal injury; defense expenses for suits filed against the insured; cases of infringement upon another's copyrighted advertisement or registered trademark; publication of materian that violates a person's privacy or libels or slanders a person or organization; and personal injury.

Chubb notes that GL, however, does not cover financial injury from actual or alleged wrongdoings of a company's directors and officers; employment-related discrimination, harassment or retaliation; breach of fiduciary duty imposed by ERISA for an employee benefit fiduciary-liability claim; financial injury that may be insured by professional liability or product or service E&O liability policies; first-party expenses resulting from a privacy-data breach.

Employee Fraud Exposures

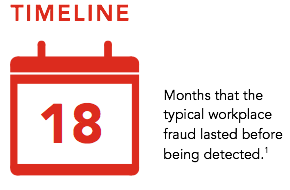

| Smaller companies face a greater threat from employee fraud, Chubb says citing data from the Association of Certified Fraud Examiners. But just 30% of executives at small companies (<$5 million in revenue) say they are concerned about this risk, compared to 56% of executives at large companies (>$25 million in revenue).

Smaller companies face a greater threat from employee fraud, Chubb says citing data from the Association of Certified Fraud Examiners. But just 30% of executives at small companies (<$5 million in revenue) say they are concerned about this risk, compared to 56% of executives at large companies (>$25 million in revenue).

In total, only 23% of private companies purchase crime insurance, including 47% of large companies and 17% of small companies.

Chubb says 25% of private companies are likely to be involved in a major acquisition or merger, or sell part of their business. This can increase the risk of theft if employees fell their jobs are jeopardized.

1. ACFE

D&O Lawsuits: They Can Impact Private Companies Too

|Many private-company decision makers mistakenly believe they are insulated from directors and officers lawsuits because their company is not publicly traded. But Chubb says private companies carry nearly as much risk as public companies, and lawsuits can come from sources such as vendors, competitors, regulators and employees.

D&O lawsuits, says Chubb, can be costly as well, with the average coast reported to the Private Company Risk Survey being nearly $700,000.

As noted earlier, decision makers also mistakenly believe that D&O risks are covered under a GL policy. Tony Galban, global D&O product manager at Chubb, explains, "Let's say you make a drug which causes harm to people and that has to be recalled and taken off the shelf. The coverage that pays for the harm to the people would be GL insurance. The loss of monetary and reputational value of the company because of the recall would be addressed by a D&O liability policy."

Fiduciary Liability: The Unseen Risk

|Three quarters of private companies use outside service providers for employee benefit plans, but only a quarter purchase fiduciary liability insurance to insure managers who select and hire these service providers.

Just 26% of respondents purchased fiduciary-liability insurance; 72% of the non-buyers either believe the exposure is covered under their GL policy (51%) or don't know if it is covered under their GL policy (21%).

Chubb says companies may also not realize the potential exposure for their fiduciaries, or may be "confusing fiduciary-liability insurance with fiduciary-bond insurance—required by law—that protects the plan assets but not the fiduciaries." Chubb says fiduciary liability "appears to be one of the most poorly understood of private-company risks.

Want to continue reading?

Become a Free PropertyCasualty360 Digital Reader

Your access to unlimited PropertyCasualty360 content isn’t changing.

Once you are an ALM digital member, you’ll receive:

- Breaking insurance news and analysis, on-site and via our newsletters and custom alerts

- Weekly Insurance Speak podcast featuring exclusive interviews with industry leaders

- Educational webcasts, white papers, and ebooks from industry thought leaders

- Critical converage of the employee benefits and financial advisory markets on our other ALM sites, BenefitsPRO and ThinkAdvisor

Already have an account? Sign In Now

© 2024 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.