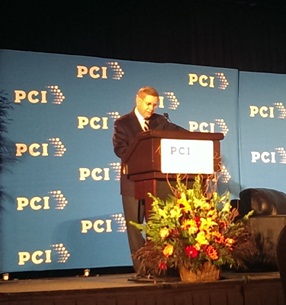

BOSTON—While the role the U.S. will play in new global-regulatory proposals remains uncertain, the threat of additional layers of restrictive guidelines is a "very real threat," says David Sampson, CEO of the Property Casualty Insurers Association of America.

BOSTON—While the role the U.S. will play in new global-regulatory proposals remains uncertain, the threat of additional layers of restrictive guidelines is a "very real threat," says David Sampson, CEO of the Property Casualty Insurers Association of America.

In outlining risks facing the industry in his opening remarks here at the PCI Annual Meeting, Sampson highlighted what he called the Financial Stability Board's clear intent to "be the global arbiter of financial regulation, which directed the International Association of Insurance Supervisors to issue plans to develop global insurance capital standards by 2016.

"The role of the U.S. government in these efforts is unclear at best," he said. He acknowledged it may be some time before capital requirements are implemented but the danger of "new layers of bank-centric, unnecessary regulation" must be monitored to ensure "this agenda does not disrupt a highly competitive U.S. insurance market."

Recommended For You

Want to continue reading?

Become a Free PropertyCasualty360 Digital Reader

Your access to unlimited PropertyCasualty360 content isn’t changing.

Once you are an ALM digital member, you’ll receive:

- Breaking insurance news and analysis, on-site and via our newsletters and custom alerts

- Weekly Insurance Speak podcast featuring exclusive interviews with industry leaders

- Educational webcasts, white papers, and ebooks from industry thought leaders

- Critical converage of the employee benefits and financial advisory markets on our other ALM sites, BenefitsPRO and ThinkAdvisor

Already have an account? Sign In Now

© 2025 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.