Apart from its impact on consumers and businesses, Superstorm Sandy set in motion a re-evaluation by state, federal and local officials of the potential effects of severe weather events.

Apart from its impact on consumers and businesses, Superstorm Sandy set in motion a re-evaluation by state, federal and local officials of the potential effects of severe weather events.

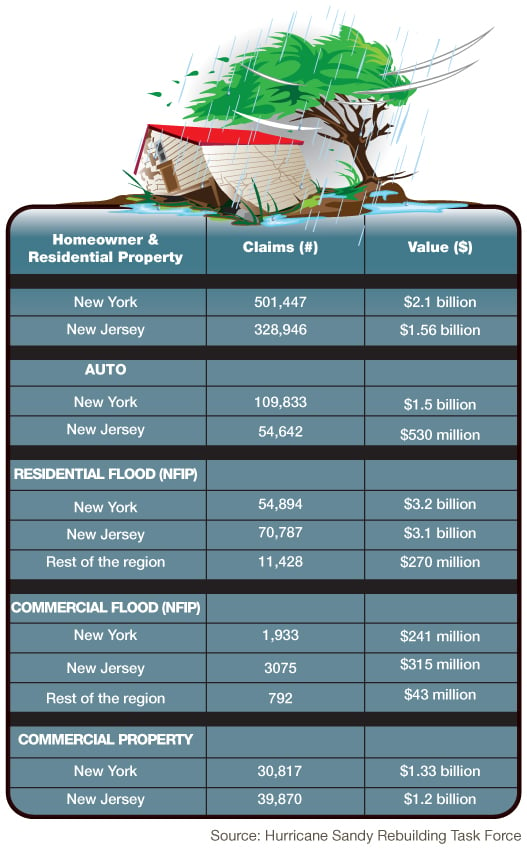

Sandy's impact, centered on the densely populated coastal areas of New Jersey and the New York Metropolitan area, inspired the creation of a federal, state and local task force that in June released a 200-page report offering a comprehensive rebuilding strategy for affected areas.

The inch-thick report includes 69 recommendations, across several policy areas, designed to align funding with local rebuilding priorities; eliminate barriers to recovery while ensuring effectiveness and accountability; coordinate across levels of government; and facilitate a region-wide approach to rebuilding. It is also aimed at promoting what it terms “resilient rebuilding” so that the region will be better able to withstand the impact of the next potentially devastating weather event.

Recommended For You

Want to continue reading?

Become a Free PropertyCasualty360 Digital Reader

Your access to unlimited PropertyCasualty360 content isn’t changing.

Once you are an ALM digital member, you’ll receive:

- Breaking insurance news and analysis, on-site and via our newsletters and custom alerts

- Weekly Insurance Speak podcast featuring exclusive interviews with industry leaders

- Educational webcasts, white papers, and ebooks from industry thought leaders

- Critical converage of the employee benefits and financial advisory markets on our other ALM sites, BenefitsPRO and ThinkAdvisor

Already have an account? Sign In Now

© Touchpoint Markets, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more inforrmation visit Asset & Logo Licensing.