Insurers are acutely aware of the fact that time does not heal all wounds.

Insurers are acutely aware of the fact that time does not heal all wounds.

As Sandy victims struggle to rebuild their lives—and homes—ruined by last year's storm, P&C insurers face heavy scrutiny from both policyholders and the general public. While some of this can be attributed to media prejudice toward the industry, some property owners are saying that insurers need to do a better job handling the influx of claims.

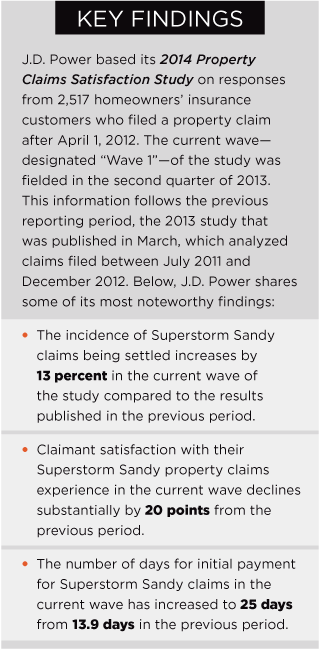

About a month ago, J.D. Power reported that policyholders in Mid-Atlantic States were "very dissatisfied" with how their Sandy-related auto claims were processed, particularly those deemed total losses. Total loss claims of course, are intrinsically problematic under even the best circumstances, as happy outcomes and by extension customers are few and far between. However, the findings of a subsequent report focusing on property claims suggests there is much room for insurers to improve.

Want to continue reading?

Become a Free PropertyCasualty360 Digital Reader

Your access to unlimited PropertyCasualty360 content isn’t changing.

Once you are an ALM digital member, you’ll receive:

- Breaking insurance news and analysis, on-site and via our newsletters and custom alerts

- Weekly Insurance Speak podcast featuring exclusive interviews with industry leaders

- Educational webcasts, white papers, and ebooks from industry thought leaders

- Critical converage of the employee benefits and financial advisory markets on our other ALM sites, BenefitsPRO and ThinkAdvisor

Already have an account? Sign In Now

© 2024 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.