Insurers are acutely aware of the fact that time does not heal all wounds.

Insurers are acutely aware of the fact that time does not heal all wounds.

As Sandy victims struggle to rebuild their lives—and homes—ruined by last year's storm, P&C insurers face heavy scrutiny from both policyholders and the general public. While some of this can be attributed to media prejudice toward the industry, some property owners are saying that insurers need to do a better job handling the influx of claims.

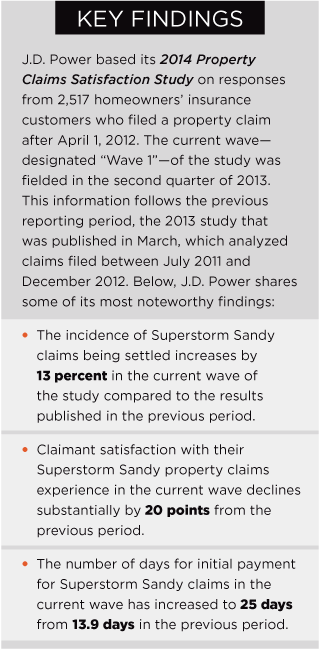

About a month ago, J.D. Power reported that policyholders in Mid-Atlantic States were “very dissatisfied” with how their Sandy-related auto claims were processed, particularly those deemed total losses. Total loss claims of course, are intrinsically problematic under even the best circumstances, as happy outcomes and by extension customers are few and far between. However, the findings of a subsequent report focusing on property claims suggests there is much room for insurers to improve.

According to the J.D. Power 2014 Property Claims Satisfaction Study—Wave 1, a large number of Sandy victims aren't exactly thrilled with how their property claims have been handled. In fact, claimant satisfaction with Sandy-related property claims has decreased by 20 points to 826 (on a 1,000-point scale), compared with 846 during the previous period. Despite this substantial decline, overall satisfaction with the property claims experience remained relatively stable at 832 points, J.D. Power adds.

The study, which is being conducted on a quarterly basis for the first time, draws from responses from 2,517 homeowners' insurance customers who filed a property claim after April 1, 2012. The current wave of the J.D. Power study was fielded during the second quarter of 2013. This information follows the previous reporting period, the 2013 study that published in March, covering claims that were filed between July 2011 and December 2012.

More Complex Claims = Slower Settlements

To gauge homeowners' satisfaction with the claims experience, J.D. Power examines five factors: the settlement; first notice of loss (FNOL); estimation process; service interaction; and repair process. The current findings indicate an increase in the severity of property damage, settlement amount and length of claims payment processing for Sandy, when compared with the previous period. J.D. Power says the average settlement amount for property claims increased to $10,205 from $5,517 in the previous period. Moreover, a higher number of claims related to damage to the exterior of the house—71 compared to 65 percent previously) contributes to the higher settlement figures.

“Since we wait until the conclusion of each claim to survey the customer, the complexity of the Sandy claims in this wave has increased from the last reporting period,” explains Jeremy Bowler, senior director of the insurance practice at J.D. Power. “Property claims related to Superstorm Sandy were primarily for items damaged in the yard, and the settlement process was expedient. The current wave study findings include more complex Superstorm Sandy property claims being processed for the structure of the home.” Bowler notes that settling a claim for structural damage tends to take significantly more time because of the scope of the claim. The longer claimants must wait for settlement, the less satisfied they generally are with their experience. These more complex claims captured in this wave took much longer to settle than the Sandy claims captured in the previous period, and all of the timing metrics related to claims handling increased. The most dramatic changes are an increase of nearly 10 days in the time it takes to inform claimants about the settlement terms (19.6 days after reporting claim), and an increase in the number of days until the initial payment is received by the claimant to 25 days (from 14.1 days). “Providing an accurate estimate of how long it will take to settle a claim is very important in managing the claims experience,” says Bowler. “When estimates to settle are extended and claims become drawn out, the possibility that insurers will not return claimants' calls increases, as does the likelihood claimants will be required to repeat information, both of which contribute to a decline in claims experience satisfaction.” With the timing of key milestones in the claims process taking significantly longer for Sandy claims, performance in several key performance indicators (KPIs) has also declined substantially. For example, J.D. Power found that “returning all promised calls” slipped 10 percentage points to 82 percent; avoiding having claimants repeat information is down by 12 percentage points to 61 percent; and providing an accurate claims length estimate is down by 5 percentage points to 69 percent.Want to continue reading?

Become a Free PropertyCasualty360 Digital Reader

Your access to unlimited PropertyCasualty360 content isn’t changing.

Once you are an ALM digital member, you’ll receive:

- Breaking insurance news and analysis, on-site and via our newsletters and custom alerts

- Weekly Insurance Speak podcast featuring exclusive interviews with industry leaders

- Educational webcasts, white papers, and ebooks from industry thought leaders

- Critical converage of the employee benefits and financial advisory markets on our other ALM sites, BenefitsPRO and ThinkAdvisor

Already have an account? Sign In Now

© 2024 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.