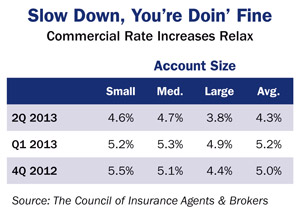

Commercial insurance rate increases moderated a bit in the second quarter of this year slightly off the pace of the previous two quarters, according to the Council of Insurance Agents & Brokers.

The association's quarterly survey of insurance rates shows while prices continue to climb, the rate of increase fell a little more than a full point on average from the first quarter to 4.3 percent. Small and medium size accounts had the sharpest increases in Q2 at 4.6 and 4.7 percent respectively, but even there the increases were off slightly by 0.6 points from the Q1 survey. Large accounts were not immune to increases, but the rate of increase fell 1.1 percentage points compared to Q1 to 3.8 percent.

“There weren't any great surprises in the second quarter,” says CIAB President and CEO Ken A. Crerar. “Prices inched up, underwriting tightened and insurers looked to reduce exposure in some critical areas. However, the market hardening appears to have moderated in the last quarter.”

Recommended For You

Want to continue reading?

Become a Free PropertyCasualty360 Digital Reader

Your access to unlimited PropertyCasualty360 content isn’t changing.

Once you are an ALM digital member, you’ll receive:

- Breaking insurance news and analysis, on-site and via our newsletters and custom alerts

- Weekly Insurance Speak podcast featuring exclusive interviews with industry leaders

- Educational webcasts, white papers, and ebooks from industry thought leaders

- Critical converage of the employee benefits and financial advisory markets on our other ALM sites, BenefitsPRO and ThinkAdvisor

Already have an account? Sign In Now

© 2025 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.