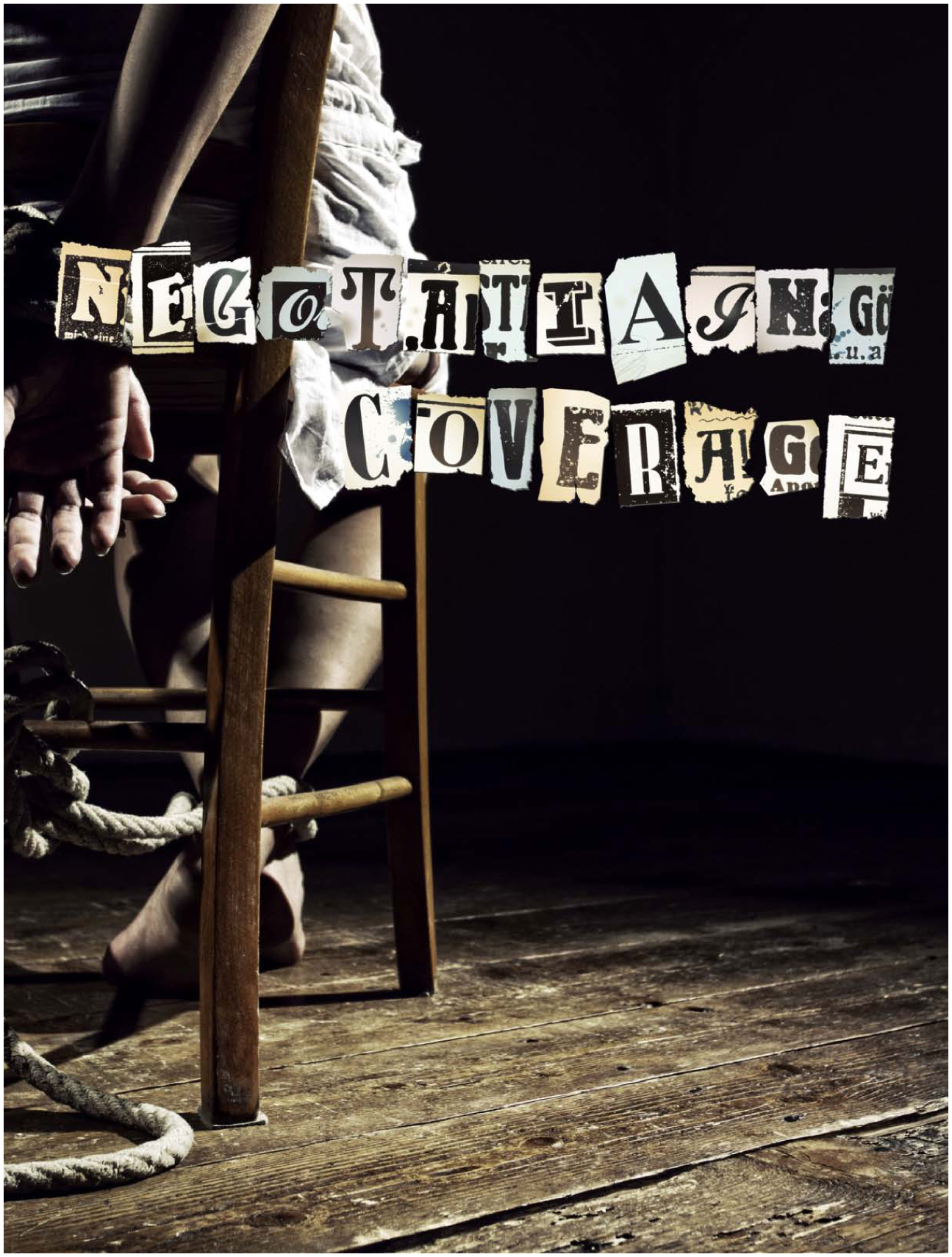

The face of the Kidnap & Ransom insurance market is changing as exposures become more broadly distributed across all business lines, sizes and insureds. And while some carriers are reacting by shaking things up, for Hiscox USA's Jeremy Lang, maintaining a longtime enterprise with the company's rescue partner is the key to success.

The face of the Kidnap & Ransom insurance market is changing as exposures become more broadly distributed across all business lines, sizes and insureds. And while some carriers are reacting by shaking things up, for Hiscox USA's Jeremy Lang, maintaining a longtime enterprise with the company's rescue partner is the key to success.

Hiscox's senior vice president and manager, U.S. Kidnap and Ransom says that over the last year, a surprising number of competitors that offer Kidnap & Ransom insurance products have switched their crisis response firm for another. “Either the response firm has left, or the carrier has chosen a different response firm,” Lang says. “It's highly unusual within the industry.”

That's because the most important aspect of a Kidnap & Ransom policy is not actually who is selling it, but which crisis-response team that carrier has partnered with; carrier choice is often the second-most consideration in the K&R insurance market for clients, he says. So why would those carriers switch?

Recommended For You

Want to continue reading?

Become a Free PropertyCasualty360 Digital Reader

Your access to unlimited PropertyCasualty360 content isn’t changing.

Once you are an ALM digital member, you’ll receive:

- Breaking insurance news and analysis, on-site and via our newsletters and custom alerts

- Weekly Insurance Speak podcast featuring exclusive interviews with industry leaders

- Educational webcasts, white papers, and ebooks from industry thought leaders

- Critical converage of the employee benefits and financial advisory markets on our other ALM sites, BenefitsPRO and ThinkAdvisor

Already have an account? Sign In Now

© 2025 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.