No doubt the sight of it makes for pretty pictures, but lightning is much less awe-inspiring for insurers.

No doubt the sight of it makes for pretty pictures, but lightning is much less awe-inspiring for insurers.

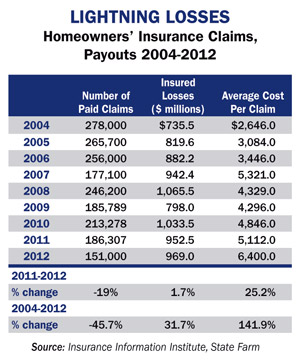

Lightning strikes cost U.S. insurers nearly $1 billion last year, according to the Insurance Information Institute.

While the insured-loss tally varies from year-to-year, what remains a clear trend is the increase in average cost per claim.

From 2004-2012 the average cost of a claim has skyrocketed nearly 142 percent despite a decline in paid claims during teh same period.

From 2011 to 2012, the cost increased 25 percent, an analysis by I.I.I. and State Farm shows.

Loretta Worters, vice president of I.I.I., says the cost of claims keeps rising in part due to increases in the number of value of electronics.

State Farm, which paid more than $200 million in lightning-related claims last year, put together a list of the top 5 states for lightning claims in 2012.

Click “Next” to see what states lead the pack.

Hint: Don't take refuge under a peach tree.

|5. Tennessee

The Volunteer State filed 1,591 claims to State Farm in 2012.

The nation's top insurer listed the states by amount of claims. Had the list been put together by claims paid, Tennessee's total of about $12.5 would rank it third.

Here's a bolt of lightning facts: Central Florida leads the nation in lightning strikes (though you won't see Florida on this list). Lightning hits the earth about 8,640,000 times per day, says The Weather Channel.

| 4. Alabama

4. Alabama

Alabamians filed 1,713 claims with the “Good Neighbor” insurer, which shelled out about $11.5 million to pay them.

Lightning Facts: The Insurance Institute for Home and Business Safety says a whole-house surge protector is the best starting point for reducing the risk of damage or fire from a lightning strike. Localized surge protection can be used as another step for expensive electronics.

|3. Texas

State Farm paid about $17.7 million on 1,825 claims from the Lonestar State.

The National Weather Service says 34 Texans died as the result of lightning during the last nine years. More than 180 injuries and nearly $23 million in damages can be blamed on lightning here.

Lightning Facts: If you can here thunder, you're close enough to be hit by lighnting. Three-quarters of lightning deaths in the U.S. occur June-August. 28 people died in 2012.

|2. Louisiana

State Farm got 1,989 lightning claims in Louisiana in 2012 and paid $9.1 million. Interestingly the Bayou State and Alabama are the only states on this list that are also on traditional lists ranking where lightning hits the ground most often (Florida, Mississippi, South Carolina and Oklahoma are typical on these lists).

Lightning Facts: Lightning causes 30,000 house fires in the U.S. every year. 30 percent of U.S. businesses suffer damage from lightning storms.

|1. Georgia

Either Georgia had a very bad lightning year or Georgians are particularly unlucky when it comes to lightning because State Farm received a whopping 3,844 claims here in 2012. The insurer paid about $21.5 million to settle them.

Lightning Facts: A large majority–85 percent–of lightning victims are children or men 10-35 years old engaged in recreation or working. About 20 percent of people die after being struck by lighting and 70 perrcent suffer serious long-term effects.

Want to continue reading?

Become a Free PropertyCasualty360 Digital Reader

Your access to unlimited PropertyCasualty360 content isn’t changing.

Once you are an ALM digital member, you’ll receive:

- Breaking insurance news and analysis, on-site and via our newsletters and custom alerts

- Weekly Insurance Speak podcast featuring exclusive interviews with industry leaders

- Educational webcasts, white papers, and ebooks from industry thought leaders

- Critical converage of the employee benefits and financial advisory markets on our other ALM sites, BenefitsPRO and ThinkAdvisor

Already have an account? Sign In Now

© 2024 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.