In the world of insurance, agents are much more likely to retain clients for the long term if those clients hold numerous products through one particular agent relationship. When establishing and maintaining relationships with clients, it is essential to have the ability to meet the broad-spectrum needs of clients. After all, clients have a penchant for one-stop shopping.

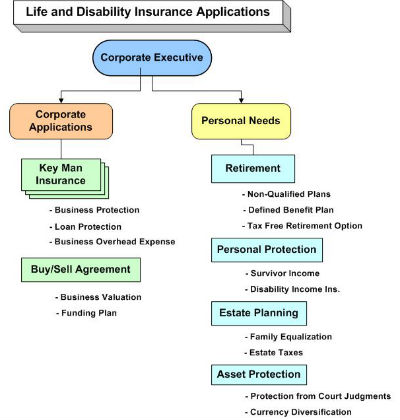

In working with corporate executives, it's beneficial to provide solutions to both their business and personal coverage requirements — as oftentimes these two are highly correlated. P&C agencies are a great source of clients — many of whom have complex asset protection and wealth preservation needs.

It's been our experience that a private business life cycle in combination with its owner's management role cycle represents an opportunity for P&C agencies to offer multiple applications of life products including life insurance, disability insurance and annuities.

It's been our experience that a private business life cycle in combination with its owner's management role cycle represents an opportunity for P&C agencies to offer multiple applications of life products including life insurance, disability insurance and annuities.

Recommended For You

Want to continue reading?

Become a Free PropertyCasualty360 Digital Reader

Your access to unlimited PropertyCasualty360 content isn’t changing.

Once you are an ALM digital member, you’ll receive:

- Breaking insurance news and analysis, on-site and via our newsletters and custom alerts

- Weekly Insurance Speak podcast featuring exclusive interviews with industry leaders

- Educational webcasts, white papers, and ebooks from industry thought leaders

- Critical converage of the employee benefits and financial advisory markets on our other ALM sites, BenefitsPRO and ThinkAdvisor

Already have an account? Sign In Now

© 2025 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.