A majority of organizations have an enterprise risk management program but a “surprisingly large minority” of these programs do not include property risks.

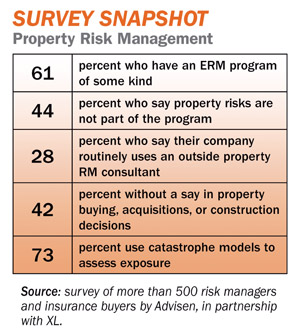

According to a survey by Advisen, done in partnership with XL, 61 percent of the 507 risk managers and insurance buyers who took part say ERM program are in place at their organization but 44 percent the program exclude property. The results “[call] into question the enterprise-wide scope of these programs,” says a report of the results.

Additionally, 42 percent of risk professionals say they aren't involved in decisions their company makes regarding building acquisitions or construction—though 54 percent say there is someone within the company devoted to or substantially responsible for property risk.

The survey found that successfully risk-aware companies are relationship-oriented and insistent on working with quality brokers and underwriters, understand the principles of good underwriting, communicate with senior management to align risk with corporate objectives, and emphasize business continuity during a catastrophe. Size of the organization appears to have no bearing, according to survey results.

Fifty-four percent of respondents say that aside from purchasing insurance, the risk department does not play a role in managing supply-chain risks for the majority of manufacturing, healthcare, public administration, social assistance, finance and insurance companies.

Almost half of companies say they do not have staff or third parties devoted to property risk management, even though 44 percent answered that they have large accumulations of physical assets in catastrophe-exposed regions- with company size having no impact on the response.

Almost 60 percent of respondents say the safety-management role is independent of RM but maintains regular communication between the departments; 21 percent say they report directly to risk management, and 17 percent say it is separated and sporadically communicates with risk management.

A separate survey was distributed to brokers. They say:

“Risk managers need to work with internal clients as well as external and spend time making sure they understand the process and benefits of risk management,” says Janice Ochenkowski, managing director of broker Jones Lang LaSalle. “Having a degree of internal communication helps the risk management department know what is in the pipeline, what folks are working on and when we can actually take responsibility for an exposure.”

Another broker says risk managers must have, “a deep knowledge about their own company including knowledge about suppliers/customers, interdependencies and bottlenecks.”

Want to continue reading?

Become a Free PropertyCasualty360 Digital Reader

Your access to unlimited PropertyCasualty360 content isn’t changing.

Once you are an ALM digital member, you’ll receive:

- Breaking insurance news and analysis, on-site and via our newsletters and custom alerts

- Weekly Insurance Speak podcast featuring exclusive interviews with industry leaders

- Educational webcasts, white papers, and ebooks from industry thought leaders

- Critical converage of the employee benefits and financial advisory markets on our other ALM sites, BenefitsPRO and ThinkAdvisor

Already have an account? Sign In Now

© 2024 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.