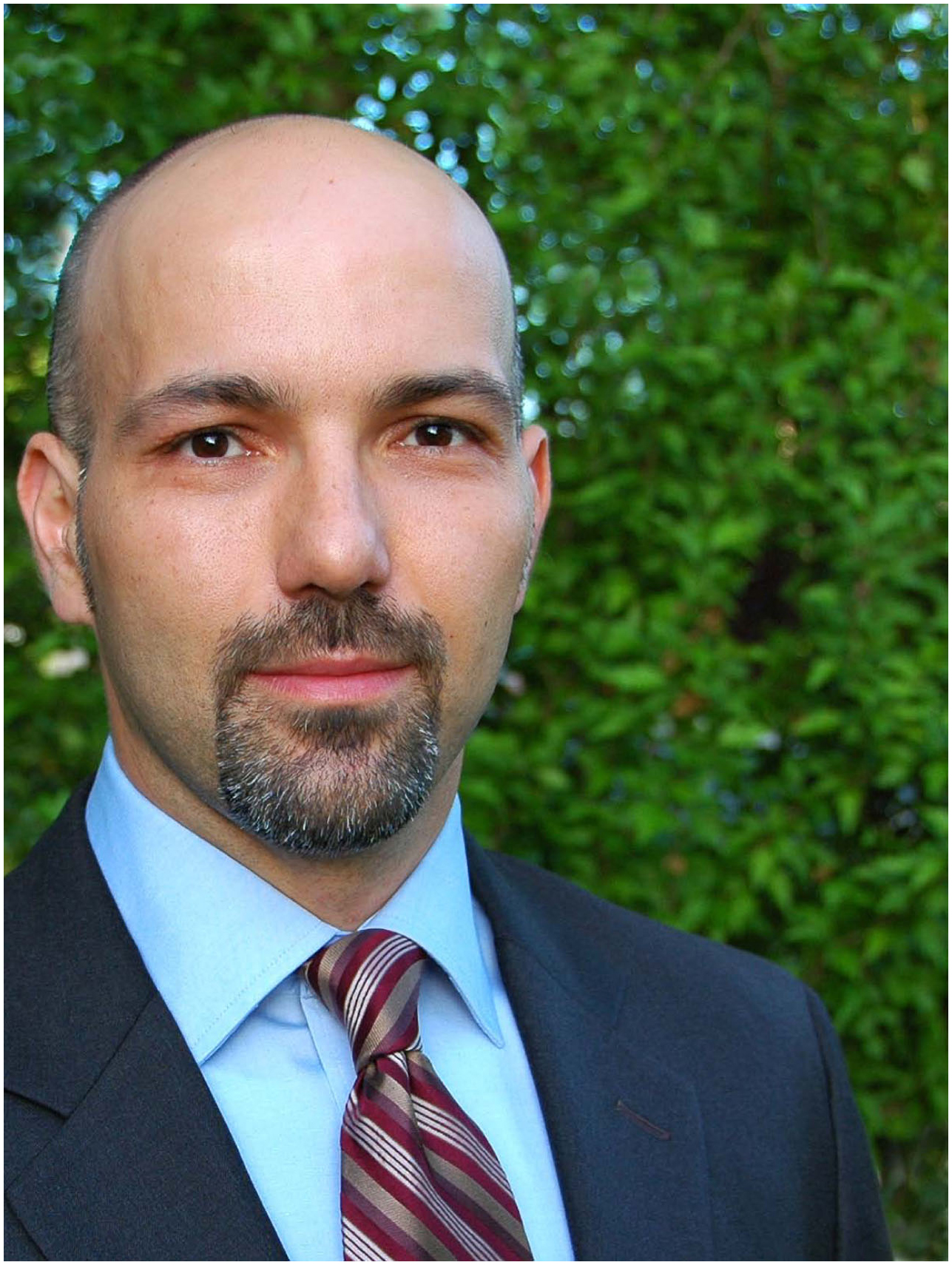

For Nicky Alexandru, head of Crisis Management and vice president of Global Casualty for AIG, the Product Recall segment is an ongoing process of discovery.

For Nicky Alexandru, head of Crisis Management and vice president of Global Casualty for AIG, the Product Recall segment is an ongoing process of discovery.

The Product Recall segment is growing: the fourth quarter of 2012 saw some 552 products recalled, according to Food & Drug Administration statistics—and 35 percent of those companies involved had more than one recall in that period. Yet these statistics show just a part of how serious recall incidents can be for a company.

“When we think about risk, we think about two things: frequency and severity,” Alexandru says. “What has emerged in recent years is the severity of those incidents, the magnitude of the financial losses.”

Recommended For You

Want to continue reading?

Become a Free PropertyCasualty360 Digital Reader

Your access to unlimited PropertyCasualty360 content isn’t changing.

Once you are an ALM digital member, you’ll receive:

- Breaking insurance news and analysis, on-site and via our newsletters and custom alerts

- Weekly Insurance Speak podcast featuring exclusive interviews with industry leaders

- Educational webcasts, white papers, and ebooks from industry thought leaders

- Critical converage of the employee benefits and financial advisory markets on our other ALM sites, BenefitsPRO and ThinkAdvisor

Already have an account? Sign In Now

© 2025 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.