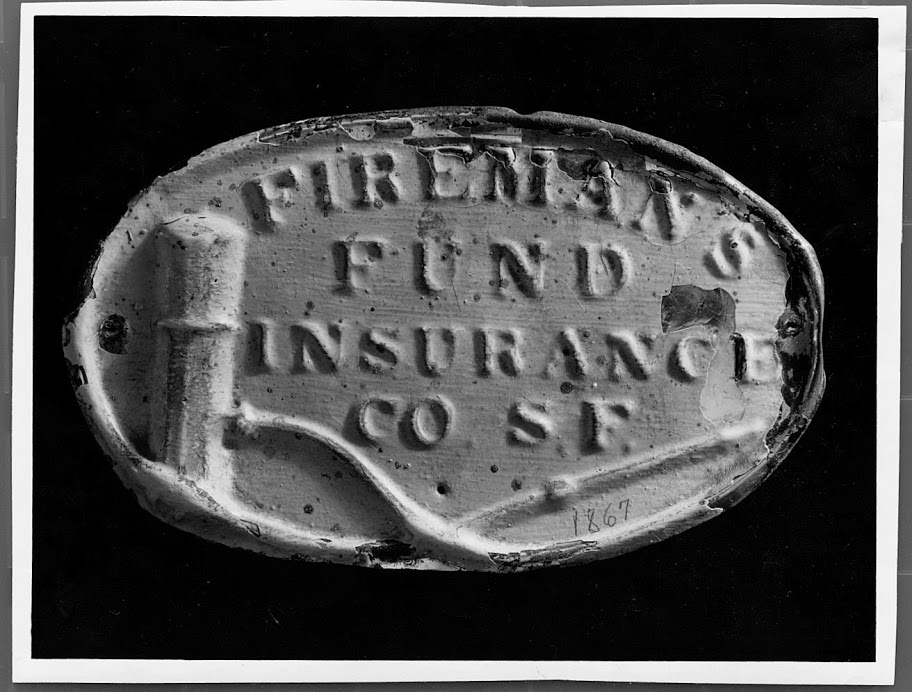

Fireman's Fund is marking its 150th anniversary with a traveling exhibit of vintage artifacts that link the company's underwritten policies to some of the nation's most important moments, from great disasters to the early days of movies and aviation.

The exhibit, which began its journey in San Francisco in April, will move to Seattle on May 15; Minneapolis, May 21; New York, June 11; Atlanta, July 16; Los Angeles, Sept 10; St. Louis, Sept 24; and end in Chicago, Oct 10.

Click next to see some of the most significant insured risks in Fireman's Fund's history.

Fireman's Fund's first policy, written in 1863, insured half the interest in 1,000 kegs of Boston molasses syrup, with a premium of a $12 cash advance, a sum that would be worth more than $200 today.

The Great Chicago Fire of 1871 destroyed insurance companies that couldn't stand the financial heat of a tragedy that cost hundreds of human lives and nearly $100 million in property losses. According to company spokesman Paul Fuegner, although Fireman's Fund's share of the loss exceeded all the company's available assets, each claimholder received 50 cents cash on-hand, plus an IOU with interest, from the insurer within 60 days of the fire.

The company was shaken once again when its headquarters crumbled during the San Francisco Earthquake of 1906, but Fireman's Fund used a combination of cash and stock to pay its unprecedented policyholder claims.

Source: AP Images

Fireman's Fund underwrote some of the earliest movies with sound in the 1920's, such as the swashbuckling Douglas Fairbanks Sr. films, and has since put its stamp on classics like Lassie, Mutiny on the Bounty, Spartacus, Top Gun, and The Lord of the Rings.

Source: AP Images

When Charles Lindbergh took off in the Spirit of St. Louis in 1927, flying more than 33 hours from New York to Paris, the risky but groundbreaking flight was insured by Fireman's Fund.

The Golden Gate Bridge was completed in San Francisco in 1937 with the help on a Fireman's Fund surety bond. In true risk management practice, hard hats were first developed for construction workers during the building of this bridge.

Source: AP Images

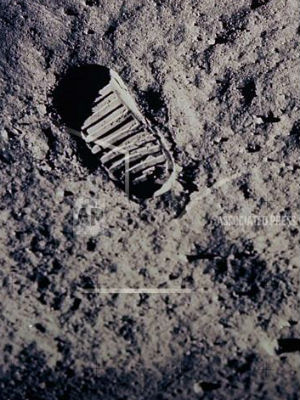

In 1970, Fireman's Fund wrote a $10 million policy on a national tour of the Apollo II Space Capsule, bringing a piece of the moon down to man.

When the Statue of Liberty began a two-year renovation in 1984, Fireman's Fund issued a $95 million all-risk policy against her exposure to fire, flood, earthquake, vandalism and other physical damage.

On July 4, 2011, Lori Fouché became the chief executive officer of Fireman's Fund, the first African-American woman to serve as the CEO of a top property and casualty insurance company in the United States.

In 2006, Fireman's Fund combined its three sustainable-building insurance policies into one policy for real estate customers, which insures a building's existing 'green' features, pays for a green upgrade investment, and pays to recalibrate the efficiency of heating, plumbing and electric systems.

Want to continue reading?

Become a Free PropertyCasualty360 Digital Reader

Your access to unlimited PropertyCasualty360 content isn’t changing.

Once you are an ALM digital member, you’ll receive:

- Breaking insurance news and analysis, on-site and via our newsletters and custom alerts

- Weekly Insurance Speak podcast featuring exclusive interviews with industry leaders

- Educational webcasts, white papers, and ebooks from industry thought leaders

- Critical converage of the employee benefits and financial advisory markets on our other ALM sites, BenefitsPRO and ThinkAdvisor

Already have an account? Sign In Now

© 2024 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.