Clark Insurance has 77 employees. It also has 77 owners.

Clark hasn't always been employee-owned. The Clough family of Portland, Maine, started the B. M. Clough Insurance Agency in 1931. Paul Woodworth purchased the agency and added Richard W. Clark as a co-owner, changing the agency's name to Woodworth & Clark. In 1988, the agency changed its name to Clark Assocs. to recognize the expanding number of employee-owners, and again in 2009 to Clark Insurance.

Related: Read “Family Matters“

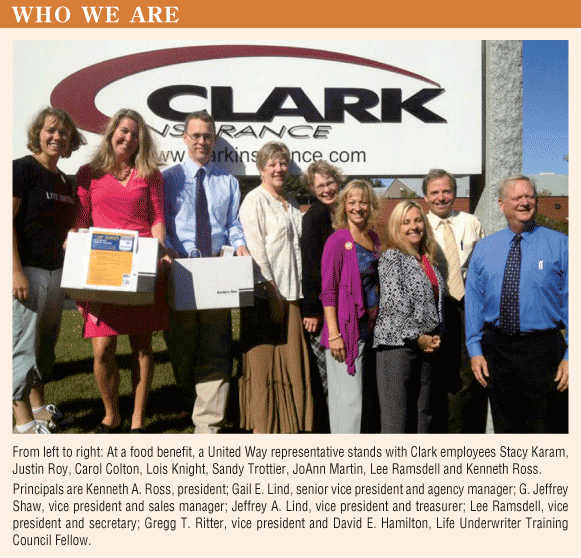

In addition to its headquarters in Portland, Maine, Clark has opened branches in Saco and Windham, Maine, as well as an office in Manchester, N. H. “In order to grow an agency organically, one needs to invest in people, training and technology,” said Kenneth A. Ross, president. “There are no shortcuts.” This philosophy has proved successful, as retention rates are more than 90 percent.

Clark chose to remain a generalist agency focused on offering insurance products and services. “We have explored expanding our services,” Ross said, “and every time we circle back to an understanding that we are insurance agents.” Employees know and understand insurance, so Clark believes its limited resources of time and capital are best spent where it can obtain the best return.

Over the years, Clark Insurance has developed several specialties, including an exclusive relationship with XL America's professional liability program for design professionals. The Fur Information Council of America (FICA) selected Clark as its sponsored agency. Employees are trained to understand the needs of contractors, not-for profits, schools, restaurants and more.

“It is important to understand the difference between an investment and an expense. Though we have been cutting expenses during the past 3 to 4 years, we have continued to invest in our long-term future,” Ross said. Looking ahead is one of Clark's strengths.

Superstar Staff

Nothing motivates staff like having a real stake in the company's profits. Principals own one-third of the agency's stock directly, but the other two- thirds is owned by employees via an employee stock ownership plan (ESOP).

The ESOP also acts as a built-in succession plan. Employees think and behave as owners, and many will become principals. Clark teaches employees how to network, use referral-based selling strategies, and cross-sell to current policyholders. Employees receive a referral bonus when they refer a prospect to another sector of the company.

Specializing members of the Clark staff include the loss control/safety consultant, the marketing director and the training director. Positions like these offer necessary support to the staff and unique services to clients.

Related: Read “Protecting Those Who Serve“

Having a dedicated training director allows Clark to select new hires with little to no insurance experience without sacrificing quality, and also keeps current employees up to date on their responsibilities. Training begins with identifying an individual's needs relative to the position they aspire to. Computer systems, Maine Insurance Agent Assn. coverage programs, online webinars, books, mentoring with other employees, field exposure, and spending time with management and sales professionals all play a role. Employees train for 2 to 4 years before moving on to sales positions.

The loss control and safety consultant assists clients with special projects and devises custom, on-site risk management plans. One insured asked the safety consultant to ride along with a driver to observe workplace conditions and practices at a private high school. The consultant identified and documented unsafe actions and conditions with photographs and developed a presentation focused on the best, safest delivery practices to show all of the insured's staff members. The presentation is now used by the insured in every new employee orientation.

Growth on the Horizon

Hiring a competent, motivated workforce combined with the training and support Clark provides led the company to its best business year ever in 2010, and second best in 2009—successes made even more impressive by the current soft market and difficult economic time. Clark fell less than 5 percent short of meeting its 2010 business goal in 2012, but did exceed the agency's 2012 new business goal by 16 percent.

Four years ago, Clark committed to growing its employee benefits department with the addition of a five employees and a sole proprietor. The department has seen growth in the double digits every year since.

Related: Read “Recycling's Best Defense“

Technology is a growing part of the insurance industry, and keeping up with new tools and systems is important to stay ahead. Clark moved its agency management system to the cloud in 2011. The cloud also offered the best disaster recovery option. Clark currently operates with Applied Systems' Epic product.

“We are committed to being where consumers search for insurance solutions,” Ross said. The company's website and mobile website allow users to report a claim, receive a quote or contact Clark. Clark's blog updates regularly. Posts offer information about current market news and general claims guidelines with intriguing titles like “Holy Accident, Batman!” and “Marriage, Marijuana & Maine.” Clark also has a social media presence on Facebook, Twitter and LinkedIn.

Alongside organic growth, Clark acquired a small property-casualty agency in New Hampshire in late 2011, which brought in $1.3 million of premium revenue to Clark. The company is currently looking for a new acquisition in Maine and plans to continue expanding its New Hampshire presence.

Giving Back

One of Clark's values is to serve the needs of the community. “We look for opportunities that provide mutual benefit between us and our not-for-profit customers,” Ross said. In practice, this means supporting golf tournaments and other fundraising events.

Other ways the company gives back include a “wear jeans to work day” one Friday of each month. Employees pay $3 for the privilege, and the company votes on which charities to donate the money to each December. Clark has previously delivered meals to families in need on Thanksgiving, formed groups to ring bells for the Salvation Army during the holiday season, and served a monthly dinner to the homeless in conjunction with Portland's Preble Resource Center. Next up: a Habitat for Humanity home site.

Ross has a wealth of advice for those looking to increase profitability and build a strong business: “Perpetuating an agency is hard work, and can be expensive. Whether the plan is to perpetuate internally, or look outside, the strategies for growth and profitability ought to be similar.” For Clark, the ESOP is the heart of the agency: “I can't overemphasize how significantly this contributes to our success!”

Want to continue reading?

Become a Free PropertyCasualty360 Digital Reader

Your access to unlimited PropertyCasualty360 content isn’t changing.

Once you are an ALM digital member, you’ll receive:

- Breaking insurance news and analysis, on-site and via our newsletters and custom alerts

- Weekly Insurance Speak podcast featuring exclusive interviews with industry leaders

- Educational webcasts, white papers, and ebooks from industry thought leaders

- Critical converage of the employee benefits and financial advisory markets on our other ALM sites, BenefitsPRO and ThinkAdvisor

Already have an account? Sign In Now

© 2025 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.