We reached out to risk managers and asked a couple of simple questions: Who do you use, and why? Here's what they had to say:

Carolyn Snow, director of risk management for Humana Inc. who is a member of the RIMS Board of Directors, says Humana prefers AIG for its executive-protection and property-related coverage.

“When we find a company that provides us with good products and services, we tend to stay with them,” says Snow. “We like developing long-terms relationships where the companies really get to know us and understand our exposure.”

This relationship is paramount when market changes occur. Snow says long-term relationships allow the managed health-care company to work with insurers to moderate the impact of the changes.

“If we can talk with underwriters that truly understand our business, or take the time to learn about us, then we can work out coverage details and pricing,” she says.

.jpg) Lori Seidenberg, senior vice president of enterprise risk management for Centerline Capital Group, says Ironshore, C.V. Starr and Philadelphia Indemnity are some insurers handling Habitational exposures for Centerline, which provides real estate finance and asset management services for multifamily housing.

Lori Seidenberg, senior vice president of enterprise risk management for Centerline Capital Group, says Ironshore, C.V. Starr and Philadelphia Indemnity are some insurers handling Habitational exposures for Centerline, which provides real estate finance and asset management services for multifamily housing.

A member of the RIMS Board of Directors, Seidenberg says Centerline's insurance choices “start with the carriers that have appetite for our specific risk.”

“Once we have those identified,” she continues. “we make decisions based on a combination of price, coverage and claims-paying ability.”

Gary Pearce, vice president of risk management at Kelly Services Inc., says the temporary staffing company has 14 different carriers on its various insurance programs, with half writing more than one program.

Gary Pearce, vice president of risk management at Kelly Services Inc., says the temporary staffing company has 14 different carriers on its various insurance programs, with half writing more than one program.

Pearce says financial strength and cost competitiveness are important, but “the carriers with which we have our most critical relationships—such as Ace, XL, Beazley, Alterra, Chubb, Zurich and Allied World—have other common attributes: They have taken the time to learn our story, the management is accessible and they understand that we act as an extension of their underwriting function in order to deliver favorable underwriting results.”

Michael Liebowitz, director of insurance and risk management at New York University, looks to Ace “a lot,” especially for international General Liability (the school has multiple global sites) and Environmental coverage.

Michael Liebowitz, director of insurance and risk management at New York University, looks to Ace “a lot,” especially for international General Liability (the school has multiple global sites) and Environmental coverage.

“They have a great global footprint and their coverage has become broader and more flexible,” says Liebowitz, adding that he coverage NYU gets from Ace is a “good value for the money.”

Additionally, the university relies on Chubb for coverage related to its award-winning film program as well as financial-products lines.

Sarah Perry, risk manager for the City of Columbia, Mo., says the city is self-insured but it relies “highly” on FM Global for its Excess Property insurance needs.

Sarah Perry, risk manager for the City of Columbia, Mo., says the city is self-insured but it relies “highly” on FM Global for its Excess Property insurance needs.

On a more limited basis, Columbia looks to Safety National for Workers' Compensation.

For Liability, Columbia turns to the state's risk retention group, as the city is part of the pool program. The RRG provides the city with a good price, service and “incredible terms and conditions,” says Perry.

Columbia choice of FM Global is based on the fact the insurer is member-owned and has extensive resources, capacity and service, she adds.

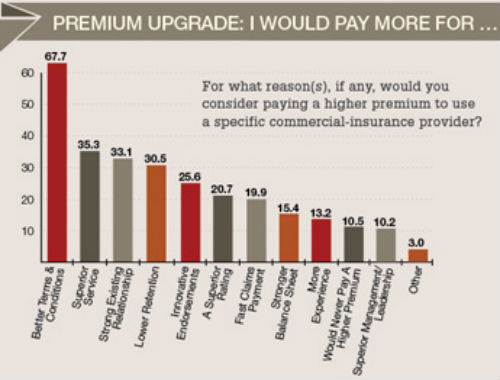

The risk-manager interviews were conducted in conjunction with a Flaspohler Research Group/PC360-NUsurvey of hundreds of risk managers regarding their insurance-buying habits. That survey found that AIG was the top choice of insurance buyers for commercial insurance. The survey also asked what would make risk managers consider paying a higher premium to use a specific carrier. Nearly 68 percent rank better terms and conditions as the top reason. Superior service, lower retentions and innovative endorsements were also popular answers.

Want to continue reading?

Become a Free PropertyCasualty360 Digital Reader

Your access to unlimited PropertyCasualty360 content isn’t changing.

Once you are an ALM digital member, you’ll receive:

- Breaking insurance news and analysis, on-site and via our newsletters and custom alerts

- Weekly Insurance Speak podcast featuring exclusive interviews with industry leaders

- Educational webcasts, white papers, and ebooks from industry thought leaders

- Critical converage of the employee benefits and financial advisory markets on our other ALM sites, BenefitsPRO and ThinkAdvisor

Already have an account? Sign In Now

© 2024 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.