Insurance broker Aon says insureds can expect commercial property rates to continue their modest rise through the first half of 2013, with Superstorm Sandy victims bearing the brunt of that increase.

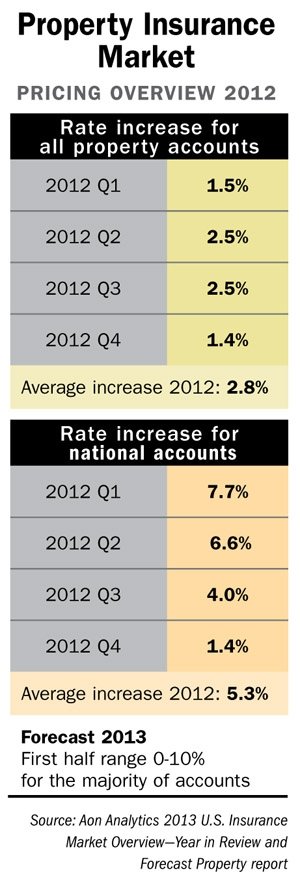

Rates were up 2.8 percent in 2012 compared to 2011, the report notes, and national accounts rose 5.3 percent because they tend to have higher natural-catastrophe exposures. National accounts have experienced rate increases for slightly longer than the rest of the property market—a total of six quarters compared to only five for all property risks.

Aon says most accounts saw little change from the previous year in terms of limits, deductibles/retentions, coverage and capacity. Accounts can expect little to change this year except for flood and wind coverage and contingent business interruption (CBI): Insurers will closely scrutinize limits for both flood and CBI and will work to clarify language surrounding flood and wind coverage. While capacity should remain adequate, insurers will be more circumspect in their flood-insurance offerings.

The report notes that global insured catastrophe losses in 2012 came in at $65 billion, with Sandy adding significantly to the total by approximately $25 billion. More than 90 percent of last year's insured losses came from the United States. While 2012's global losses were about 50 percent lower than 2011, the losses rank considerably higher than the average for the past 10 years.

Responding to questions, Mike Andler, managing director of Aon Risk Solutions of the Greater New York Property Brokerage Group said in an e-mail that some underwriters with significant flood risk on their book will seek to reduce their exposure while those with capacity will pursue expansion, but the price will hinge on the cost of capital.

Underwriters will be examining whether storm surge belongs under the definition of windstorm or flood, Andler continued. If market pressures lead to pushing the coverage under flood, then clients may need to increase their flood limits.

“There is no danger of finding coverage at this point, the market will respond if an increased need for [flood] limits occurs,” Andler said.

Updated: 5:16 p.m. with comments from Mike Andler.

Want to continue reading?

Become a Free PropertyCasualty360 Digital Reader

Your access to unlimited PropertyCasualty360 content isn’t changing.

Once you are an ALM digital member, you’ll receive:

- Breaking insurance news and analysis, on-site and via our newsletters and custom alerts

- Weekly Insurance Speak podcast featuring exclusive interviews with industry leaders

- Educational webcasts, white papers, and ebooks from industry thought leaders

- Critical converage of the employee benefits and financial advisory markets on our other ALM sites, BenefitsPRO and ThinkAdvisor

Already have an account? Sign In Now

© 2024 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.