A significant majority of insurance-carrier CEOs are upbeat about the prospects of revenue growth over the next few years, mirroring the views of financial-services executives in general, according to a recent survey.

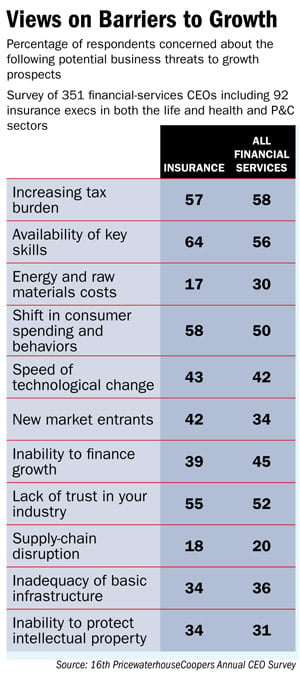

Of the 92 insurance CEOs (a mix of P&C and life insurers) in 39 countries surveyed for PricewaterhouseCoopers' 16th annual global CEO survey, 90 percent are reasonably confident revenue will grow over the next 12 months, and next three years.

Of the 92 insurance CEOs (a mix of P&C and life insurers) in 39 countries surveyed for PricewaterhouseCoopers' 16th annual global CEO survey, 90 percent are reasonably confident revenue will grow over the next 12 months, and next three years.

Carrier executives are not as positive about the overall economic picture, though. Just 15 percent believe the economy will improve in the next 12 months, according to the survey, and close to a quarter expect the economy to decline. PwCsays last year's survey showed even more skepticism, with close to half believing the economy would get worse.

Recommended For You

Want to continue reading?

Become a Free PropertyCasualty360 Digital Reader

Your access to unlimited PropertyCasualty360 content isn’t changing.

Once you are an ALM digital member, you’ll receive:

- Breaking insurance news and analysis, on-site and via our newsletters and custom alerts

- Weekly Insurance Speak podcast featuring exclusive interviews with industry leaders

- Educational webcasts, white papers, and ebooks from industry thought leaders

- Critical converage of the employee benefits and financial advisory markets on our other ALM sites, BenefitsPRO and ThinkAdvisor

Already have an account? Sign In Now

© 2025 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.