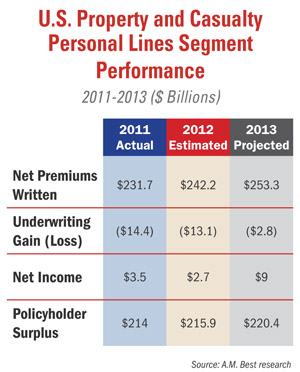

More frequent and severe weather-related events are creating a volatile business environment for the property-insurance line, but favorable results in auto are offsetting some of the negative impact, leading A.M. Best to maintain a stable outlook for the personal-lines segment.

“Although property line volatility continues to be a drag on overall results, it has not materially weakened the segment’s overall capital position, and auto results continue to be stable despite some margin compression,” says A.M. Best in its latest Review/Preview analysis.

“Although property line volatility continues to be a drag on overall results, it has not materially weakened the segment’s overall capital position, and auto results continue to be stable despite some margin compression,” says A.M. Best in its latest Review/Preview analysis.

For the property line, A.M. Best says it expects more of the same with respect to the weather. “Whether it’s an issue of frequency, severity, or sometimes both, the expectation is that regardless of the underlying causes, the erratic and volatile weather patterns experienced over the past few years will continue, and significant rate increases cannot be the only action taken to stabilize results.”

The ratings agency notes that carriers are, in fact, thinking beyond just rate increases, implementing risk-management initiatives such as mandatory wind/hail deductibles, percentage hurricane deductibles, and roof limitations based on the roof’s age and condition. “In addition, improved geocoding, greater understanding of risk concentrations and adherence to stricter underwriting guidelines has partially mitigated overall losses,” A.M. Best says.

The analysis also points to continued to sophistication in how property risks are priced. homeowners. “This is particularly true regarding the ongoing development and expansion of by-peril pricing modules and more granular pricing metrics across this line of business,” says A.M. Best.

The analysis notes that as of the 2012 third quarter, personal-lines insurers had been reporting “considerable improvement” in results due to a lack of catastrophe losses relative to 2011. “However,” the ratings agency says, “with Superstorm Sandy making landfall in the fourth quarter, the potential for a ‘below-average’ catastrophe loss year was quickly erased.”

Despite the more frequent and severe weather events, A.M. Best says the personal-lines segment remains adequately capitalized, and the ratings agency attributes that mainly to results in the auto line. The ratings agency says it expects auto to continue to produce results similar to the past several years.

“Pricing sophistication continues to evolve, particularly through telematics...,” says A.M. Best.

The analysis adds, “Another trend, multi-channel distribution – interaction with potential and existing customers across a wide spectrum of distribution outlets – remains a key differentiating factor for a large portion of the personal-auto market. In addition, brand awareness programs and marketing budgets are expected to continue growing at the current pace.”

The line does have its challenges though. A.M. Best notes that while loss-cost trends “remain generally moderate,” there is some pressure from rising medical and auto-repair costs. “In addition, Sandy’s effect on the automobile line was somewhat higher than anticipated, which may drive movement to additional risk-management attention on auto’s exposure to catastrophe loss,” states the analysis.

A.M. Best says its stable outlook implies that most rating actions in 2013 will be affirmations and that the number of positive rating actions will keep pace with negative rating actions.

Want to continue reading?

Become a Free PropertyCasualty360 Digital Reader

Your access to unlimited PropertyCasualty360 content isn’t changing.

Once you are an ALM digital member, you’ll receive:

- Breaking insurance news and analysis, on-site and via our newsletters and custom alerts

- Weekly Insurance Speak podcast featuring exclusive interviews with industry leaders

- Educational webcasts, white papers, and ebooks from industry thought leaders

- Critical converage of the employee benefits and financial advisory markets on our other ALM sites, BenefitsPRO and ThinkAdvisor

Already have an account? Sign In Now

© 2024 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.